Compare MEP Infrast. with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength as the company has not declared results in the last 6 months

- Poor long term growth as Net Sales has grown by an annual rate of -51.44% and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

The company has declared Negative results for the last 8 consecutive quarters

Risky - No result in last 6 months

78.13% of Promoter Shares are Pledged

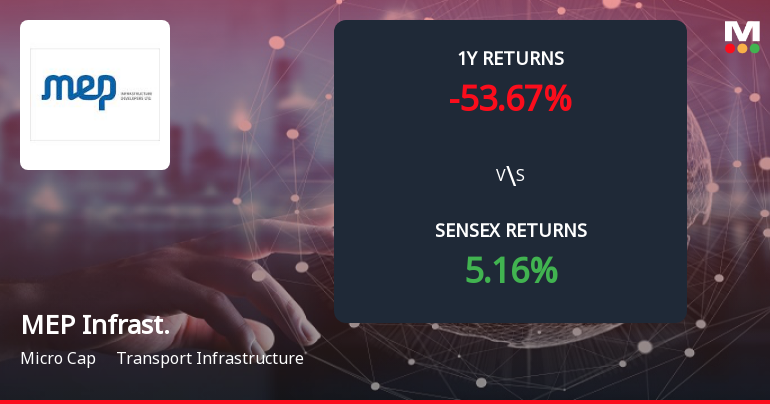

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Transport Infrastructure

INR 26 Cr (Micro Cap)

NA (Loss Making)

36

0.00%

-0.95

60.78%

-0.07

Total Returns (Price + Dividend)

Latest dividend: 0.3 per share ex-dividend date: Aug-29-2019

Risk Adjusted Returns v/s

Returns Beta

News

MEP Infrastructure Developers Ltd Forms Death Cross, Signalling Bearish Trend

MEP Infrastructure Developers Ltd has recently formed a Death Cross, a significant technical indicator where the 50-day moving average crosses below the 200-day moving average, signalling a potential prolonged bearish trend and deterioration in the stock’s momentum.

Read full news article

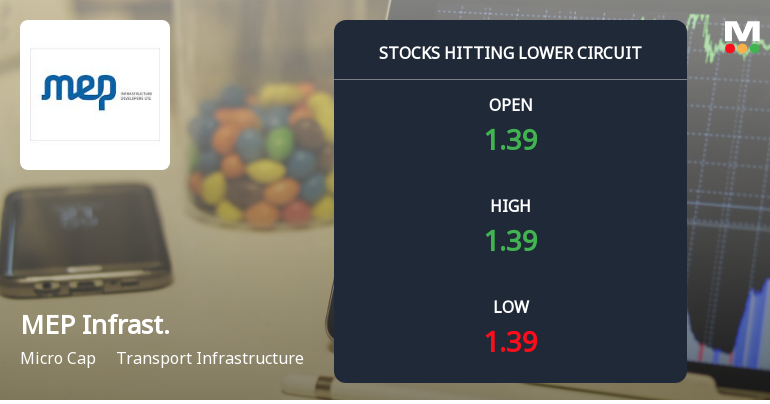

MEP Infrastructure Developers Ltd Hits Lower Circuit Amid Heavy Selling Pressure

Shares of MEP Infrastructure Developers Ltd, a micro-cap player in the transport infrastructure sector, plunged to their lower circuit limit on 1 Feb 2026, reflecting intense selling pressure and investor panic. The stock closed at ₹1.39, down 1.42% on the day, marking its 11th consecutive day of decline and a cumulative loss of 16.77% over this period.

Read full news article

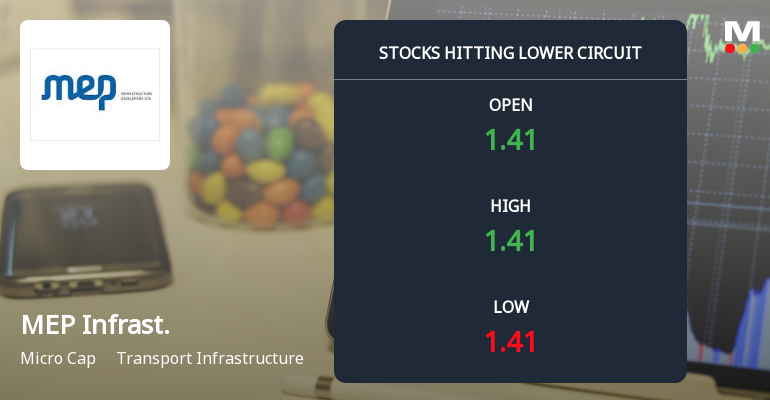

MEP Infrastructure Developers Ltd Hits Lower Circuit Amid Heavy Selling Pressure

Shares of MEP Infrastructure Developers Ltd, a micro-cap player in the transport infrastructure sector, plunged to their lower circuit limit on 30 Jan 2026, reflecting intense selling pressure and a sustained downtrend. The stock closed at ₹1.41, marking a maximum daily loss of 1.4%, as panic selling gripped investors amid unfilled supply and deteriorating technical indicators.

Read full news article Announcements

Corporate Insolvency Resolution Process (CIRP)-Updates - Corporate Insolvency Resolution Process (CIRP)

27-Jan-2026 | Source : BSEPost facto intimation of 21st Meeting of Committee of Creditors

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Jan-2026 | Source : BSECompliance Certificate under Reg 74(5) of SEBI (DP) Regulations 2018

Corporate Insolvency Resolution Process (CIRP)-Intimation of meeting of Committee of Creditors

30-Dec-2025 | Source : BSEPost facto intimation of 20th meeting of Committee of Creditors

Corporate Actions

No Upcoming Board Meetings

MEP Infrastructure Developers Ltd has declared 3% dividend, ex-date: 29 Aug 19

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

78.1297

Held by 1 Schemes (4.41%)

Held by 3 FIIs (0.12%)

A J Tolls Pvt Ltd (7.87%)

Hdfc Trustee Company Ltd. A/c Hdfc Balanced Advantage Fund (4.41%)

54.25%

Quarterly Results Snapshot (Standalone) - Mar'24 - QoQ

QoQ Growth in quarter ended Mar 2024 is 87.64% vs 275.26% in Dec 2023

QoQ Growth in quarter ended Mar 2024 is -551.69% vs -134.93% in Dec 2023

Half Yearly Results Snapshot (Consolidated) - Sep'23

Growth in half year ended Sep 2023 is -91.47% vs -53.16% in Sep 2022

Growth in half year ended Sep 2023 is 14.34% vs -134.02% in Sep 2022

Nine Monthly Results Snapshot (Consolidated) - Dec'23

YoY Growth in nine months ended Dec 2023 is -83.58% vs -68.12% in Dec 2022

YoY Growth in nine months ended Dec 2023 is -32.39% vs -169.48% in Dec 2022

Annual Results Snapshot (Standalone) - Mar'24

YoY Growth in year ended Mar 2024 is -15.24% vs -69.34% in Mar 2023

YoY Growth in year ended Mar 2024 is -476.33% vs -188.60% in Mar 2023