Compare M & M Fin. Serv. with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 53,375 Cr (Mid Cap)

21.00

22

1.74%

4.90

9.96%

2.10

Total Returns (Price + Dividend)

Latest dividend: 6.5 per share ex-dividend date: Jul-15-2025

Risk Adjusted Returns v/s

Returns Beta

News

Mahindra & Mahindra Financial Services Ltd is Rated Hold

Mahindra & Mahindra Financial Services Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 21 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 31 January 2026, providing investors with an up-to-date view of its performance and prospects.

Read full news articleAre Mahindra & Mahindra Financial Services Ltd latest results good or bad?

Mahindra & Mahindra Financial Services Ltd (M&MFIN) has reported its latest financial results for Q3 FY26, reflecting a complex operational landscape. The company achieved net sales of ₹5,026.19 crores, marking a year-on-year growth of 12.56% and a modest sequential increase of 0.71%. This indicates sustained demand for vehicle financing, particularly in rural and semi-urban markets where M&MFIN has a strong presence. The consolidated net profit for the quarter stood at ₹564.48 crores, showing a significant year-on-year increase of 44.95% and a quarter-on-quarter rise of 6.94%. The profit after tax (PAT) margin improved to 11.26%, up from 10.60% in the previous quarter, suggesting better asset quality and reduced provisioning requirements. However, the company continues to face challenges, particularly with elevated interest expenses, which accounted for 43.72% of net sales. Despite a sequential decline i...

Read full news article

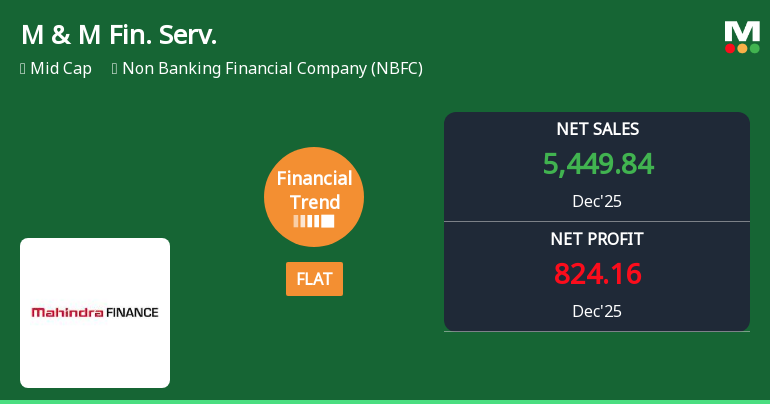

Mahindra & Mahindra Financial Services Reports Flat Quarterly Performance Amid Record Revenues

Mahindra & Mahindra Financial Services Ltd (M&M Fin. Serv.) has reported a flat financial performance for the quarter ended December 2025, marking a notable shift from its previously positive growth trajectory. Despite achieving record-high net sales and profitability metrics, the company’s overall financial trend score has declined, prompting a reassessment of its market standing and investor outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

29-Jan-2026 | Source : BSECopy of Newspaper Publication Financial Results Q3 FY2026.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

28-Jan-2026 | Source : BSEPress Release- Q3FY26 Financial Results

Outcome Of Board Meeting - Unaudited Standalone And Consolidated Financial Results For The Third Quarter And Nine Months Ended 31St December 2025

28-Jan-2026 | Source : BSEOutcome of Board Meeting - Unaudited standalone and consolidated financial results for the quarter and nine months ended 31st December 2025

Corporate Actions

No Upcoming Board Meetings

Mahindra & Mahindra Financial Services Ltd has declared 325% dividend, ex-date: 15 Jul 25

Mahindra & Mahindra Financial Services Ltd has announced 2:10 stock split, ex-date: 15 Feb 13

No Bonus history available

Mahindra & Mahindra Financial Services Ltd has announced 1:8 rights issue, ex-date: 14 May 25

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 29 Schemes (17.18%)

Held by 233 FIIs (9.11%)

Mahindra & Mahindra Limited (52.49%)

Life Insurance Corporation Of India, Lic-p&gs Fund, Lici Funds (10.33%)

5.18%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 13.61% vs 16.99% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -10.18% vs 47.39% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 14.08% vs 18.39% in Sep 2024

Growth in half year ended Sep 2025 is 23.14% vs 38.65% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 13.91% vs 17.90% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 6.20% vs 42.96% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 16.88% vs 24.39% in Mar 2024

YoY Growth in year ended Mar 2025 is 17.03% vs -6.74% in Mar 2024