Dashboard

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 1.04 times

Healthy long term growth as Net Sales has grown by an annual rate of 17.69% and Operating profit at 17.98%

Flat results in Dec 25

With ROCE of 11.8, it has a Fair valuation with a 2 Enterprise value to Capital Employed

High Institutional Holdings at 39.37%

With its market cap of Rs 18,21,470 cr, it is the biggest company in the sector and constitutes 66.23% of the entire sector

Stock DNA

Oil

INR 1,841,634 Cr (Large Cap)

23.00

14

0.41%

0.17

9.47%

2.08

Total Returns (Price + Dividend)

Latest dividend: 5.5 per share ex-dividend date: Aug-14-2025

Risk Adjusted Returns v/s

Returns Beta

News

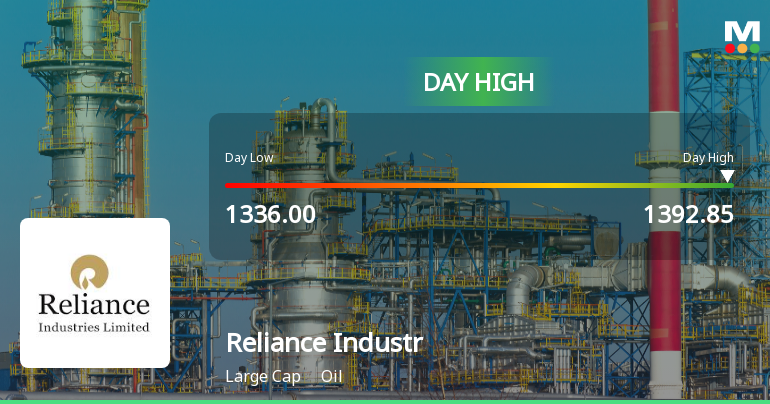

Reliance Industries Ltd Hits Intraday High with 3.06% Surge on 2 Feb 2026

Reliance Industries Ltd demonstrated robust intraday strength on 2 Feb 2026, surging to an intraday high of Rs 1,388.5, marking a 3.16% increase from its previous close. This performance outpaced both its sector peers and the broader market indices, reflecting notable trading momentum in the oil sector.

Read full news article

Reliance Industries Sees Heavy Put Option Activity Ahead of February Expiry

Reliance Industries Ltd, a heavyweight in the Indian oil sector, has witnessed significant put option trading activity ahead of the 24 February 2026 expiry, signalling increased bearish positioning and hedging among investors. Despite a modest 1.37% day gain, the options market reveals a cautious outlook with substantial open interest and turnover concentrated at strike prices below the current underlying value of ₹1,360.

Read full news article

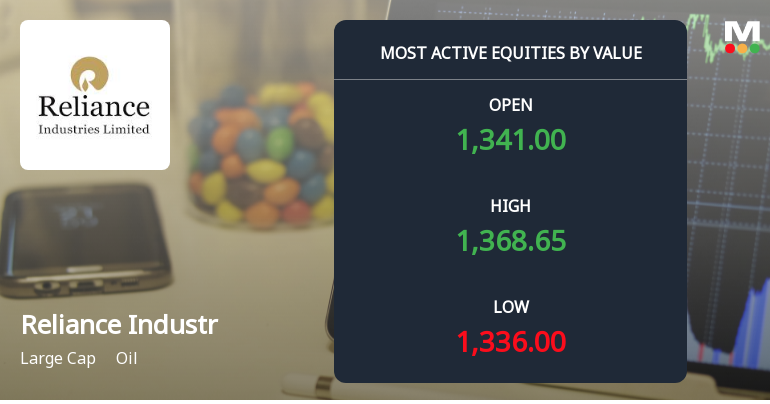

Reliance Industries Ltd Sees Robust Value Turnover Amid Mixed Technical Signals

Reliance Industries Ltd (RELIANCE), a heavyweight in the Indian oil sector, witnessed significant trading activity on 2 Feb 2026, with a total traded value exceeding ₹32,252 crores and volume surpassing 23 lakh shares. Despite a modest day gain of 1.37%, the stock’s technical indicators and institutional participation present a nuanced picture for investors navigating the current market environment.

Read full news article Announcements

Disclosure Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015

29-Jan-2026 | Source : BSEWe wish to inform that the Honble National Company Law Tribunal Amaravati Bench (NCLT) vide its order dated January 19 2026 (order uploaded on the NCLT website on January 28 2026) has approved the resolution plan submitted by Capri Global Holdings Private Limited with the Company / Reliance Strategic Business Ventures Limited as the Equity Support Provider for the resolution of SevenHills Healthcare Private Limited under the Corporate Insolvency Resolution Process of the Insolvency and Bankruptcy Code 2016.

Announcement under Regulation 30 (LODR)-Credit Rating

29-Jan-2026 | Source : BSERe-affirmation of rating with respect to the Non-convertible Debentures and Commercial Paper of the Company

Disclosure Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015

22-Jan-2026 | Source : BSEPlease find attached disclosure under Regulation 30 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Reliance Industries Ltd has declared 55% dividend, ex-date: 14 Aug 25

No Splits history available

Reliance Industries Ltd has announced 1:1 bonus issue, ex-date: 28 Oct 24

Reliance Industries Ltd has announced 1:15 rights issue, ex-date: 13 May 20

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 77 Schemes (9.52%)

Held by 1735 FIIs (19.09%)

Srichakra Commercials Llp (11.13%)

Life Insurance Corporation Of India (6.82%)

8.27%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 4.04% vs 4.51% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 2.64% vs -32.71% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 7.54% vs 5.43% in Sep 2024

Growth in half year ended Sep 2025 is 42.45% vs -5.10% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 8.51% vs 5.83% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 27.00% vs -0.85% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 7.06% vs 2.65% in Mar 2024

YoY Growth in year ended Mar 2025 is 0.04% vs 4.38% in Mar 2024