Compare Sumuka Agro with Similar Stocks

Dashboard

With ROCE of 18.2, it has a Very Expensive valuation with a 8.1 Enterprise value to Capital Employed

- The stock is trading at a premium compared to its peers' average historical valuations

- Over the past year, while the stock has generated a return of 18.01%, its profits have fallen by -16.7%

Total Returns (Price + Dividend)

Sumuka Agro for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

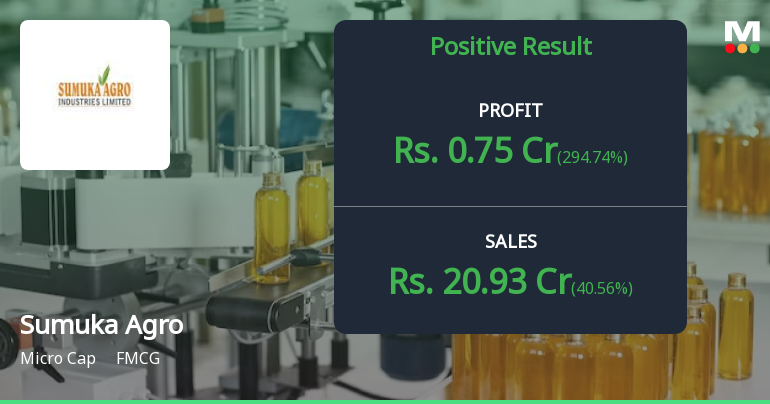

Are Sumuka Agro Industries Ltd latest results good or bad?

The latest financial results for Sumuka Agro Industries Ltd present a complex picture of growth and challenges. In the quarter ending September 2025, the company reported net sales of ₹20.93 crores, reflecting a year-on-year growth of 40.56% and a sequential increase of 6.30%. This marks a continuation of the company's robust topline momentum, achieving the highest quarterly revenue in its recent history. However, despite this impressive revenue growth, the operating margins have contracted sharply to 4.16%, down from 9.32% a year ago, indicating significant pressure on profitability. The net profit for the same quarter was ₹0.75 crores, which, while showing a substantial year-on-year growth of 294.74%, represents an 8.54% decline compared to the previous quarter. This decline is particularly noteworthy as it occurred despite the absence of tax payments in Q2 FY26, which artificially inflated the year-on-y...

Read full news article

Sumuka Agro Q2 FY26: Strong Revenue Growth Masks Margin Compression Concerns

Sumuka Agro Industries Ltd., a micro-cap player in India's FMCG sector with a market capitalisation of ₹176.00 crores, reported net profit of ₹0.75 crores for Q2 FY26 ending September 2025, marking a sequential decline of 8.54% quarter-on-quarter but a remarkable turnaround of 294.74% year-on-year. The company's shares closed at ₹249.50 on January 30, 2026, down 2.79% on the day, though the stock has delivered an impressive 40.56% year-on-year revenue growth, significantly outperforming its FMCG sector peers.

Read full news article

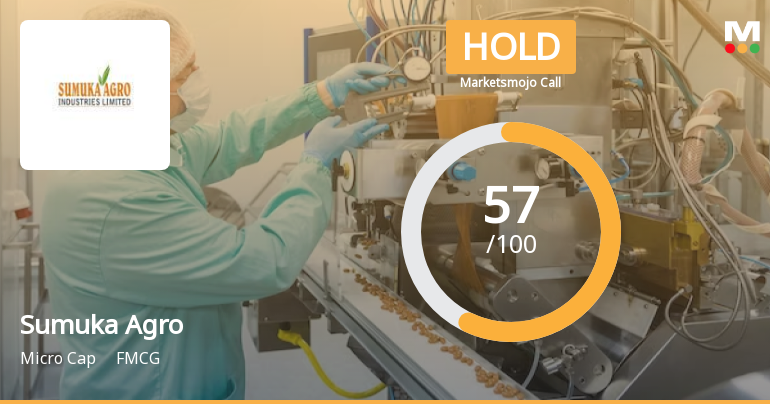

Sumuka Agro Industries Ltd Upgraded to Hold on Technical and Financial Improvements

Sumuka Agro Industries Ltd has seen its investment rating upgraded from Sell to Hold, reflecting a notable improvement in its technical indicators and sustained financial performance. The upgrade, effective from 29 January 2026, is underpinned by a shift in technical trends, robust management efficiency, and encouraging institutional participation, despite some valuation concerns.

Read full news article Announcements

Financial Result For The Quarter Ended 31St December 2025

31-Jan-2026 | Source : BSEfinancial result for the quarter ended 31st December 2025

Board Meeting Outcome for Outcome Of Board Meeting Held Today I.E Saturday January 31 2026

31-Jan-2026 | Source : BSEWith reference to the captioned subject and pursuant to Regulation 30 and other applicable provisions of the SEBI Listing Regulations this is to inform you that the Board of Directors of the Company at its meeting held on Saturday January 31 2026 commenced at 05:00 p.m. and concluded at 07:30 p.m. at the Registered Office of the Company have inter alia considered and approved the following: 1.Pursuant to Regulation 33 and Regulation 30 read with Part A of Schedule III of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 Unaudited Financial Results (Standalone ) for the third quarter and nine months ended December 31 2025 along with Limited Review Report issued by M/s. S K Jha &Co Chartered Accountants Statutory Auditors of the Company which were approved by the Board of Directors of the Company at its meeting held on today i.e. Saturday January 31 2026. The same is annexed as Annexure I.

Board Meeting Intimation for Intimation Of Board Meeting Schedule To Be Held On Saturday 31St January2026.

07-Jan-2026 | Source : BSESumuka Agro Industries Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 31/01/2026 inter alia to consider and approve Pursuant to Regulation 29 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 this is to inform you that the meeting of the Board of Directors of the Company is scheduled to be held on Saturday 31st January2026. inter-alia to approve the Unaudited Financial Results for the quarter ended December 31 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 2 FIIs (12.89%)

Vishal Vipinbhai Bhatt (8.81%)

Aegis Investment Fund Pcc (7.6%)

40.68%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 24.31% vs 29.90% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 8.45% vs -10.13% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 46.27% vs 20.74% in Sep 2024

Growth in half year ended Sep 2025 is -13.26% vs -27.89% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 37.92% vs 24.07% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -7.14% vs -23.64% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 13.38% vs 97.09% in Mar 2024

YoY Growth in year ended Mar 2025 is -35.68% vs 83.62% in Mar 2024