Compare Avalon Tech with Similar Stocks

Dashboard

Company has a low Debt to Equity ratio (avg) at 0.08 times

Healthy long term growth as Operating profit has grown by an annual rate 27.45%

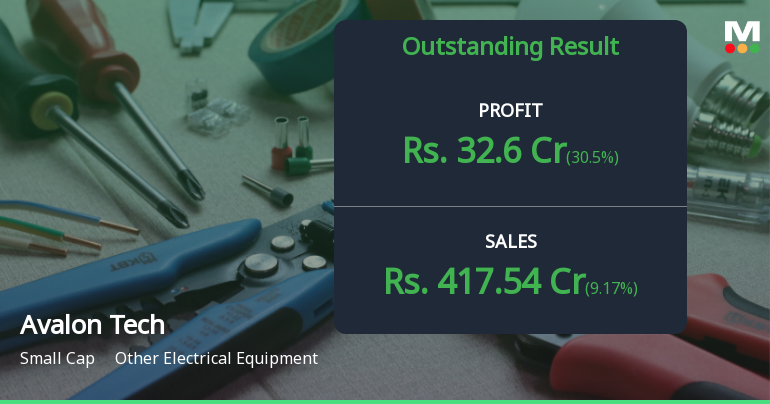

With a growth in Net Profit of 30.5%, the company declared Outstanding results in Dec 25

With ROCE of 15, it has a Very Expensive valuation with a 9.4 Enterprise value to Capital Employed

High Institutional Holdings at 32.96%

Market Beating Performance

Stock DNA

Other Electrical Equipment

INR 6,886 Cr (Small Cap)

79.00

51

0.00%

0.15

13.45%

10.57

Total Returns (Price + Dividend)

Avalon Tech for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Avalon Technologies Q3 FY26: Strong Momentum Continues with 49% Revenue Growth

Avalon Technologies Ltd., a Chennai-based electronics manufacturing services provider, delivered an outstanding third-quarter performance for FY2026, posting net profit of ₹32.60 crores—a robust 35.89% year-on-year growth and 30.50% sequential expansion. The company's revenue momentum remained strong at ₹417.54 crores, marking a 48.67% YoY surge, whilst operating margins improved sequentially to 11.49%. Following the results announcement, the stock has gained 29.60% over the past week, currently trading at ₹1,030.00, valuing the company at ₹6,886 crores.

Read full news articleAre Avalon Technologies Ltd latest results good or bad?

Avalon Technologies Ltd's latest financial results for Q2 FY26 reflect a notable revenue growth, with net sales reaching ₹382.46 crores, marking an 18.30% increase quarter-on-quarter and a 39.07% rise year-on-year. This performance underscores the company's ability to capture market share in the expanding electronics manufacturing sector, driven by favorable government initiatives. The net profit for the quarter stood at ₹24.98 crores, representing a significant 75.79% increase from the previous quarter and a 42.91% increase year-on-year. This improvement in profitability is a positive indicator, although the operating margin, which was reported at 10.10%, remains modest and reflects ongoing challenges in maintaining consistent profitability amidst rapid growth. Avalon Technologies has achieved a record return on capital employed (ROCE) of 13.07% for H1 FY26, indicating enhanced capital productivity. How...

Read full news article

Avalon Technologies Ltd Sees Technical Momentum Shift Amid Strong Price Rally

Avalon Technologies Ltd has experienced a notable shift in its technical momentum following a robust price surge, with key indicators signalling a transition from a mildly bearish trend to a more neutral sideways stance. This development comes alongside a remarkable 20% gain in a single trading session, pushing the stock price to ₹1,029.10 from the previous close of ₹857.60, reflecting renewed investor interest in the Other Electrical Equipment sector.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

31-Jan-2026 | Source : BSEPlease find the enclosed Intimation of Investor Meet pursuant to Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015.

Announcement under Regulation 30 (LODR)-Credit Rating

30-Jan-2026 | Source : BSEPlease find the enclosed disclosure on Credit Rating as per Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015.

Board Meeting Intimation for Board Meeting Intimation For The Meeting To Be Held On February 04 2026

27-Jan-2026 | Source : BSEAvalon Technologies Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 04/02/2026 inter alia to consider and approve the Unaudited Standalone and Consolidated Financial Results for the Quarter Ended December 31 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 14 Schemes (21.78%)

Held by 74 FIIs (7.56%)

Kunhamed Bicha (21.61%)

Nippon Life India Trustee Ltd-a/c Nippon India Small Cap Fund (5.68%)

9.7%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 9.17% vs 18.30% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 30.50% vs 75.79% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 48.74% vs 8.81% in Sep 2024

Growth in half year ended Sep 2025 is 158.34% vs 5.71% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 48.72% vs 16.14% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 83.32% vs 87.19% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 26.63% vs -8.21% in Mar 2024

YoY Growth in year ended Mar 2025 is 126.65% vs -46.69% in Mar 2024