Compare FCS Software with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 0.31

- The company has been able to generate a Return on Equity (avg) of 0.63% signifying low profitability per unit of shareholders funds

The company has declared Negative results for the last 3 consecutive quarters

Risky - Negative Operating Profits

Below par performance in long term as well as near term

Stock DNA

Computers - Software & Consulting

INR 253 Cr (Micro Cap)

580.00

27

0.00%

-0.09

0.11%

0.60

Total Returns (Price + Dividend)

Latest dividend: 0.5 per share ex-dividend date: Sep-03-2009

Risk Adjusted Returns v/s

Returns Beta

News

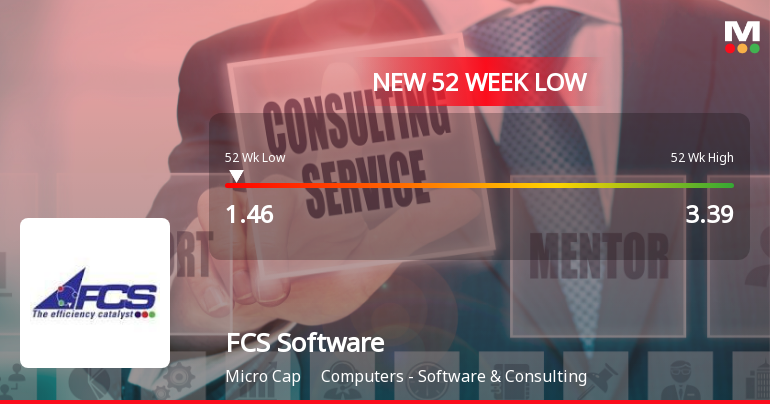

FCS Software Solutions Ltd Hits 52-Week Low Amid Continued Downtrend

FCS Software Solutions Ltd has touched a new 52-week low of Rs.1.46 today, marking a significant decline amid ongoing financial pressures and subdued market performance. The stock has underperformed its sector and broader indices, reflecting persistent challenges in profitability and operational metrics.

Read full news article

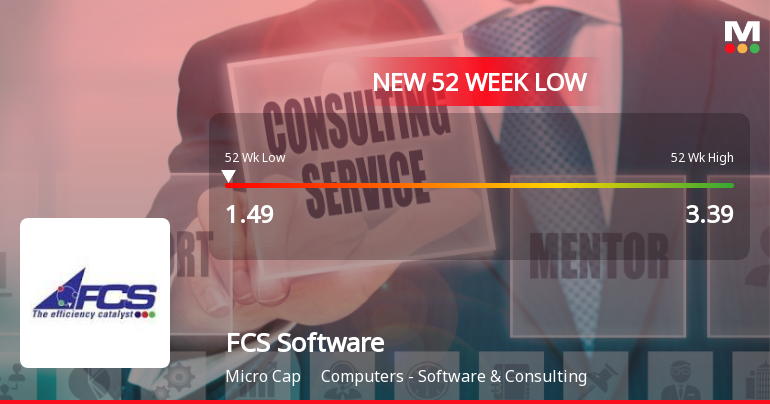

FCS Software Solutions Ltd Falls to 52-Week Low of Rs.1.49

FCS Software Solutions Ltd has touched a new 52-week low of Rs.1.49 today, marking a significant decline in its share price amid ongoing financial pressures and subdued market performance. The stock’s fall comes despite a broadly stable Sensex, highlighting company-specific concerns within the Computers - Software & Consulting sector.

Read full news article

FCS Software Solutions Ltd Falls to 52-Week Low of Rs.1.5

FCS Software Solutions Ltd has reached a new 52-week low of Rs.1.5 today, marking a significant decline in its stock price amid ongoing financial pressures and subdued market performance within the Computers - Software & Consulting sector.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Jan-2026 | Source : BSESubmission of certificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the Quarter Ended on 31st December 2025.

Closure of Trading Window

26-Dec-2025 | Source : BSEClosure of Trading Window of the Company under SEBI (Prohibition of Insider Trading) Regulations 2015

Announcement under Regulation 30 (LODR)-Newspaper Publication

13-Nov-2025 | Source : BSEPlease find enclosed herewith the copy of Newspaper Advertisement with respect to the outcome of 226th Board Meeting held on 12th November2025 published in Finacial Express-New Delhi ( English Newspaper)and Haribhoomi-New Delhi(Hindi Newspaper)

Corporate Actions

No Upcoming Board Meetings

FCS Software Solutions Ltd has declared 5% dividend, ex-date: 03 Sep 09

FCS Software Solutions Ltd has announced 1:10 stock split, ex-date: 15 Oct 09

FCS Software Solutions Ltd has announced 1:1 bonus issue, ex-date: 26 Feb 10

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 3 FIIs (0.01%)

Dalip Kumar (10.88%)

Slg Softech Private Limited (6.27%)

65.89%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -11.72% vs -0.11% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -212.73% vs 119.93% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -10.61% vs 3.24% in Sep 2024

Growth in half year ended Sep 2025 is -132.93% vs 149.60% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 2.82% vs 1.28% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 139.03% vs -816.54% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -0.08% vs 4.76% in Mar 2024

YoY Growth in year ended Mar 2025 is 130.95% vs -925.34% in Mar 2024