Compare Titan Intech with Similar Stocks

Stock DNA

Computers - Software & Consulting

INR 84 Cr (Micro Cap)

19.00

20

0.00%

0.01

3.96%

0.73

Total Returns (Price + Dividend)

Titan Intech for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

When is the next results date for Titan Intech Ltd?

The next results date for Titan Intech Ltd is scheduled for 11 February 2026....

Read full news article

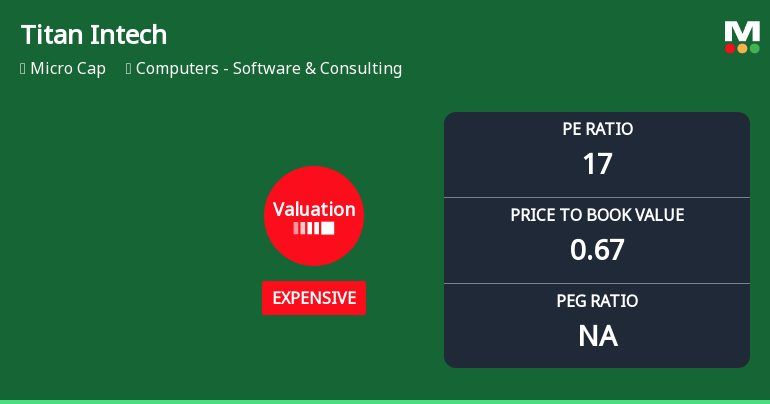

Titan Intech Ltd Valuation Shifts Signal Growing Price Caution

Titan Intech Ltd, a player in the Computers - Software & Consulting sector, has seen a notable shift in its valuation parameters, moving from fair to expensive territory. This change, coupled with a downgrade in its Mojo Grade from Hold to Sell, highlights increasing investor caution amid subdued financial returns and challenging market conditions.

Read full news article

Titan Intech Ltd is Rated Sell

Titan Intech Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 24 November 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 30 January 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news article Announcements

Board Meeting Intimation for Unaudited Financial Results For The Quarter Ended December 31 2025

02-Feb-2026 | Source : BSETitan Intech Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 11/02/2026 inter alia to consider and approve Board meeting intimation

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

27-Jan-2026 | Source : BSEPostal Ballot Notice

Board Meeting Outcome for Postal Ballot Notice

24-Jan-2026 | Source : BSEPostal Ballot Notice

Corporate Actions

11 Feb 2026

No Dividend history available

Titan Intech Ltd has announced 1:10 stock split, ex-date: 08 Sep 25

Titan Intech Ltd has announced 3:5 bonus issue, ex-date: 17 May 24

Titan Intech Ltd has announced 3:2 rights issue, ex-date: 31 Oct 25

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Pinnamaneni Estates Private Limited (15.36%)

Daevish Clothing Private Limited (2.19%)

68.82%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 38.23% vs -14.01% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 76.56% vs 23.08% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 18.26% vs -45.28% in Sep 2024

Growth in half year ended Sep 2025 is 33.08% vs -34.48% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is -30.52% vs 311.44% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -7.26% vs 207.44% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -38.66% vs 199.05% in Mar 2024

YoY Growth in year ended Mar 2025 is -29.48% vs 221.71% in Mar 2024