Key Events This Week

16 Feb: Stock opens at Rs.83.12, down 4.99%

17 Feb: New 52-week low recorded at Rs.79.62

18 Feb: Modest recovery with 1.53% gain

19 Feb: Slight gain of 0.37% despite Sensex decline

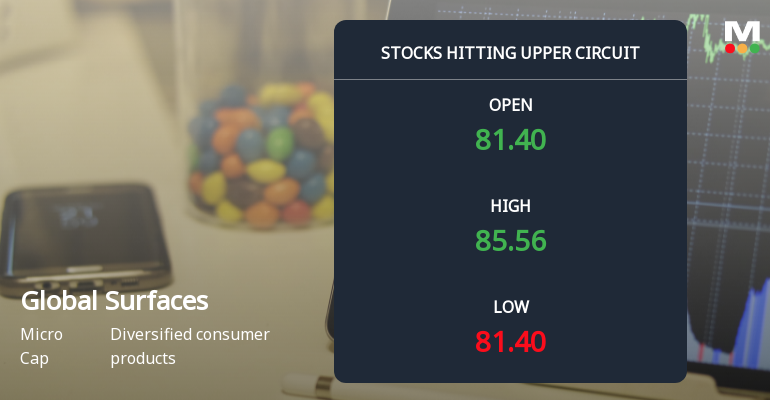

20 Feb: Shares hit upper circuit, closing at Rs.85.56 (+4.99%)

Global Surfaces Ltd Hits Upper Circuit Amid Strong Buying Pressure

Global Surfaces Ltd, a micro-cap player in the diversified consumer products sector, surged to hit its upper circuit limit on 20 Feb 2026, closing at ₹84.67, marking a maximum daily gain of 5.0%. This sharp rally was driven by robust buying interest, despite a backdrop of falling investor participation and a regulatory freeze on further price movement.

Read full news article

Global Surfaces Ltd Stock Falls to 52-Week Low of Rs.79.62

Global Surfaces Ltd, a key player in the diversified consumer products sector, has reached a new 52-week low of Rs.79.62, marking a significant decline in its stock price amid a sustained downward trend over recent sessions.

Read full news article