Compare Timex Group with Similar Stocks

Dashboard

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 0.35 times

Healthy long term growth as Net Sales has grown by an annual rate of 33.48% and Operating profit at 46.24%

With a growth in Operating Profit of 70.14%, the company declared Outstanding results in Sep 25

Market Beating Performance

Stock DNA

Gems, Jewellery And Watches

INR 2,884 Cr (Small Cap)

51.00

46

0.00%

-0.33

46.98%

23.76

Total Returns (Price + Dividend)

Timex Group for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Timex Group India Ltd is Rated Buy

Timex Group India Ltd is rated 'Buy' by MarketsMOJO, with this rating last updated on 13 August 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 01 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Timex Group India Ltd is Rated Buy

Timex Group India Ltd is rated 'Buy' by MarketsMOJO, with this rating last updated on 13 August 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 21 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

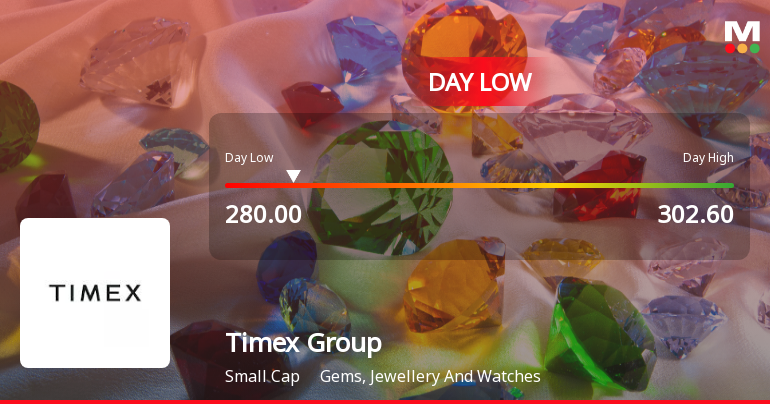

Timex Group India Ltd Hits Intraday Low Amid Price Pressure

Timex Group India Ltd experienced a significant intraday decline on 20 Jan 2026, touching a low of Rs 280, down 7.96% from previous levels, reflecting sustained selling pressure amid broader market weakness and sectoral underperformance.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

10-Jan-2026 | Source : BSEPursuant to Regulation 30 of the SEBI(LODR) Regulations 2015 please find enclosed herewith copies of Newspaper Advertisement published on January 9 2026 in Business Standard(English) in New Delhi and Mumbai edition and Business Standard (Hindi) in New Delhi edition with respect to the notice for transfer of share certificate(s).

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Jan-2026 | Source : BSEPursuant to Regulation 74(5) of SEBI(Depositories and Participants) Regulations 2018 Please find enclosed herewith a confirmation certificate from Alankit Assignments Limited the Registrar and Share Transfer Agent (RTA) of the Company for the quarter ended December 31 2025

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

06-Jan-2026 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Timex Group Luxury Watches B V

Corporate Actions

(03 Feb 2026)

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 6 Schemes (0.01%)

Held by 20 FIIs (2.02%)

Timex Group Luxury Watches B.v. (51.0%)

Chetan Jayantilal Shah (2.38%)

33.88%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 39.98% vs 37.77% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 69.74% vs 61.91% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 45.93% vs 21.53% in Sep 2024

Growth in half year ended Sep 2025 is 121.84% vs 32.72% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 23.20% vs 8.90% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 61.19% vs -42.98% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 28.45% vs 9.25% in Mar 2024

YoY Growth in year ended Mar 2025 is 50.77% vs -55.20% in Mar 2024