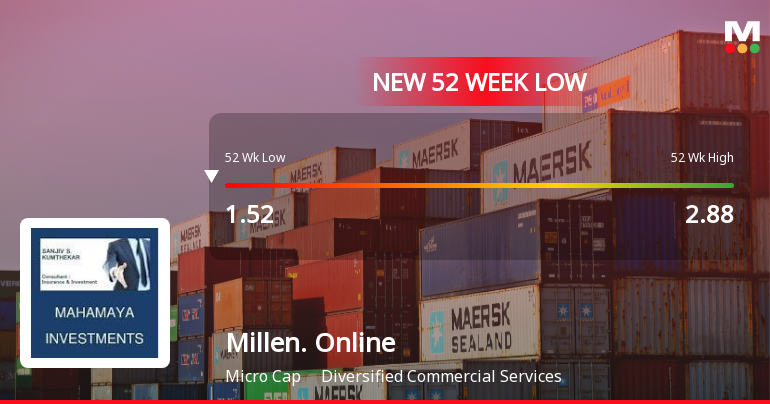

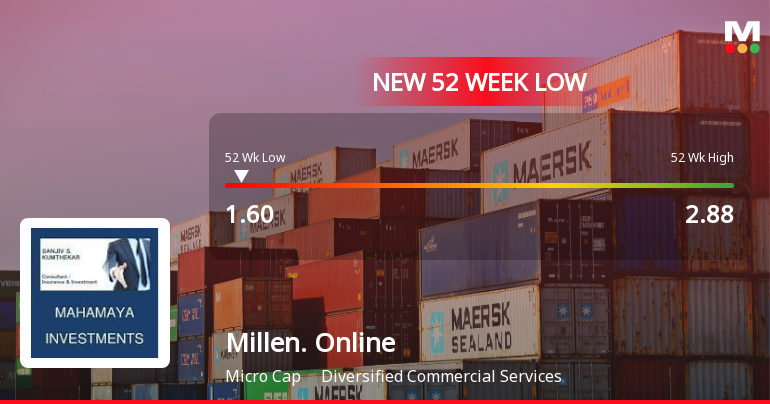

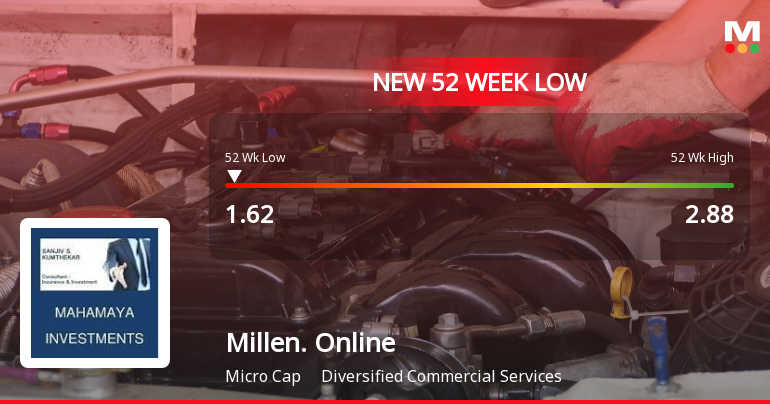

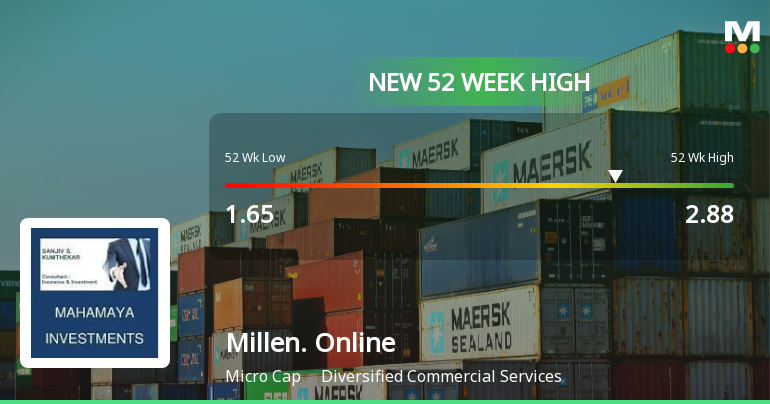

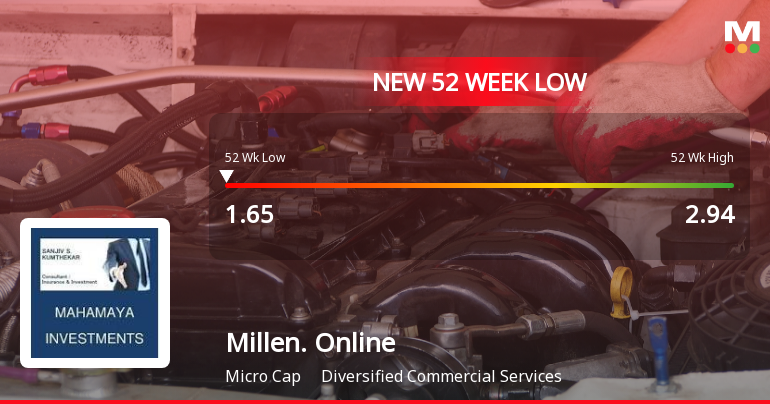

Recent Price Movement and Trend Reversal

Millennium Online Solutions had been on a strong upward trajectory, culminating in a new 52-week high of ₹2.88 on 19 December. This marked a significant milestone for the stock, signalling renewed investor interest and optimism. However, the stock price reversed sharply by ₹0.22, or 8.4%, by the close at 8:45 PM, indicating a pullback after sustained gains. This decline ended a five-day consecutive rise, suggesting that investors may be locking in profits after the recent surge.

Performance Relative to Benchmarks and Sector

Despite the day's setback, Millennium Online Solutions has delivered impressive returns over the past week and month, outperforming the Sensex benchmark substantially. The stock gained...

Read full news article