Compare R M Drip & Sprin with Similar Stocks

Dashboard

Low ability to service debt as the company has a high Debt to EBITDA ratio of 3.45 times

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 3.45 times

- The company has been able to generate a Return on Equity (avg) of 9.81% signifying low profitability per unit of shareholders funds

With ROCE of 27.2, it has a Very Expensive valuation with a 11.4 Enterprise value to Capital Employed

Falling Participation by Institutional Investors

Underperformed the market in the last 1 year

Stock DNA

Miscellaneous

INR 1,290 Cr (Small Cap)

57.00

32

0.07%

0.41

27.60%

15.67

Total Returns (Price + Dividend)

Latest dividend: 0.5 per share ex-dividend date: Sep-08-2025

Risk Adjusted Returns v/s

Returns Beta

News

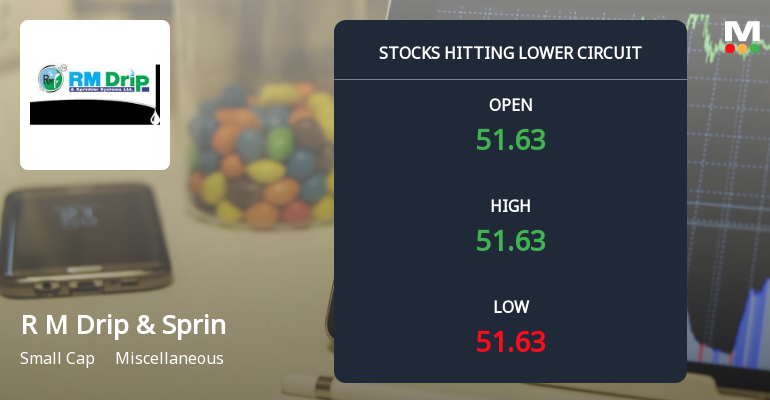

R M Drip & Sprinklers Systems Ltd Hits Lower Circuit Amid Heavy Selling Pressure

Shares of R M Drip & Sprinklers Systems Ltd plunged to their lower circuit limit on 6 March 2026, closing at ₹51.58 after a sharp fall of 4.99% in a single session. The stock has been under intense selling pressure, marking its seventh consecutive day of decline and accumulating losses of nearly 58% over this period, signalling deepening investor concerns and panic selling in the miscellaneous sector.

Read full news article

R M Drip & Sprinklers Systems Ltd Plunges to Lower Circuit Amid Heavy Selling Pressure

Shares of R M Drip & Sprinklers Systems Ltd plunged to their lower circuit limit on 5 Mar 2026, closing at ₹54.29 after a sharp intraday fall of 4.99%. The stock has been under intense selling pressure, marking its sixth consecutive day of decline and accumulating losses of 55.66% over this period, signalling mounting investor concerns and panic selling in the small-cap miscellaneous sector player.

Read full news article

R M Drip & Sprinklers Systems Ltd Plunges to Lower Circuit Amid Heavy Selling Pressure

Shares of R M Drip & Sprinklers Systems Ltd plunged to their lower circuit limit on 4 March 2026, closing at ₹57.14, marking a maximum daily loss of 9.99%. The stock witnessed intense selling pressure, with volumes drying up and a sharp decline in investor participation, signalling panic selling and unfilled supply in the market.

Read full news article Announcements

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

04-Mar-2026 | Source : BSENotice of postal ballot meeting.

Board Meeting Outcome for Issuance Of Bonus Equity Shares

28-Feb-2026 | Source : BSEWith reference to above mentioned subject we would like to inform you that a meeting of the Board of Directors of R M Drip and Sprinklers Systems Limited was held on 28th February 2026 Inter alia considered and approved the following matters 1. Issue of Bonus Equity Shares 2. Record Date 3. Increase in Authorised Share Capital 4. Approval of Postal Ballot Notice

Corporate Action-Board to consider Bonus Issue

28-Feb-2026 | Source : BSERecord date for determining the entitlement of members for Bonus issue of Equity shares.

Corporate Actions

No Upcoming Board Meetings

R M Drip & Sprinklers Systems Ltd has declared 5% dividend, ex-date: 08 Sep 25

R M Drip & Sprinklers Systems Ltd has announced 1:10 stock split, ex-date: 26 Sep 25

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 3 FIIs (2.5%)

Nivrutti Pandurang Kedar (18.03%)

Kunal Haresh Mehta (14.64%)

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Half Yearly Results Snapshot (Consolidated) - Mar'25

Growth in half year ended Mar 2025 is 178.61% vs -17.34% in Sep 2024

Growth in half year ended Mar 2025 is 470.47% vs -25.67% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -0.23% vs 5.80% in Dec 2025

YoY Growth in nine months ended Dec 2024 is -5.26% vs 40.81% in Dec 2025

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 160.97% vs 359.09% in Mar 2024

YoY Growth in year ended Mar 2025 is 345.10% vs 17,933.33% in Mar 2024