Compare Oriental Trimex with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -1.78

- The company has been able to generate a Return on Equity (avg) of 1.12% signifying low profitability per unit of shareholders funds

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Diversified consumer products

INR 53 Cr (Micro Cap)

10.00

25

0.00%

0.02

5.61%

0.55

Total Returns (Price + Dividend)

Oriental Trimex for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

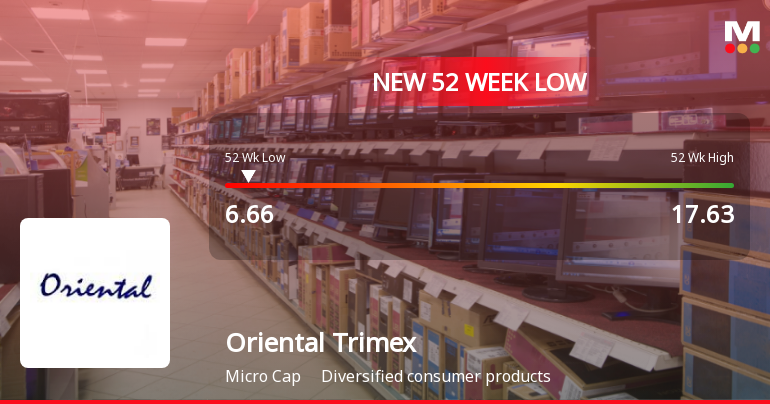

Oriental Trimex Ltd Falls to 52-Week Low Amidst Continued Underperformance

Oriental Trimex Ltd, a player in the diversified consumer products sector, has touched a new 52-week low of Rs.6.66 today, marking a significant decline amid persistent underperformance relative to market benchmarks and sector peers.

Read full news article

Oriental Trimex Ltd is Rated Sell

Oriental Trimex Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 21 January 2026. While the rating change occurred on that date, the analysis and financial metrics discussed here reflect the stock's current position as of 30 January 2026, providing investors with an up-to-date perspective on the company's standing.

Read full news article

Oriental Trimex Ltd Falls to 52-Week Low Amidst Continued Downtrend

Oriental Trimex Ltd has declined to its 52-week low, reflecting ongoing challenges in its market performance and financial metrics. The stock's recent slide to this significant price level underscores a period of sustained underperformance relative to its sector and broader market indices.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Jan-2026 | Source : BSESubmission of Certificate under Regulation 74(5) of the SEBI (Depository & participants ) Regulations 2018 for the Quarter ended 31st December 2025.

Closure of Trading Window

30-Dec-2025 | Source : BSEWe hereby inform that the trading window of the company shall remain closed for all the designated Person/Directors/KMPs/Officers and their immediate relatives w.e.f Thursday January 01 2026.

Disclosures By Listed Entities Of Defaults On Payment Of Interest/Repayment Of Principal Amount On Loans From Banks / Financial Institutions And Unlisted Debt Securities

04-Dec-2025 | Source : BSEDisclosure of defaults on payment of interest/repayment of One Time Settlement

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

Oriental Trimex Ltd has announced 3:2 rights issue, ex-date: 05 Sep 24

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

12.4997

Held by 0 Schemes

Held by 0 FIIs

Rajesh Kumar Punia (17.4%)

Bindesh Kurani (2.99%)

64.21%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 31.18% vs -89.80% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -138.33% vs -89.95% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 58.47% vs 490.48% in Sep 2024

Growth in half year ended Sep 2025 is 121.56% vs -826.09% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 592.06% vs -92.66% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 375.53% vs 76.38% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 475.89% vs -58.09% in Mar 2024

YoY Growth in year ended Mar 2025 is 231.85% vs -50.46% in Mar 2024