Compare Kewaunee Scientific Corp. with Similar Stocks

Dashboard

Company has a low Debt to Equity ratio (avg) at times

Low Debt Company with Strong Long Term Fundamental Strength

The company has declared negative results in Jan'2025 after 9 consecutive positive quarters

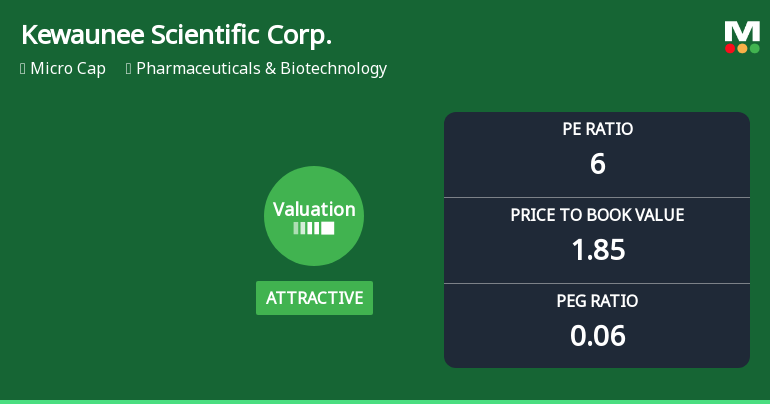

With ROE of 29.30%, it has a attractive valuation with a 1.85 Price to Book Value

Underperformed the market in the last 1 year

Stock DNA

Pharmaceuticals & Biotechnology

USD 112 Million (Micro Cap)

6.00

NA

0.00%

0.38

17.22%

1.60

Total Returns (Price + Dividend)

Kewaunee Scientific Corp. for the last several years.

Risk Adjusted Returns v/s

News

Kewaunee Scientific Corp. Experiences Revision in Its Stock Evaluation Amid Strong Financial Metrics

Kewaunee Scientific Corp., a microcap in the Pharmaceuticals & Biotechnology sector, has recently adjusted its valuation. The company exhibits strong financial metrics, including a P/E ratio of 6 and a return on equity of 29.30%, indicating effective management and a competitive position within its industry.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Oct 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 11 Schemes (15.9%)

Held by 16 Foreign Institutions (3.14%)

Quarterly Results Snapshot (Consolidated) - Oct'25 - QoQ

QoQ Growth in quarter ended Oct 2025 is -1.41% vs -7.78% in Jul 2025

QoQ Growth in quarter ended Oct 2025 is -21.88% vs -34.69% in Jul 2025

Annual Results Snapshot (Consolidated) - Apr'25

YoY Growth in year ended Apr 2025 is 18.01% vs -7.15% in Apr 2024

YoY Growth in year ended Apr 2025 is -39.27% vs 1,264.29% in Apr 2024