Compare Krebs Biochem with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -11.65% and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

The company has declared Negative results for the last 5 consecutive quarters

Risky - Negative EBITDA

Below par performance in long term as well as near term

Stock DNA

Pharmaceuticals & Biotechnology

INR 125 Cr (Micro Cap)

NA (Loss Making)

32

0.00%

-1.39

17.42%

-0.78

Total Returns (Price + Dividend)

Krebs Biochem for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Are Krebs Biochemicals & Industries Ltd latest results good or bad?

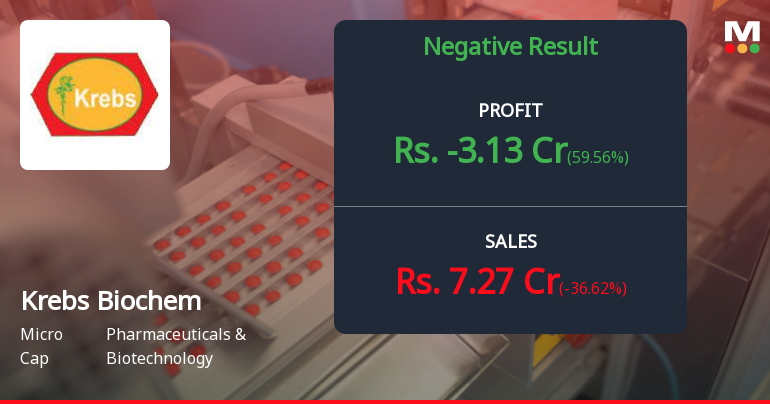

Krebs Biochemicals & Industries Ltd's latest financial results for Q3 FY26 present a complex picture. The company reported net sales of ₹7.27 crores, which reflects a significant sequential improvement of 74.34% from the previous quarter, yet this figure is still substantially lower than the ₹11.47 crores recorded in the same quarter of the previous year, indicating a year-on-year decline of 36.62%. This trend of revenue contraction is concerning, especially as the cumulative revenue for the first nine months of FY26 shows a severe contraction of 52.98% compared to the same period last year. On the profitability front, Krebs Biochemicals achieved a positive operating margin of 3.99%, a notable turnaround from the previous quarter's negative margin of -66.91%. However, the company still reported a net loss of ₹3.13 crores, which, while a reduction from the prior quarter's loss, remains a significant concern...

Read full news article

Krebs Biochemicals Q3 FY26: Mounting Losses Deepen Crisis as Revenue Collapses 67% YoY

Krebs Biochemicals & Industries Ltd. reported a catastrophic third quarter for FY2026, with net losses widening to ₹3.13 crores despite a sequential improvement from the disastrous ₹6.14 crore loss in Q2 FY26. The Visakhapatnam-based active pharmaceutical ingredient (API) manufacturer, which operates one of the world's few fermentation-based production facilities, continues to grapple with severe operational challenges as revenue plummeted 36.62% year-on-year to ₹7.27 crores in Q3 FY26. The stock has reflected this deteriorating fundamental picture, collapsing 45.96% over the past year and trading at ₹55.62 as of February 9, 2026—down 51.17% from its 52-week high of ₹113.90.

Read full news article

Krebs Biochemicals & Industries Ltd is Rated Strong Sell

Krebs Biochemicals & Industries Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 06 February 2025. However, the analysis and financial metrics discussed below reflect the company’s current position as of 08 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article Announcements

Board Meeting Intimation for Board Meeting Intimation To Consider And Adopt The Unaudited Financial Results For The 3Rd Quarter And Nine Months Ended December 31 2025

14-Jan-2026 | Source : BSEKrebs Biochemicals & Industries Ltd-has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 09/02/2026 inter alia to consider and approve Board Meeting intimation to consider and adopt the unaudited financial results for the 3rd quarter and nine months ended December 31 2025

Report On Re-Lodgement Of Transfer Requests Of Physical Shares Dec 2025

05-Jan-2026 | Source : BSEThe Company has enclosed herewith report on relodgement of shares for the month of December 2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

02-Jan-2026 | Source : BSEThe Company has enclosing herewith certificate recived from RTA under Regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended 31.12.2025.

Corporate Actions

(09 Feb 2026)

No Dividend history available

No Splits history available

No Bonus history available

Krebs Biochemicals & Industries Ltd has announced 21:100 rights issue, ex-date: 31 Jan 19

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 1 FIIs (0.49%)

Ipca Laboratories Limited (0.5%)

Sun Pharmaceutical Industries Ltd (0.048%)

19.8%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is -36.62% vs -11.63% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 59.56% vs -55.42% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -62.51% vs 1.06% in Sep 2024

Growth in half year ended Sep 2025 is -4.94% vs -22.81% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -54.53% vs -3.22% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 21.80% vs -34.51% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -14.10% vs -3.28% in Mar 2024

YoY Growth in year ended Mar 2025 is -36.54% vs 20.09% in Mar 2024