Total Returns (Price + Dividend)

Rocket Lab Corp. for the last several years.

Risk Adjusted Returns v/s

News

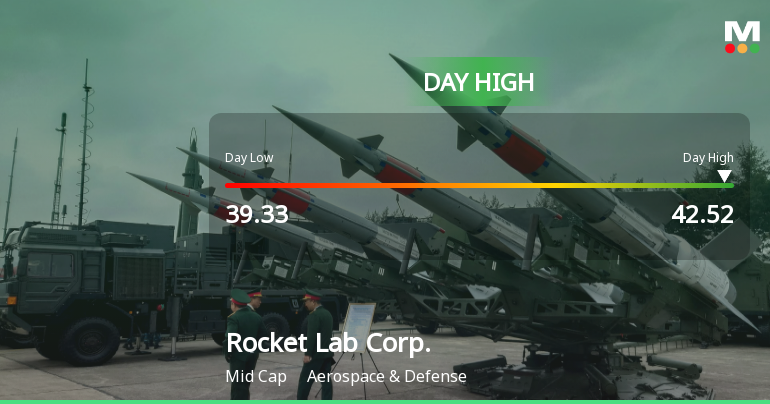

Rocket Lab Corp. Hits Day High with Strong 5.33% Intraday Surge

Rocket Lab Corp. has seen significant growth, with an 82.5% increase over the past year, outperforming the S&P 500. Despite a recent decline in monthly and weekly performance, the company maintains a year-to-date rise of 66.67%. However, it faces challenges with negative cash flow and a complex financial structure.

Read full news article

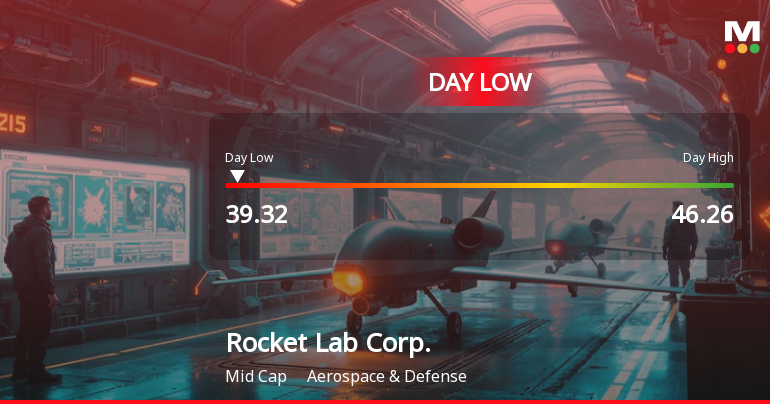

Rocket Lab Corp. Hits Day Low at $39.32 Amid Price Pressure

Rocket Lab Corp. saw a notable decline in its stock today, contrasting with the S&P 500's modest gain. The company has faced challenges, including negative operating cash flow and a pre-tax loss in the latest quarter, despite impressive long-term growth and a significant market capitalization in the Aerospace & Defense sector.

Read full news article

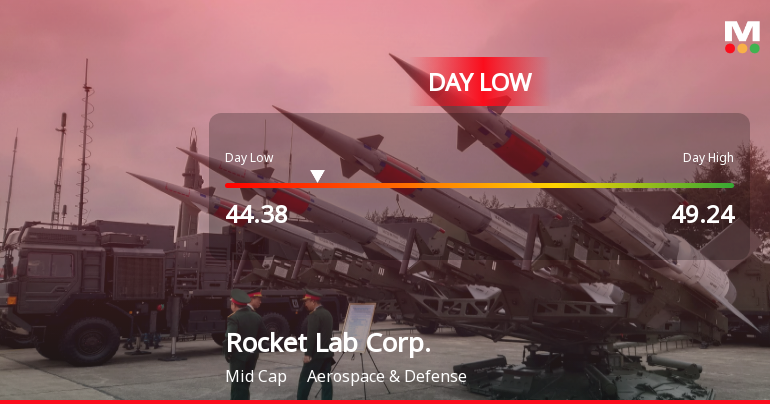

Rocket Lab Corp. Hits Day Low of $44.38 Amid Price Pressure

Rocket Lab Corp., a mid-cap Aerospace & Defense company, saw its stock decline significantly today, reflecting a challenging trading environment. Despite a strong one-year performance, recent metrics indicate difficulties, including negative operating cash flow and pre-tax profit. The company has a market capitalization of USD 23,026 million.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 77 Schemes (26.95%)

Held by 176 Foreign Institutions (10.73%)

Quarterly Results Snapshot (Consolidated) - Jun'25 - QoQ

QoQ Growth in quarter ended Jun 2025 is 17.86% vs -7.40% in Mar 2025

QoQ Growth in quarter ended Jun 2025 is -9.57% vs -15.87% in Mar 2025

Annual Results Snapshot (Consolidated) - Dec'24

YoY Growth in year ended Dec 2024 is 78.33% vs 15.92% in Dec 2023

YoY Growth in year ended Dec 2024 is -4.16% vs -34.36% in Dec 2023