Compare Sarthak Global with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -28.80% and Operating profit at -21.40% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 4.54 times

- The company has been able to generate a Return on Equity (avg) of 4.88% signifying low profitability per unit of shareholders funds

Flat results in Sep 25

Risky - Negative EBITDA

Stock DNA

Steel/Sponge Iron/Pig Iron

INR 10 Cr (Small Cap)

20.00

28

0.00%

4.08

22.27%

4.69

Total Returns (Price + Dividend)

Sarthak Global for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Sarthak Global Ltd Upgraded to Sell on Technical Improvements Despite Weak Fundamentals

Sarthak Global Ltd’s investment rating has been upgraded from Strong Sell to Sell, reflecting a nuanced shift in its technical outlook amid persistent fundamental challenges. While the company’s financial performance remains subdued with operating losses and high leverage, recent technical indicators suggest a mildly bullish trend, prompting a reassessment of its market stance.

Read full news article

Sarthak Global Ltd Opens with Strong Gap Up, Reflecting Positive Market Sentiment

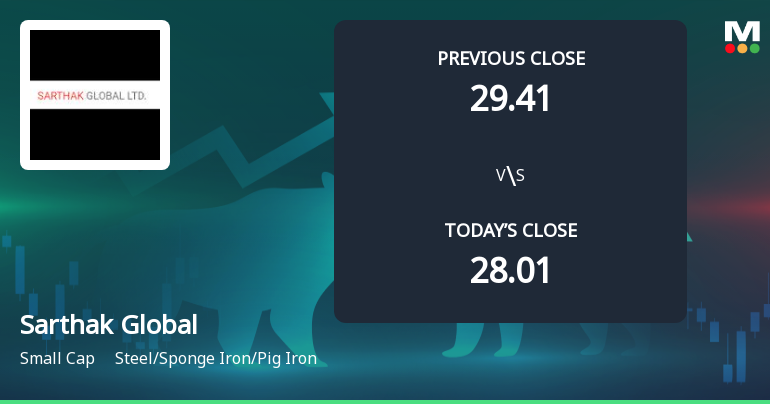

Sarthak Global Ltd commenced trading on 14 Jan 2026 with a significant gap up, opening at Rs 29.41, marking a 5.0% increase from its previous close. This robust start underscores a positive market sentiment despite the stock’s recent underperformance over the past month.

Read full news article

Sarthak Global Ltd Downgraded to Strong Sell Amid Weak Fundamentals and Technical Setbacks

Sarthak Global Ltd has seen its investment rating downgraded from Sell to Strong Sell as of 13 January 2026, reflecting deteriorating technical indicators and persistently weak financial fundamentals. The company’s Mojo Score has declined to 23.0, signalling heightened risk for investors amid sideways technical trends and poor long-term growth metrics.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Jan-2026 | Source : BSECompliance Certificate under Regulation 74(5) of SEBI (DP) Regulations 2018 as amended for the Quarter Ended December 31 2025.

Closure of Trading Window

27-Dec-2025 | Source : BSEIntimation of Closure of Trading Window

Announcement under Regulation 30 (LODR)-Newspaper Publication

15-Nov-2025 | Source : BSENewspaper Publication for the Standalone Financial Results for the Quarter and Half Year Ended 30.09.2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Gagandeep Exports Pvt. Ltd. (14.13%)

Patanjali Foods Limited (0.04%)

13.92%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -89.02% vs -76.90% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -100.00% vs 162.50% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -70.16% vs 1,505.26% in Sep 2024

Growth in half year ended Sep 2025 is 295.24% vs -520.00% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 968.25% vs -86.57% in Dec 2022

YoY Growth in nine months ended Dec 2024 is -420.00% vs 42.86% in Dec 2022

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 77.64% vs -15.38% in Mar 2024

YoY Growth in year ended Mar 2025 is 50.00% vs 100.48% in Mar 2024