Compare Visa Steel with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -5.33% and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

With a fall in Net Sales of -55.64%, the company declared Very Negative results in Sep 25

Risky - Negative Operating Profits

59.6% of Promoter Shares are Pledged

Underperformed the market in the last 1 year

Stock DNA

Ferrous Metals

INR 440 Cr (Micro Cap)

NA (Loss Making)

28

0.00%

-1.01

3.24%

-0.32

Total Returns (Price + Dividend)

Latest dividend: 0.9500 per share ex-dividend date: Jul-14-2011

Risk Adjusted Returns v/s

Returns Beta

News

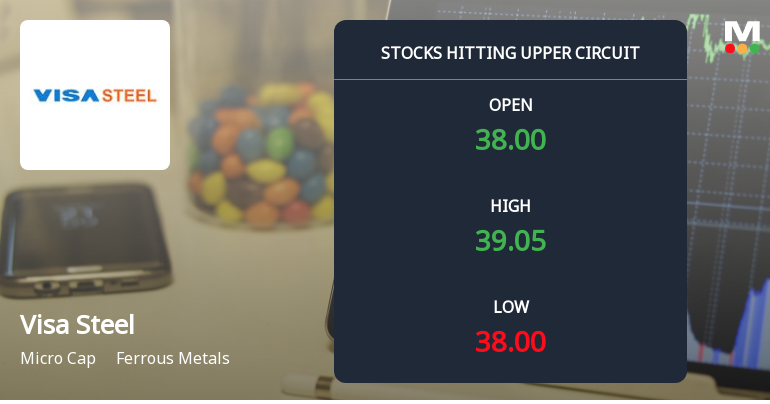

Visa Steel Ltd Hits Upper Circuit Amid Strong Buying Pressure Despite Sector Underperformance

Visa Steel Ltd, a micro-cap player in the ferrous metals sector, witnessed a significant surge in demand on 3 Feb 2026, hitting its upper circuit price limit of ₹40.84. This sharp price movement was driven by robust buying interest despite a subdued trading volume, reflecting a complex market dynamic amid sectoral gains and regulatory constraints.

Read full news article

Visa Steel Ltd Surges to Upper Circuit Amid Strong Buying Pressure

Visa Steel Ltd, a micro-cap player in the ferrous metals sector, surged to hit its upper circuit limit on 30 Jan 2026, registering a maximum daily gain of 5.0% to close at ₹38.22. This sharp rally was driven by robust buying interest, a significant rise in delivery volumes, and a notable outperformance against its sector and benchmark indices despite prevailing bearish trends in the steel industry.

Read full news article

Visa Steel Ltd is Rated Strong Sell

Visa Steel Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 18 Nov 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 24 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news article Announcements

Board Meeting Intimation for Intimation Under Regulation 29 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015 (Listing Regulations)

29-Jan-2026 | Source : BSEVisa Steel Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 04/02/2026 inter alia to consider and approve In terms of the provisions of Regulation 29 of the Listing Regulations this is to inform you that a meeting of the Board of Directors of the Company is scheduled to be held on Wednesday 4 February 2026 to inter alia consider and approve the standalone and consolidated unaudited financial results of the company for the quarter and nine months ended 31 December 2025.

Intimation Under Regulation 29 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015 (Listing Regulations)

29-Jan-2026 | Source : BSEIntimation under Regulation 29 of SEBI LODR.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

17-Jan-2026 | Source : BSEPursuant to Regulation 74(5) of the SEBI Regulations we enclose herewith the Compliance Certificate as received from Kfin Technologies Limited the Registrar and Share Transfer Agent of the Company for the quarter and nine months ended December 31 2025.

Corporate Actions

04 Feb 2026

Visa Steel Ltd has declared 10% dividend, ex-date: 14 Jul 11

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

59.5984

Held by 0 Schemes

Held by 3 FIIs (11.95%)

Visa Infrastructure Limited (34.33%)

Visa International Limited (18.4%)

6.24%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -55.64% vs 5.28% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -568.06% vs 100.88% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -13.50% vs -32.73% in Sep 2024

Growth in half year ended Sep 2025 is -43.63% vs 71.36% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -21.36% vs -6.61% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 55.01% vs -103.75% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -15.44% vs 1.89% in Mar 2024

YoY Growth in year ended Mar 2025 is -618.53% vs -104.33% in Mar 2024