Compare Sparkle GoldRock with Similar Stocks

Dashboard

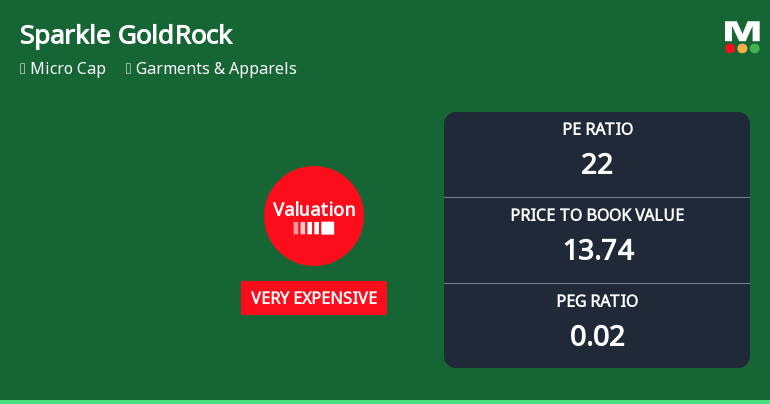

With ROE of 62.2, it has a Very Expensive valuation with a 13.7 Price to Book Value

- The stock is trading at a premium compared to its peers' average historical valuations

- Over the past year, while the stock has generated a return of -2.61%, its profits have risen by 160% ; the PEG ratio of the company is 0

Underperformed the market in the last 1 year

Stock DNA

Garments & Apparels

INR 34 Cr (Micro Cap)

22.00

20

0.00%

0.09

62.23%

14.43

Total Returns (Price + Dividend)

Sparkle GoldRock for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Sparkle Gold Rock Ltd Valuation Shifts Amid Market Volatility

Sparkle Gold Rock Ltd, a key player in the Garments & Apparels sector, has seen a marked shift in its valuation parameters, moving from expensive to very expensive territory. This change, reflected in its price-to-earnings (P/E) and price-to-book value (P/BV) ratios, raises important questions about the stock’s price attractiveness relative to its historical averages and peer group benchmarks.

Read full news article

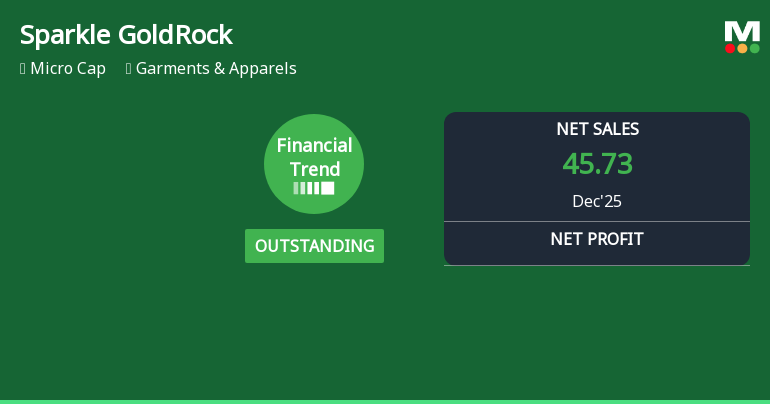

Sparkle Gold Rock Ltd Reports Outstanding Quarterly Performance Amid Mixed Market Returns

Sparkle Gold Rock Ltd, a key player in the Garments & Apparels sector, has demonstrated a remarkable turnaround in its financial performance for the quarter ended December 2025. The company’s financial trend has shifted from positive to very positive, driven by robust revenue growth, margin expansion, and record profitability metrics, signalling renewed investor interest despite recent share price volatility.

Read full news articleAre Sparkle Gold Rock Ltd latest results good or bad?

Sparkle Gold Rock Ltd's latest financial results for Q3 FY26 reflect a significant surge in both revenue and net profit compared to the previous quarter. The company reported net sales of ₹45.73 crores, which represents a remarkable year-on-year growth of 1,905.70% from a very low base of ₹2.28 crores in Q3 FY25. This growth is also accompanied by a sequential increase of 244.61% from ₹13.27 crores in Q2 FY26. Similarly, the net profit reached ₹0.81 crores, marking a year-on-year increase of 1,720.00% from a negative profit in the same quarter last year, and a sequential growth of 153.13%. Despite these positive figures, the company's profitability remains under pressure, as indicated by a decline in the PAT margin to 1.77% from 2.41% in the previous quarter. The operating margin also reflects a slight improvement to 2.93%, although it remains thin, raising concerns about the company's ability to withstand...

Read full news article Announcements

Results- Financial Results For 31/12/2025

30-Jan-2026 | Source : BSEFinancial Results for 31/12/2025

Board Meeting Outcome for Outcome Of Board Meeting Held On 30/01/2026

30-Jan-2026 | Source : BSEOutcome of Board Meeting held on 30/01/2026- Financial Statements approved for Quarter year ended December 31 2025 .

Board Meeting Intimation for Prior Intimation For Declaration Of Quarterly Financial Results

23-Jan-2026 | Source : BSESparkle Gold Rock Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 30/01/2026 inter alia to consider and approve The Un-Audited Financial Results of the Company for the Quarter year ended 31st December 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 2 Schemes (0.87%)

Held by 0 FIIs

K. V. Prabhakar (0.0%)

Sarita Devi Sharma (8.34%)

55.5%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 1,905.70% vs 0.00% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 1,720.00% vs -101.45% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 0.00% vs 0.00% in Sep 2024

Growth in half year ended Sep 2025 is 766.67% vs 71.43% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 2,568.86% vs 0.00% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 1,200.00% vs -103.40% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 0.00% vs 0.00% in Mar 2024

YoY Growth in year ended Mar 2025 is -107.79% vs 5,450.00% in Mar 2024