Compare Apcotex Industri with Similar Stocks

Dashboard

High Management Efficiency with a high ROE of 17.89%

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 0.68 times

Healthy long term growth as Net Sales has grown by an annual rate of 27.88% and Operating profit at 66.61%

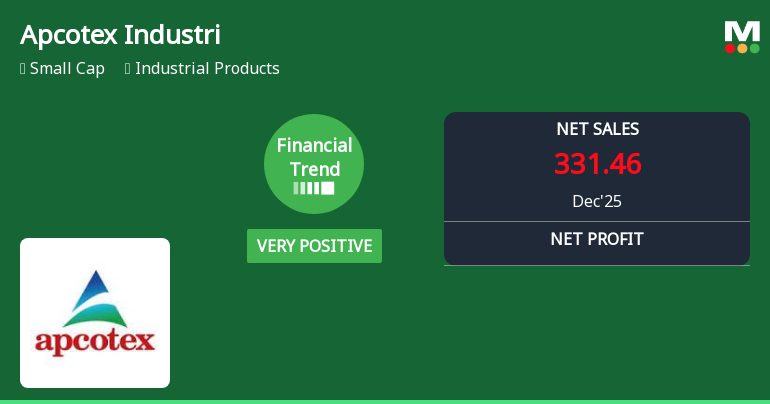

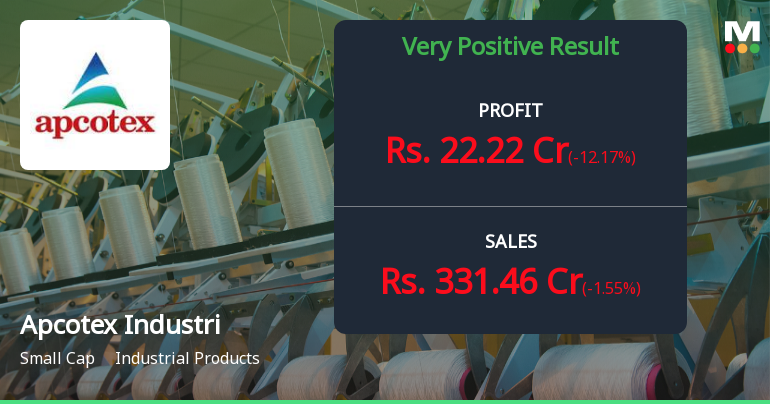

With a growth in Operating Profit of 3.56%, the company declared Very Positive results in Dec 25

With ROCE of 15.6, it has a Fair valuation with a 2.9 Enterprise value to Capital Employed

Majority shareholders : Promoters

With its market cap of Rs 1,814 cr, it is the second biggest company in the sector (behind Cupid)and constitutes 9.82% of the entire sector

Stock DNA

Industrial Products

INR 1,893 Cr (Small Cap)

26.00

50

0.57%

0.11

11.85%

3.13

Total Returns (Price + Dividend)

Latest dividend: 2 per share ex-dividend date: Feb-03-2025

Risk Adjusted Returns v/s

Returns Beta

News

Apcotex Industries Ltd Reports Very Positive Quarterly Financial Performance Amid Mixed Market Returns

Apcotex Industries Ltd has delivered a very positive financial performance in the quarter ended December 2025, marked by record profitability and operational efficiency despite a dip in net sales. The company’s financial trend score has improved significantly, reflecting robust margin expansion and superior returns on capital, signalling a turnaround from previous quarters.

Read full news articleAre Apcotex Industries Ltd latest results good or bad?

Apcotex Industries Ltd's latest financial results reveal a complex picture characterized by both operational challenges and some positive trends. In the quarter ended December 2025, the company reported a net sales figure of ₹331.46 crores, which reflects a slight sequential decline of 1.55% compared to the previous quarter. This follows a more significant decline of 10.40% in the prior quarter, suggesting a potential stabilization in sales trends. The standalone net profit for the same period was ₹22.22 crores, marking a decrease of 12.17% from the previous quarter, which contrasts with a notable increase of 25.30% in the prior quarter. This indicates a reversal in profit momentum, raising questions about the sustainability of recent gains. Operating profit, measured as PBDIT excluding other income, showed a positive trend with a reported figure of ₹43.54 crores, reflecting a growth of 7.24% from the pr...

Read full news article

Apcotex Industries Q2 FY17: Profit Plunges 48% as Margins Contract Sharply

Apcotex Industries Ltd., India's second-largest player in the industrial products sector with a market capitalisation of ₹1,825 crores, has reported a concerning quarterly performance for Q2 FY17 (September 2016), with consolidated net profit declining 48.03% sequentially to ₹3.56 crores from ₹6.85 crores in Q1 FY17. On a year-on-year basis, profit fell 41.64% from ₹6.10 crores in the corresponding quarter last year, marking a significant setback for the manufacturer of emulsion polymers, synthetic latexes, and rubber products.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

20-Jan-2026 | Source : BSEPlease find enclosed intimation regarding Earnings Conference Call scheduled on 30th January 2026 at 2.00 p.m. IST

Board Meeting Intimation for Consideration And Approval Of The Audited Financial Results Of The Company For The Quarter And Nine Months Ended 31St December 2025 And For Consideration Of The Proposal For The Declaration Of Interim Dividend And Fix The Reco

16-Jan-2026 | Source : BSEApcotex Industries Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 29/01/2026 inter alia to consider and approve the audited financial results of the Company for the quarter and nine months ended 31st December 2025 and to consider the proposal for declaration of interim dividend and fix the record date for the same.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

06-Jan-2026 | Source : BSEPlease find enclosed certificate under Regulation 74(5) of SEBI (DP) Regulations 2018.

Corporate Actions

No Upcoming Board Meetings

Apcotex Industries Ltd has declared 100% dividend, ex-date: 03 Feb 25

Apcotex Industries Ltd has announced 2:5 stock split, ex-date: 04 Jul 19

Apcotex Industries Ltd has announced 1:1 bonus issue, ex-date: 23 Sep 15

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 4 Schemes (1.6%)

Held by 27 FIIs (0.62%)

Parul Atul Choksey (14.27%)

Icici Prudential Smallcap Fund (1.59%)

32.2%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -1.55% vs -10.40% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -12.17% vs 32.05% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 3.60% vs 23.47% in Sep 2024

Growth in half year ended Sep 2025 is 72.66% vs -6.12% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 0.09% vs 28.13% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 78.72% vs -3.24% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 23.81% vs 4.13% in Mar 2024

YoY Growth in year ended Mar 2025 is 0.33% vs -50.08% in Mar 2024