Compare Ashika Credit with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 1,604 Cr (Small Cap)

NA (Loss Making)

22

0.00%

0.00

-1.97%

2.60

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: Aug-01-2019

Risk Adjusted Returns v/s

Returns Beta

News

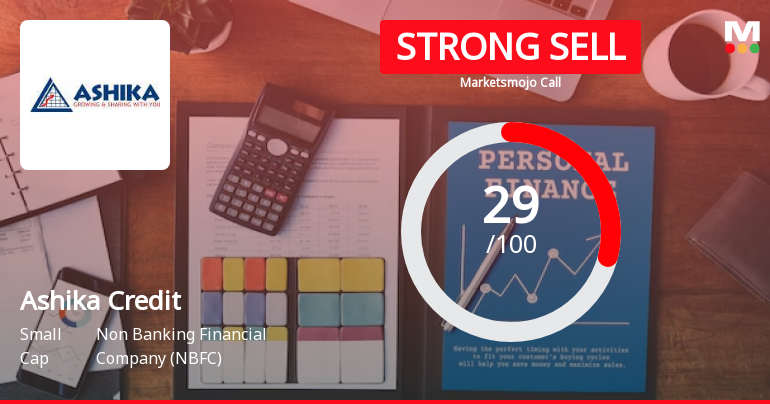

Ashika Credit Capital Ltd is Rated Strong Sell

Ashika Credit Capital Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 10 December 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 03 February 2026, providing investors with the most recent and relevant data to assess the company’s outlook.

Read full news articleWhen is the next results date for Ashika Credit Capital Ltd?

The next results date for Ashika Credit Capital Ltd is scheduled for February 4, 2026....

Read full news article

Ashika Credit Capital Ltd is Rated Strong Sell

Ashika Credit Capital Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 10 December 2025, reflecting a reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed below are current as of 23 January 2026, providing investors with the latest perspective on the company’s position in the market.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Cessation

29-Jan-2026 | Source : BSEWe hereby inform that Ms. Ishita Jain Chief Business Officer (CBO) Key Managerial Officer of the Company appointed u/s 2(51) of the Companies Act 2013 has tendered her resignation from the said post due to personal reason with effect from the close of business hours on January 28 2026.

Board Meeting Intimation for Notice Of Board Meeting Of The Company Pursuant To Regulation 29 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 And Amendments Thereof

28-Jan-2026 | Source : BSEAshika Credit Capital Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 04/02/2026 inter alia to consider and approve Notice is hereby given that the Meeting of the Board of Directors of Ashika Credit Capital Limited (the Company) is scheduled to be held on Wednesday 4th February 2026 to consider and approve the following: 1. The Standalone and Consolidated Un-Audited Financial Results of the Company along with Limited Review Report prepared in accordance with the IND-AS Rules for the quarter and nine-months ending on 31st December 2025. 2. Any other matter with the permission of the Chair As per the Companys Code of Conduct for Regulating Monitoring and Reporting of Trading by Insiders the Trading Window for dealing in the securities of the Company shall continue to remain closed till the end of 48 hours after the announcement of the un-audited financial results of the Company for the quarter and nine-months ending on 31st December 2025 to the Stock Exchanges.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Jan-2026 | Source : BSEPlease find enclosed herewith the compliance under regulation 74 (5) of SEBI (DP) Regulations 2018 for the quarter ended 31.12.2025.

Corporate Actions

(04 Feb 2026)

Ashika Credit Capital Ltd has declared 10% dividend, ex-date: 01 Aug 19

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 4 FIIs (0.73%)

Ashika Global Securities Private Limited (14.07%)

Eminence Global Fund Pcc- Eubilia Capital Partners Fund I (2.09%)

19.08%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 6.09% vs 168.40% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 22.22% vs 125.00% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 147.36% vs 216.83% in Sep 2024

Growth in half year ended Sep 2025 is 172.34% vs 208.55% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 48.09% vs 133.24% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -85.68% vs 176.41% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -76.93% vs 73.40% in Mar 2024

YoY Growth in year ended Mar 2025 is -580.56% vs 81.66% in Mar 2024