Compare Wheels India with Similar Stocks

Dashboard

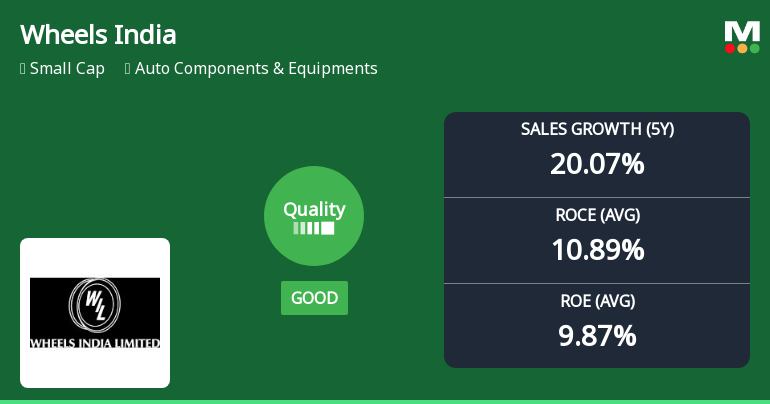

Healthy long term growth as Net Sales has grown by an annual rate of 20.07% and Operating profit at 65.90%

The company has declared Positive results for the last 8 consecutive quarters

With ROCE of 16.2, it has a Attractive valuation with a 1.6 Enterprise value to Capital Employed

Majority shareholders : Promoters

Stock DNA

Auto Components & Equipments

INR 1,899 Cr (Small Cap)

14.00

37

1.49%

0.74

12.89%

1.95

Total Returns (Price + Dividend)

Latest dividend: 7 per share ex-dividend date: Jul-10-2025

Risk Adjusted Returns v/s

Returns Beta

News

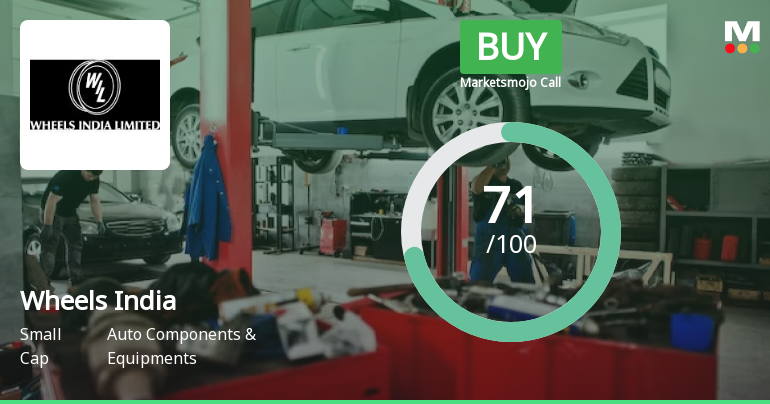

Wheels India Ltd. Upgraded to Buy on Strong Financial and Valuation Metrics

Wheels India Ltd., a key player in the Auto Components & Equipments sector, has seen its investment rating upgraded from Hold to Buy as of 30 January 2026. This upgrade reflects significant improvements across quality, valuation, financial trends, and technical indicators, signalling renewed investor confidence in the company’s prospects amid a challenging market backdrop.

Read full news article

Wheels India Ltd. is Rated Buy by MarketsMOJO

Wheels India Ltd. is rated Buy by MarketsMOJO, with this rating last updated on 30 January 2026. While the rating change occurred on that date, all fundamentals, returns, and financial metrics discussed here reflect the stock's current position as of 01 February 2026.

Read full news article

Wheels India Ltd: Quality Upgrade Reflects Strengthened Business Fundamentals

Wheels India Ltd., a key player in the auto components sector, has seen its quality grade upgraded from average to good, reflecting notable improvements in its business fundamentals. The company’s enhanced return ratios, robust sales and earnings growth, and manageable debt levels underpin this positive reassessment, signalling a stronger investment case amid a challenging market backdrop.

Read full news article Announcements

Newspaper Advertisement - Regulation 47 of the SEBI (LODR) 2015 (SEBI LODR)

30-Jan-2026 | Source : BSEWheels India Ltd has submitted to BSE a copy of Newspaper Advertisement - Regulation 47 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 (SEBI LODR).

Results Press Release for December 31 2025

30-Jan-2026 | Source : BSEWheels India Ltd has informed BSE about :

1. Result Press Release for the period ended December 31 2025

Standalone & Consolidated Financial Results Limited Review Report for December 31 2025

30-Jan-2026 | Source : BSEWheels India Ltd has informed BSE about :

1. Standalone Financial Results for the period ended December 31 2025

2. Consolidated Financial Results for the period ended December 31 2025

3. Standalone Limited Review for the period ended December 31 2025

4. Consolidated Limited Review for the period ended December 31 2025

Corporate Actions

No Upcoming Board Meetings

Wheels India Ltd. has declared 53% dividend, ex-date: 05 Feb 26

No Splits history available

Wheels India Ltd. has announced 1:1 bonus issue, ex-date: 08 Aug 18

Wheels India Ltd. has announced 51:20 rights issue, ex-date: 13 Feb 14

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 2 Schemes (9.52%)

Held by 24 FIIs (1.08%)

Trichur Sundaram Santhanam & Family Private Limited (29.86%)

Nippon Life India Trustee Ltd-a/c Nippon India Elss Tax Saver Fund (4.88%)

19.76%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 8.50% vs -0.12% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 16.39% vs 3.71% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 7.99% vs -6.13% in Sep 2024

Growth in half year ended Sep 2025 is 27.85% vs 236.70% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 12.51% vs -6.44% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 33.43% vs 199.46% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -4.68% vs 7.26% in Mar 2024

YoY Growth in year ended Mar 2025 is 76.68% vs 13.41% in Mar 2024