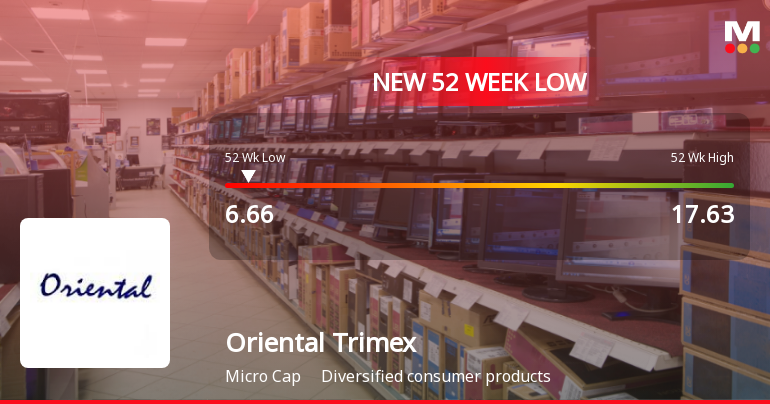

Oriental Trimex Ltd Falls to 52-Week Low Amidst Continued Underperformance

2026-02-02 09:42:59Oriental Trimex Ltd, a player in the diversified consumer products sector, has touched a new 52-week low of Rs.6.66 today, marking a significant decline amid persistent underperformance relative to market benchmarks and sector peers.

Read full news article

Oriental Trimex Ltd is Rated Sell

2026-01-30 10:11:27Oriental Trimex Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 21 January 2026. While the rating change occurred on that date, the analysis and financial metrics discussed here reflect the stock's current position as of 30 January 2026, providing investors with an up-to-date perspective on the company's standing.

Read full news article

Oriental Trimex Ltd Falls to 52-Week Low Amidst Continued Downtrend

2026-01-28 16:00:34Oriental Trimex Ltd has declined to its 52-week low, reflecting ongoing challenges in its market performance and financial metrics. The stock's recent slide to this significant price level underscores a period of sustained underperformance relative to its sector and broader market indices.

Read full news article

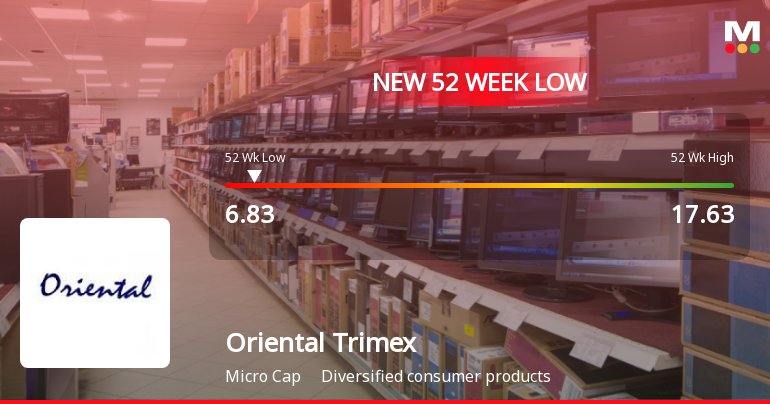

Oriental Trimex Ltd Falls to 52-Week Low of Rs.6.83 Amidst Continued Downtrend

2026-01-27 09:56:05Oriental Trimex Ltd, a player in the diversified consumer products sector, touched a new 52-week low of Rs.6.83 today, marking a significant decline in its share price amid ongoing market pressures and underperformance relative to benchmarks.

Read full news article

Oriental Trimex Ltd Falls to 52-Week Low Amidst Continued Underperformance

2026-01-23 10:41:52Oriental Trimex Ltd, a player in the diversified consumer products sector, touched a new 52-week low of Rs.7.3 today, marking a significant decline in its stock price amid ongoing challenges reflected in its financial and market performance.

Read full news article

Oriental Trimex Ltd is Rated Strong Sell

2026-01-19 10:10:46Oriental Trimex Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 24 Nov 2025, reflecting a reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed here are current as of 19 January 2026, providing investors with the latest perspective on the company’s position.

Read full news article

Oriental Trimex Ltd is Rated Strong Sell

2026-01-07 10:10:55Oriental Trimex Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 24 Nov 2025. However, the analysis and financial metrics discussed below reflect the stock's current position as of 07 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article

Oriental Trimex Ltd is Rated Strong Sell

2025-12-25 15:13:16Oriental Trimex Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 24 Nov 2025. However, the analysis and financial metrics discussed below reflect the stock's current position as of 25 December 2025, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Oriental Trimex Sees Revision in Market Evaluation Amidst Challenging Financial Trends

2025-12-07 10:10:30Oriental Trimex has experienced a revision in its market evaluation reflecting recent shifts in its financial and technical outlook. The changes stem from a reassessment of the company’s quality, valuation, financial trends, and technical indicators, set against a backdrop of sustained stock underperformance and operational challenges.

Read full news articleCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Jan-2026 | Source : BSESubmission of Certificate under Regulation 74(5) of the SEBI (Depository & participants ) Regulations 2018 for the Quarter ended 31st December 2025.

Closure of Trading Window

30-Dec-2025 | Source : BSEWe hereby inform that the trading window of the company shall remain closed for all the designated Person/Directors/KMPs/Officers and their immediate relatives w.e.f Thursday January 01 2026.

Disclosures By Listed Entities Of Defaults On Payment Of Interest/Repayment Of Principal Amount On Loans From Banks / Financial Institutions And Unlisted Debt Securities

04-Dec-2025 | Source : BSEDisclosure of defaults on payment of interest/repayment of One Time Settlement

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

Oriental Trimex Ltd has announced 3:2 rights issue, ex-date: 05 Sep 24