Compare Clean Science with Similar Stocks

Stock DNA

Specialty Chemicals

INR 8,978 Cr (Small Cap)

34.00

39

0.71%

-0.25

17.68%

5.98

Total Returns (Price + Dividend)

Latest dividend: 4 per share ex-dividend date: Sep-04-2025

Risk Adjusted Returns v/s

Returns Beta

News

Are Clean Science & Technology Ltd latest results good or bad?

Clean Science & Technology Ltd's latest financial results for Q3 FY26 reflect a continuation of challenging operational trends. The company reported a net profit of ₹45.88 crore, which represents a significant decline of 30.10% year-on-year. Revenue for the same quarter was ₹219.67 crore, marking an 8.78% contraction compared to the previous year. This revenue figure is the lowest recorded in recent quarters, indicating weak demand conditions within the specialty chemicals segment. The operating margin for Q3 FY26 stood at 32.86%, which is a notable decrease of 810 basis points year-on-year and the lowest margin observed in the trailing twelve quarters. Similarly, the profit after tax (PAT) margin decreased to 20.89%, reflecting a decline of 637 basis points year-on-year. These metrics suggest that the company is facing significant challenges in maintaining profitability amid a difficult operating environm...

Read full news article

Clean Science Q3 FY26: Margin Compression and Profit Decline Raise Concerns

Clean Science & Technology Ltd., a specialty chemicals manufacturer with a market capitalisation of ₹8,978 crores, reported disappointing results for Q3 FY26, with net profit declining 30.10% year-on-year to ₹45.88 crores. The quarter-on-quarter performance was equally concerning, showing a 17.23% decline from Q2 FY26's ₹55.43 crores. The stock, trading at ₹860.00 as of January 30, 2026, has declined 37.14% over the past year, significantly underperforming both the benchmark Sensex and its specialty chemicals peer group.

Read full news article

Clean Science & Technology Ltd is Rated Strong Sell

Clean Science & Technology Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 06 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 31 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

17-Jan-2026 | Source : BSEIn terms of the referred Regulation 30 read with Schedule III - Part A of SEBI Listing Regulations 2015 we would like to inform you that a conference call for analysts and investors has been scheduled on Saturday 31st January 2026 at 4:00 P.M. (IST) to discuss the unaudited financial results for the Quarter and Nine Months ended 31st December 2025.

Board Meeting Intimation for Prior Intimation Of The Board Meeting To Consider Un-Audited Standalone And Consolidated Financial Results For The Quarter And Nine Months Ended 31St December 2025 And Interim Dividend For FY 2025-26.

15-Jan-2026 | Source : BSEClean Science And Technology Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 31/01/2026 inter alia to consider and approve Pursuant to Regulation 29 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 intimation is hereby given that a meeting of the Board of Directors of the Company will be held on Saturday 31st January 2026 inter alia to: 1. consider and approve the Un-audited Standalone and Consolidated Financial Results for the Quarter and Nine Months ended 31st December 2025. 2.consider declaration of interim dividend for the FY 2025-26 to the equity shareholders. .

Intimation Under Regulation 30 Of SEBI Listing Regulations 2015 Investment In Clean Fino-Chem Limited - Wholly Owned Subsidiary

08-Jan-2026 | Source : BSEIntimation under Regulation 30 of SEBI Listing Regulations 2015 Investment in Clean Fino-Chem Limited - Wholly owned Subsidiary

Corporate Actions

(31 Jan 2026)

Clean Science & Technology Ltd has declared 400% dividend, ex-date: 04 Sep 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 19 Schemes (13.53%)

Held by 106 FIIs (10.0%)

Ashokkumar Ramkishan Sikchi Huf (9.96%)

Nippon Life India Trustee Ltd-a/c Nippon India Small Cap Fund (4.3%)

12.45%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

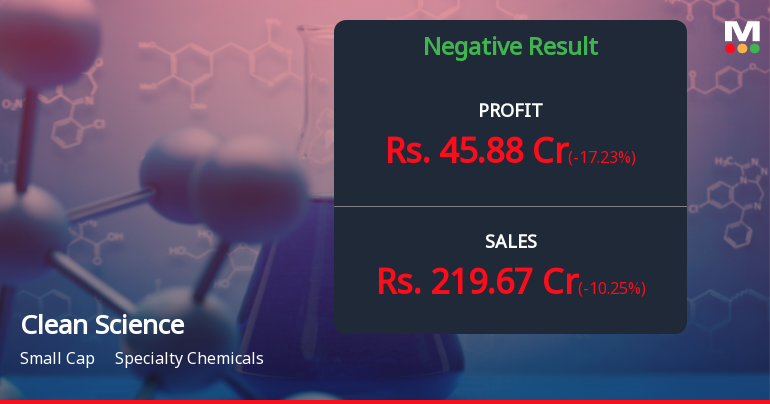

QoQ Growth in quarter ended Dec 2025 is -10.25% vs 0.77% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -17.23% vs -20.88% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 5.48% vs 25.17% in Sep 2024

Growth in half year ended Sep 2025 is 0.66% vs 12.19% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 0.59% vs 24.65% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -9.95% vs 9.53% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 22.13% vs -15.42% in Mar 2024

YoY Growth in year ended Mar 2025 is 8.35% vs -35.03% in Mar 2024