Compare Unichem Labs. with Similar Stocks

Dashboard

Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.87 times

- Poor long term growth as Net Sales has grown by an annual rate of 12.60% over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.87 times

- The company has been able to generate a Return on Equity (avg) of 1.44% signifying low profitability per unit of shareholders funds

Negative results in Dec 25

Below par performance in long term as well as near term

Stock DNA

Pharmaceuticals & Biotechnology

INR 2,822 Cr (Small Cap)

20.00

32

0.00%

0.13

6.03%

1.22

Total Returns (Price + Dividend)

Latest dividend: 4 per share ex-dividend date: Aug-01-2022

Risk Adjusted Returns v/s

Returns Beta

News

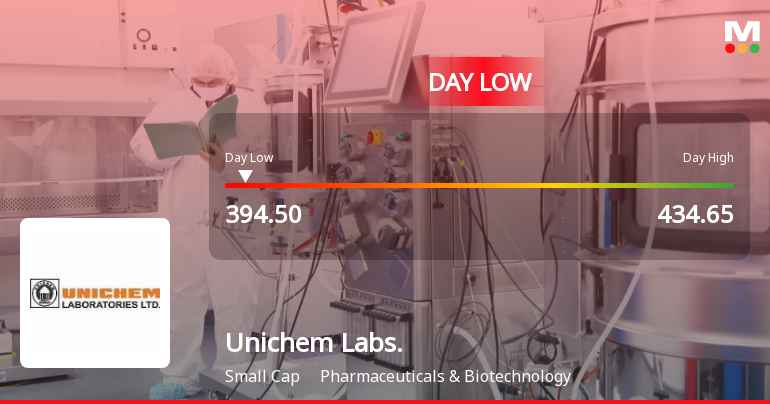

Unichem Laboratories Ltd Hits Intraday Low Amid Price Pressure on 6 Feb 2026

Shares of Unichem Laboratories Ltd declined sharply on 6 Feb 2026, hitting an intraday low of Rs 400.65, reflecting significant price pressure as the stock underperformed its sector and broader market indices.

Read full news article

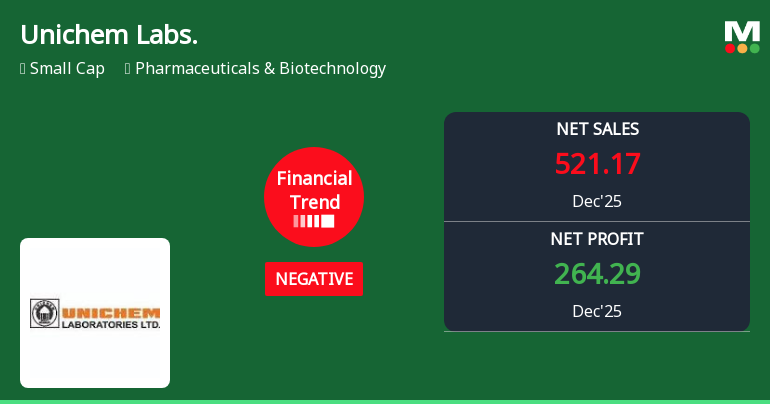

Unichem Laboratories Reports Negative Financial Trend Amidst Margin Pressure

Unichem Laboratories Ltd has reported a marked deterioration in its financial performance for the quarter ended December 2025, with key metrics signalling a shift from a previously flat trend to a negative trajectory. Despite some operational strengths, the pharmaceutical company faces significant challenges in profitability and margin sustainability, prompting a downgrade in its Mojo Grade to Sell.

Read full news articleAre Unichem Laboratories Ltd latest results good or bad?

Unichem Laboratories Ltd's latest financial results for Q3 FY26 present a complex picture. The company reported a net profit of ₹264.29 crores, which reflects a significant year-on-year increase, primarily driven by exceptional gains. However, this profit surge masks underlying operational challenges, as the company's revenue declined by 2.24% year-on-year to ₹521.17 crores, marking the lowest quarterly sales of the fiscal year. Sequentially, revenue also fell by 9.98% from the previous quarter, indicating a concerning trend in sales performance. The operating margin, excluding other income, compressed significantly to 8.59%, down from 16.04% in the same quarter last year. This decline of 746 basis points highlights persistent pressure on the company's core business operations. Additionally, the profit before tax of ₹293.43 crores indicates that a substantial portion of this figure is attributable to excep...

Read full news article Announcements

Announce Under Regulation 30 (LODR) - USFDA Inspected The CompanyS Kolhapur API Facility

02-Feb-2026 | Source : BSEUSPDA inspected Companys Kolhapur API facility from January 26 2026 to February 2 2026.

Announcement Under Reg. 30 Of Listing Regulations

27-Jan-2026 | Source : BSEAnnouncement under Reg. 30 of Listing Regulations

Final Report On Re-Lodgement Of Transfer Requests Of Physical Shares From 1St December 2025 Upto 6Th January 2026

27-Jan-2026 | Source : BSEFinal report on re-lodgement of transfer requests of physical shares from 1st December 2025 upto 6th January 2026

Corporate Actions

No Upcoming Board Meetings

Unichem Laboratories Ltd has declared 200% dividend, ex-date: 01 Aug 22

Unichem Laboratories Ltd has announced 2:5 stock split, ex-date: 21 Oct 10

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 5 Schemes (9.17%)

Held by 38 FIIs (0.99%)

Ipca Laboratories Limited (52.67%)

Hdfc Small Cap Fund (7.75%)

15.18%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -9.98% vs 9.94% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 2,322.79% vs -13.56% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 11.59% vs 18.11% in Sep 2024

Growth in half year ended Sep 2025 is -183.75% vs 206.12% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 6.76% vs 16.81% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 186.14% vs 75.93% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 18.25% vs 32.92% in Mar 2024

YoY Growth in year ended Mar 2025 is 246.67% vs 53.64% in Mar 2024