Compare Hind.Urban Infra with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -317.59% CAGR growth in Operating Profits over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 15.67 times

- The company has reported losses. Due to this company has reported negative ROE

Negative results in Jun 25

Risky - Negative EBITDA

Below par performance in long term as well as near term

Stock DNA

Other Electrical Equipment

INR 282 Cr (Micro Cap)

NA (Loss Making)

43

0.00%

0.96

-10.99%

0.81

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: Sep-12-2018

Risk Adjusted Returns v/s

Returns Beta

News

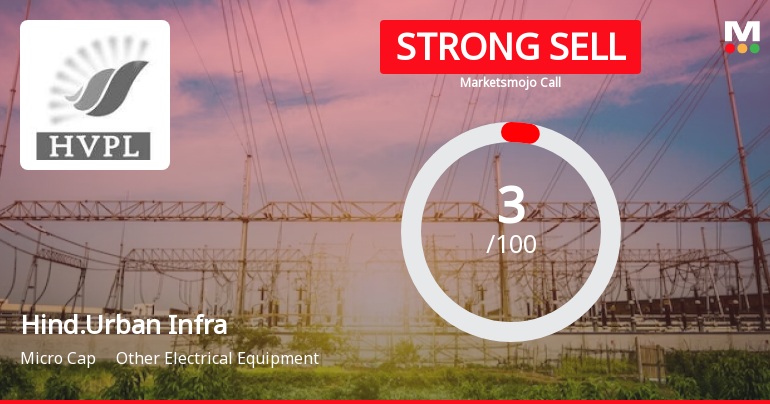

Hindusthan Urban Infrastructure Ltd is Rated Strong Sell

Hindusthan Urban Infrastructure Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 21 January 2026, reflecting a significant reassessment of the stock’s outlook. However, the analysis and financial metrics discussed below represent the company’s current position as of 02 February 2026, providing investors with the latest data to inform their decisions.

Read full news article

Hindusthan Urban Infrastructure Downgraded to Strong Sell Amid Weak Fundamentals and Bearish Technicals

Hindusthan Urban Infrastructure Ltd has been downgraded from a Sell to a Strong Sell rating as of 21 Jan 2026, reflecting deteriorating fundamentals, bearish technical indicators, and a worsening financial trend. The company’s stock has suffered a sharp decline, underperforming the broader market and its sector peers, prompting a reassessment of its investment appeal.

Read full news article

Hindusthan Urban Infrastructure Ltd Upgraded to Sell on Technical Improvements Despite Weak Fundamentals

Hindusthan Urban Infrastructure Ltd has seen its investment rating upgraded from Strong Sell to Sell as of 16 January 2026, driven primarily by improved technical indicators. However, the company continues to face significant fundamental challenges, including deteriorating financial performance and weak valuation metrics, which temper optimism despite the technical rebound.

Read full news article Announcements

Shareholder Meeting / Postal Ballot-Scrutinizers Report

06-Feb-2026 | Source : BSEOutcome of Postal Ballot-Scrutinizers Report

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

06-Feb-2026 | Source : BSEOutcome of the postal ballot-voting results

Announcement under Regulation 30 (LODR)-Change in Management

14-Jan-2026 | Source : BSEChange in Key Managerial Personnel (Company Secretary and Compliance Officer) of the Company-Intimation under Regulation 30 of the SEBI (LODR) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Hindusthan Urban Infrastructure Ltd has declared 10% dividend, ex-date: 12 Sep 18

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Hindusthan Consultancy And Services Limited (49.13%)

Ashok Kumar Gupta (4.45%)

20.18%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 18.92% vs -4.23% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -258.67% vs 30,422.22% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 11.47% vs 17.82% in Sep 2024

Growth in half year ended Sep 2025 is -268.33% vs 2,013.33% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 10.34% vs -15.35% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 157.50% vs 47.95% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 3.36% vs -9.64% in Mar 2024

YoY Growth in year ended Mar 2025 is 16.79% vs 42.26% in Mar 2024