Compare Electrovaya, Inc. with Similar Stocks

Dashboard

With a growth in Operating Profit of 388.86%, the company declared Very Positive results in Jun 25

- The company has declared positive results in Jan 70 after 3 consecutive negative quarters

- ROCE(HY) Highest at 8.31%

- NET SALES(Q) Highest at CAD 23.71 MM

- OPERATING PROFIT(Q) Highest at CAD 3.25 MM

With ROE of 4.04%, it has a fair valuation with a 10.81 Price to Book Value

Market Beating performance in long term as well as near term

Total Returns (Price + Dividend)

Electrovaya, Inc. for the last several years.

Risk Adjusted Returns v/s

News

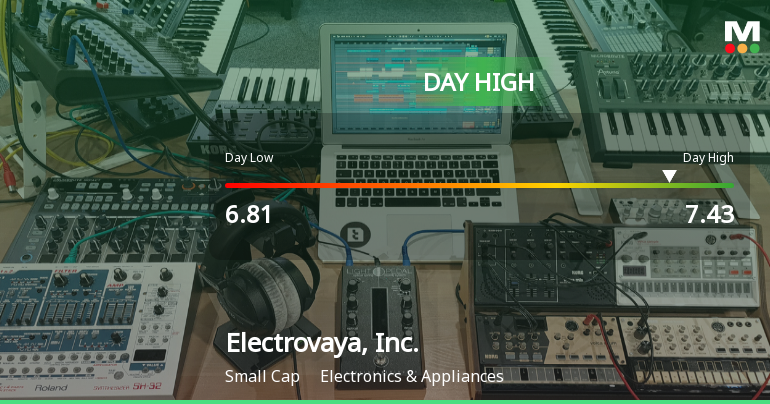

Electrovaya Stock Soars to Day High with 7.61% Intraday Surge

Electrovaya, Inc. has experienced notable stock activity, achieving a significant intraday high and a substantial weekly gain. Despite a recent monthly decline, the company has shown impressive annual growth, driven by strong operating profits and record net sales, positioning itself favorably within the Electronics & Appliances sector.

Read full news article

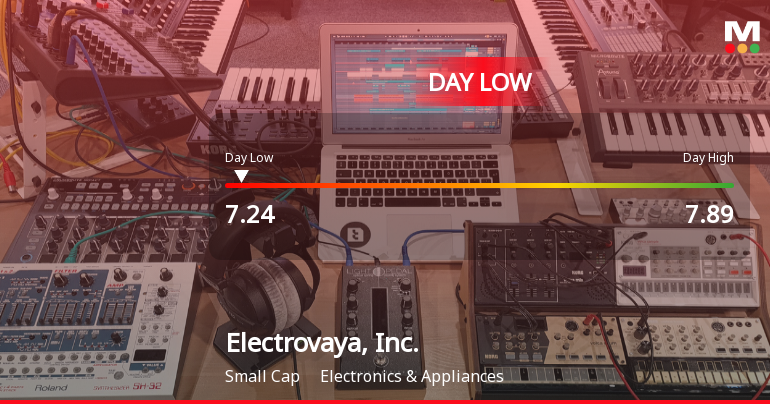

Electrovaya Stock Hits Day Low of CAD 7.24 Amid Price Pressure

Electrovaya, Inc. faced a significant decline in its stock price during a challenging trading session, contrasting with the S&P/TSX 60's gains. Despite recent downturns, the company has shown impressive long-term growth, with substantial operating profit increases and strong performance metrics over the past year and three years.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Foreign Institutions

Held in 1 Schemes (0.02%)

Held by 57 Foreign Institutions (13.74%)

Quarterly Results Snapshot (Consolidated) - Jun'25 - YoY

YoY Growth in quarter ended Jun 2025 is 68.09% vs 0.00% in Jun 2024

YoY Growth in quarter ended Jun 2025 is 425.00% vs -500.00% in Jun 2024

Annual Results Snapshot (Consolidated) - Sep'24

YoY Growth in year ended Sep 2024 is 2.19% vs 185.58% in Sep 2023

YoY Growth in year ended Sep 2024 is 0.00% vs 83.05% in Sep 2023