Dashboard

1

Weak Long Term Fundamental Strength with an average Return on Assets (ROA) of 0.33%

- A low provision coverage ratio signifies the bank has not recognized and created adeqaute reserves to cover its non perfoming loans

2

Healthy long term growth as Net Interest Income (ex other income) has grown by an annual rate of 0% and Net profit at 23.70%

3

Flat results in Jun 25

4

With ROA of 0.56%, it has a attractive valuation with a 1.03 Price to Book Value

5

Consistent Returns over the last 3 years

Total Returns (Price + Dividend)

TimePeriod

Price Return

Dividend Return

Total Return

3 Months

22.21%

0%

22.21%

6 Months

45.09%

0%

45.09%

1 Year

72.09%

0%

72.09%

2 Years

154.67%

0%

154.67%

3 Years

180.46%

0%

180.46%

4 Years

290.23%

0%

290.23%

5 Years

243.32%

0%

243.32%

Standard Chartered Plc for the last several years.

Risk Adjusted Returns v/s

News

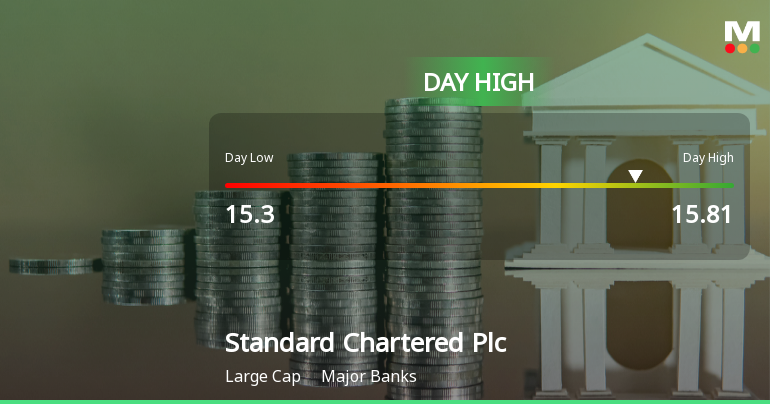

Standard Chartered Plc Hits Day High with 3.63% Surge in Stock Price

Standard Chartered Plc has experienced notable stock performance, significantly outperforming the FTSE 100 in both weekly and monthly metrics. Over the past year, the bank has achieved a substantial return, reflecting its strong market position despite some long-term fundamental challenges. Its valuation remains appealing within the banking sector.

Read More Announcements

No announcement available

Corporate Actions

No corporate action available

Quality key factors

Factor

Value

Sales Growth (5y)

26.41%

EBIT Growth (5y)

23.36%

EBIT to Interest (avg)

0

Debt to EBITDA (avg)

0

Net Debt to Equity (avg)

0

Sales to Capital Employed (avg)

0

Tax Ratio

0

Dividend Payout Ratio

25.94%

Pledged Shares

0

Institutional Holding

0.00%

ROCE (avg)

0

ROE (avg)

0

Valuation key factors

Factor

Value

P/E Ratio

9

Industry P/E

Price to Book Value

1.03

EV to EBIT

14.42

EV to EBITDA

12.17

EV to Capital Employed

1.02

EV to Sales

3.44

PEG Ratio

0.20

Dividend Yield

411.78%

ROCE (Latest)

7.04%

ROE (Latest)

11.17%

Technicals key factors

Indicator

Weekly

Monthly

MACD

Bullish

Bullish

RSI

No Signal

No Signal

Bollinger Bands

Mildly Bullish

Mildly Bullish

Moving Averages

Bullish (Daily)

KST

Mildly Bearish

Bullish

Dow Theory

Mildly Bullish

Mildly Bullish

OBV

Mildly Bullish

Mildly Bullish

Shareholding Snapshot : Mar 2025

Shareholding Compare (%holding)

Majority shareholders

Foreign Institutions

Domestic Funds

Held in 0 Schemes (0%)

Foreign Institutions

Held by 2 Foreign Institutions (0.0%)

Strategic Entities with highest holding

Highest Public shareholder

About Standard Chartered Plc

Standard Chartered Plc

Major Banks

Standard Chartered PLC is an international banking company. The Banks's segments include Corporate & Institutional Banking, Retail Banking, Commercial Banking and Private Banking. Its Corporate & Institutional Banking segment allows companies and financial institutions to operate and trade globally, and its Private Banking segment supports high net worth individuals with their banking needs across borders and offers access to global investment opportunities. Its Retail Banking segment offers clients, as well as small businesses a range of banking support solutions, and its Commercial Banking segment provides mid-sized companies with financial solutions and services. Its personal banking offerings include investments and employee banking. Its business banking capabilities include transaction banking, Islamic banking and global research. Its private banking offerings include online services.

Company Coordinates

Company Details

1 Basinghall Avenue , LONDON None : EC2V 5DD

Registrar Details