Compare Cosmo First with Similar Stocks

Total Returns (Price + Dividend)

Latest dividend: 4 per share ex-dividend date: Jul-28-2025

Risk Adjusted Returns v/s

Returns Beta

News

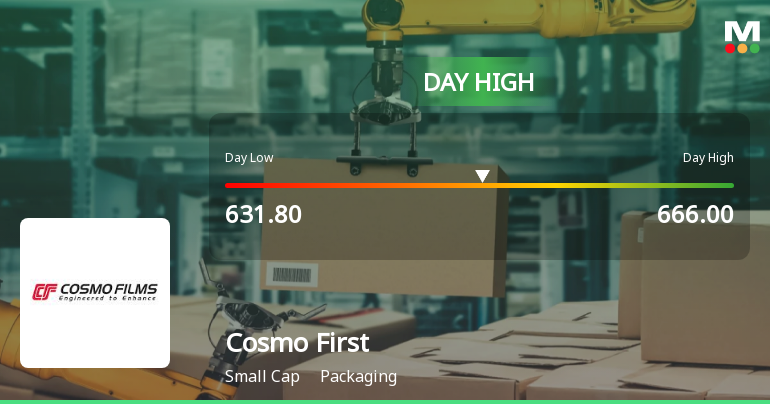

Cosmo First Ltd Hits Intraday High with 10.02% Surge on 3 Feb 2026

Cosmo First Ltd demonstrated robust intraday performance on 3 Feb 2026, surging to an intraday high of Rs 666, marking a 14.49% increase from its previous close. The stock outpaced its sector and broader market indices, reflecting heightened trading activity and volatility throughout the session.

Read full news article

Cosmo First Ltd Opens with Strong Gap Up, Reflecting Positive Market Sentiment

Cosmo First Ltd, a player in the packaging sector, commenced trading today with a significant gap up, opening 10.2% higher than its previous close. This robust start underscores a positive market sentiment despite the company’s current sell-grade status, marking a notable deviation from recent trends.

Read full news article

Cosmo First Ltd is Rated Sell

Cosmo First Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 12 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 27 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article Announcements

Intimation Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

22-Jan-2026 | Source : BSEIntimation under Regulation 30 of SEBI (LODR) Regulations 2015.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

06-Jan-2026 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulatons 2018 for the quarter ended December 31 2025

Closure of Trading Window

30-Dec-2025 | Source : BSEIntimation of Closure of Trading Window for the Quarter ended Decemeber 31 2025

Corporate Actions

No Upcoming Board Meetings

Cosmo First Ltd has declared 40% dividend, ex-date: 28 Jul 25

No Splits history available

Cosmo First Ltd has announced 1:2 bonus issue, ex-date: 16 Jun 22

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 6 Schemes (0.01%)

Held by 51 FIIs (2.68%)

Ashok Jaipuria - Registered Owner C/o Gayatri& Annapurana - Beneficial Owner (36.14%)

Minaxi Bhalchandra Trivedi (1.64%)

40.25%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 14.87% vs 7.26% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 8.91% vs 58.19% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 18.67% vs 9.64% in Sep 2024

Growth in half year ended Sep 2025 is 16.75% vs 116.39% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 10.44% vs -17.20% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 127.02% vs -77.94% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 11.89% vs -15.59% in Mar 2024

YoY Growth in year ended Mar 2025 is 114.46% vs -74.51% in Mar 2024