Compare Garware Hi Tech with Similar Stocks

Stock DNA

Plastic Products - Industrial

INR 9,073 Cr (Small Cap)

25.00

13

0.37%

-0.27

12.48%

3.02

Total Returns (Price + Dividend)

Latest dividend: 12 per share ex-dividend date: Sep-17-2025

Risk Adjusted Returns v/s

Returns Beta

News

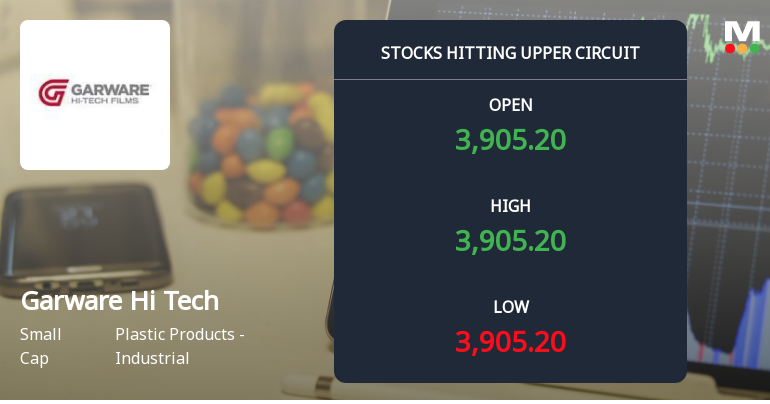

Garware Hi Tech Films Ltd Hits Upper Circuit with 20% Surge Amid Strong Buying Pressure

Garware Hi Tech Films Ltd witnessed a remarkable trading session on 3 Feb 2026, hitting its upper circuit limit with a 20.0% gain to close at ₹3,908.6. The stock demonstrated robust buying interest, outperforming its sector and broader market indices, while regulatory measures have temporarily frozen further price movement due to unfilled demand.

Read full news article

Garware Hi Tech Films Ltd Opens with Strong Gap Up, Reflecting Positive Market Sentiment

Garware Hi Tech Films Ltd witnessed a significant gap up at the opening bell on 3 Feb 2026, surging 20.0% to open at Rs 3,905.2. This robust start outpaced both its sector and the broader market, signalling a pronounced positive sentiment among traders and investors.

Read full news article

Garware Hi Tech Films Ltd Hits Intraday High with 20% Surge on 3 Feb 2026

Garware Hi Tech Films Ltd recorded a robust intraday performance on 3 Feb 2026, surging 20.0% to touch a day’s high of Rs 3,905.2. The stock opened with a significant gap up and maintained this elevated level throughout the trading session, outperforming both its sector and the broader market indices.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

01-Feb-2026 | Source : BSEIntimation of Newspaper Publication

Announcement under Regulation 30 (LODR)-Investor Presentation

31-Jan-2026 | Source : BSEInvestor presentation

Board Meeting Outcome for Outcome Of The Board Meeting Held On January 31 2026

31-Jan-2026 | Source : BSEOutcome of the Board Meeting approved unaudited financial results for the quarter and nine months ended December 31 2025.

Corporate Actions

No Upcoming Board Meetings

Garware Hi Tech Films Ltd has declared 120% dividend, ex-date: 17 Sep 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 15 Schemes (4.97%)

Held by 91 FIIs (3.96%)

S B Garware Family Trust (38.17%)

Lic Mf Multi Cap Fund (2.82%)

21.56%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -19.48% vs 15.09% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -38.87% vs 9.89% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -2.77% vs 40.97% in Sep 2024

Growth in half year ended Sep 2025 is -9.53% vs 114.97% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is -2.43% vs 26.90% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -9.23% vs 74.20% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 25.78% vs 16.62% in Mar 2024

YoY Growth in year ended Mar 2025 is 62.93% vs 22.36% in Mar 2024