Compare Tainwala Chem. with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Equity (ROE) of 3.33%

- Poor long term growth as Operating profit has grown by an annual rate 19.01% of over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -2.17

With ROE of 4.3, it has a Very Expensive valuation with a 0.9 Price to Book Value

Underperformed the market in the last 1 year

Stock DNA

Plastic Products - Industrial

INR 191 Cr (Micro Cap)

22.00

223

1.76%

0.00

4.30%

0.93

Total Returns (Price + Dividend)

Latest dividend: 3 per share ex-dividend date: Aug-11-2025

Risk Adjusted Returns v/s

Returns Beta

News

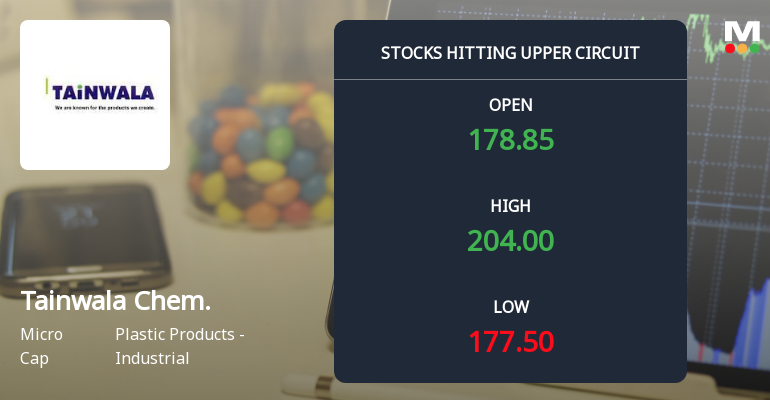

Tainwala Chemicals & Plastics Surges to Upper Circuit on Strong Buying Pressure

Tainwala Chemicals & Plastics (India) Ltd witnessed a remarkable rally on 9 Feb 2026, hitting its upper circuit limit with an 18.41% gain, driven by strong buying momentum and significant unfilled demand. The stock outperformed its sector and broader market indices, signalling renewed investor interest despite its micro-cap status and recent negative analyst sentiment.

Read full news article

Tainwala Chemicals & Plastics (India) Ltd is Rated Strong Sell

Tainwala Chemicals & Plastics (India) Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 25 August 2025. However, the analysis and financial metrics presented here reflect the stock’s current position as of 08 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article Announcements

Board Meeting Intimation for Consideration And Approval Of The Unaudited Financial Results Of The Company For The Quarter And Nine Months Ended 31St December 2025

02-Feb-2026 | Source : BSETainwala Chemicals And Plastics (India) Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 11/02/2026 inter alia to consider and approve the un-audited financial results of the company for the quarter and nine months ended 31st December 2025 and any other business matters.

Report On Re-Lodgment Of Transfer Requests Of Physical Shares.

08-Jan-2026 | Source : BSEEnclosed herewith Re-lodgment Report received from the Registrar and Share Transfer Agent of the Company for the month ended December 31 2025. Kindly take the same on your records.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

06-Jan-2026 | Source : BSEIn compliance with Regulation 74(5) of the SEBI (DP) Regulations 2018 we furnish herewith the Certificate dated 6th January 2026 issued by MUFG Intime India Private Limited (Formerly Link Intime India Private Limited) the RTA of the Company for the quarter ended 31st December 2025.

Corporate Actions

11 Feb 2026

Tainwala Chemicals & Plastics (India) Ltd has declared 30% dividend, ex-date: 11 Aug 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 9 Schemes (0.17%)

Held by 0 FIIs (0.04%)

Ramesh Dungarmal Tainwala (31.31%)

Ayush Ramesh Tainwala (2.32%)

22.82%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 8.85% vs -21.86% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 13.45% vs -27.54% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -60.90% vs 151.84% in Mar 2025

Growth in half year ended Sep 2025 is 35.98% vs 17.14% in Mar 2025

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is -35.56% vs 267.59% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -17.11% vs -13.91% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -8.93% vs 40.53% in Mar 2024

YoY Growth in year ended Mar 2025 is 2.29% vs 46.65% in Mar 2024