Compare Millen. Online with Similar Stocks

Stock DNA

Diversified Commercial Services

INR 8 Cr (Micro Cap)

NA (Loss Making)

22

0.00%

0.38

-2.47%

1.91

Total Returns (Price + Dividend)

Millen. Online for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

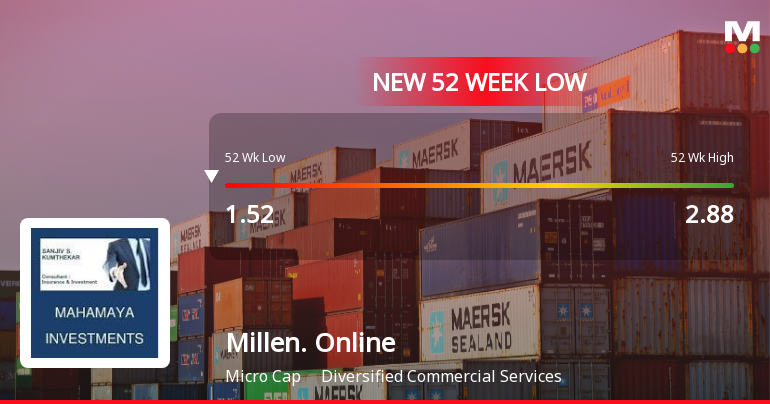

Millennium Online Solutions (India) Ltd Falls to 52-Week Low of Rs.1.48

Millennium Online Solutions (India) Ltd has touched a fresh 52-week low of Rs.1.48 today, marking a significant decline amid a broader market environment where the Sensex opened lower. The stock has underperformed its sector and key benchmarks, reflecting ongoing concerns about its financial health and market positioning.

Read full news article

Millennium Online Solutions (India) Ltd Falls to 52-Week Low Amid Continued Downtrend

Millennium Online Solutions (India) Ltd has reached a new 52-week low of Rs.1.59 today, marking a significant decline in its stock price amid broader market fluctuations and company-specific performance issues.

Read full news article

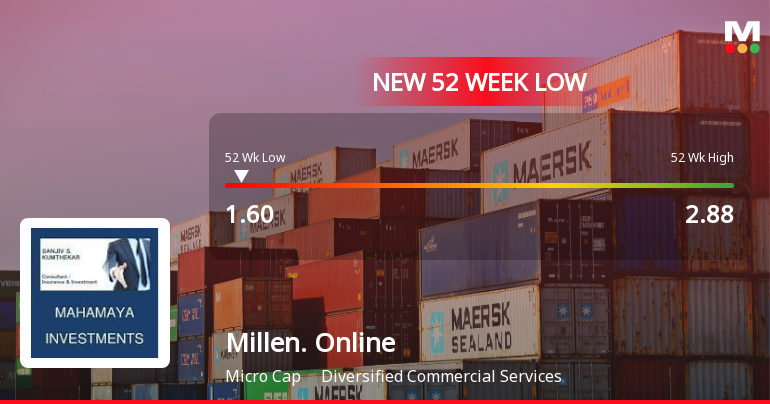

Millennium Online Solutions (India) Ltd Falls to 52-Week Low of Rs.1.6

Millennium Online Solutions (India) Ltd has reached a new 52-week low of Rs.1.6 today, marking a significant decline in its stock price amid broader market fluctuations and company-specific performance issues.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Jan-2026 | Source : BSECompliance Certificate under Reg 74(5) of SEBI (DP) Regulations 2018 for the quarter ended 31st December 2025.

Intimation Under Regulation 30 Of SEBI (LODR) Regulations 2015 For Change In Website Of The Company.

06-Jan-2026 | Source : BSEIntimation under Regulation 30 of SEBI (LODR) Regulations 2015 for change in website of the Company

Closure of Trading Window

26-Dec-2025 | Source : BSEIntimation of Closure of Trading Window for the quarter ended 31st December 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Millennium Online Solutions (India) Ltd has announced 1:10 stock split, ex-date: 30 Mar 15

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Mrs. Arundhati Balkrishna (0.0%)

Jaya Suresh Bharati . (12.05%)

93.66%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 45.10% vs 27.50% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 300.00% vs 87.50% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 125.45% vs 3.77% in Sep 2024

Growth in half year ended Sep 2025 is 108.33% vs 0.00% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 11.24% vs -44.03% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 0.00% vs 0.00% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 16.81% vs -63.72% in Mar 2024

YoY Growth in year ended Mar 2025 is 14.81% vs 38.64% in Mar 2024