Compare Marksans Pharma with Similar Stocks

Dashboard

Poor long term growth as Operating profit has grown by an annual rate 12.98% of over the last 5 years

Flat results in Sep 25

With ROE of 13.1, it has a Expensive valuation with a 3.1 Price to Book Value

Falling Participation by Institutional Investors

Underperformed the market in the last 1 year

Stock DNA

Pharmaceuticals & Biotechnology

INR 8,388 Cr (Small Cap)

23.00

32

0.48%

-0.12

13.08%

2.78

Total Returns (Price + Dividend)

Latest dividend: 0.8 per share ex-dividend date: Aug-01-2025

Risk Adjusted Returns v/s

Returns Beta

News

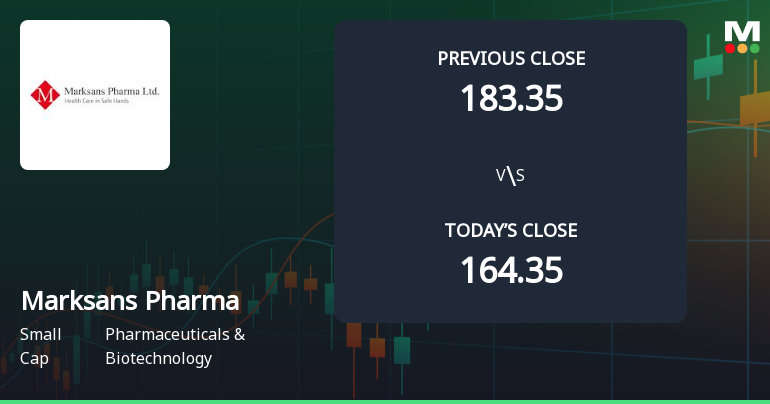

Marksans Pharma Ltd Opens with Strong Gap Up Reflecting Positive Market Sentiment

Marksans Pharma Ltd witnessed a significant gap up at the opening bell on 3 February 2026, surging 9.46% higher than its previous close. This robust start underscores a positive market sentiment towards the pharmaceutical company amid a broader sectoral uptick.

Read full news article

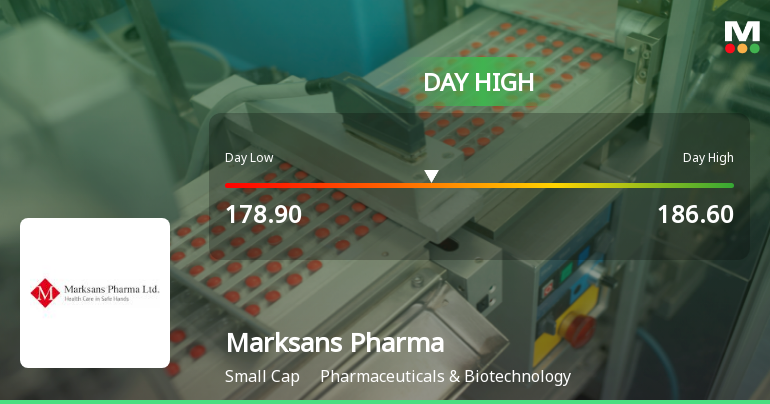

Marksans Pharma Ltd Hits Intraday High with 13.14% Surge on 3 Feb 2026

Marksans Pharma Ltd recorded a robust intraday performance on 3 Feb 2026, surging to a day’s high of Rs 186.6, marking a 13.54% increase from the previous close. This strong upward momentum outpaced both its sector and the broader market, reflecting notable trading activity and positive price action throughout the session.

Read full news article

Marksans Pharma Ltd is Rated Sell

Marksans Pharma Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 07 July 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 01 February 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Acquisition

27-Jan-2026 | Source : BSEIncorporation of two new wholly owned subsidiary Companies

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

22-Jan-2026 | Source : BSEThe Company has scheduled a conference call for analysts and investors on Friday February 06 2026 at 04:00 PM (IST) to discuss the Unaudited Financial Results (Standalone and Consolidated) of the Company for the quarter ended December 31 2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

13-Jan-2026 | Source : BSECertificate received from RTA under regulation 74(5) of SEBI (DP) regulations 2018 for the quarter ended December 31 2025

Corporate Actions

05 Feb 2026

Marksans Pharma Ltd has declared 80% dividend, ex-date: 01 Aug 25

Marksans Pharma Ltd has announced 1:10 stock split, ex-date: 11 Mar 08

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 9 Schemes (4.41%)

Held by 111 FIIs (8.12%)

Mark Saldanha (43.8%)

Orbimed Asia Iv Mauritius Fvci Limited (8.62%)

28.98%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 16.20% vs -12.49% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 68.47% vs -35.59% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 8.75% vs 19.52% in Sep 2024

Growth in half year ended Sep 2025 is -15.58% vs 21.88% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 18.36% vs 18.39% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 23.20% vs 27.68% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 20.46% vs 17.56% in Mar 2024

YoY Growth in year ended Mar 2025 is 21.32% vs 17.80% in Mar 2024