Compare R S Software (I) with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -5.14

The company has declared negative results for the last 5 consecutive quarters

Risky - Negative EBITDA

Below par performance in long term as well as near term

Stock DNA

Computers - Software & Consulting

INR 92 Cr (Micro Cap)

NA (Loss Making)

27

0.00%

0.06

-51.71%

2.49

Total Returns (Price + Dividend)

Latest dividend: 0.25 per share ex-dividend date: Jul-19-2024

Risk Adjusted Returns v/s

Returns Beta

News

R S Software (India) Ltd Falls to 52-Week Low Amidst Continued Financial Struggles

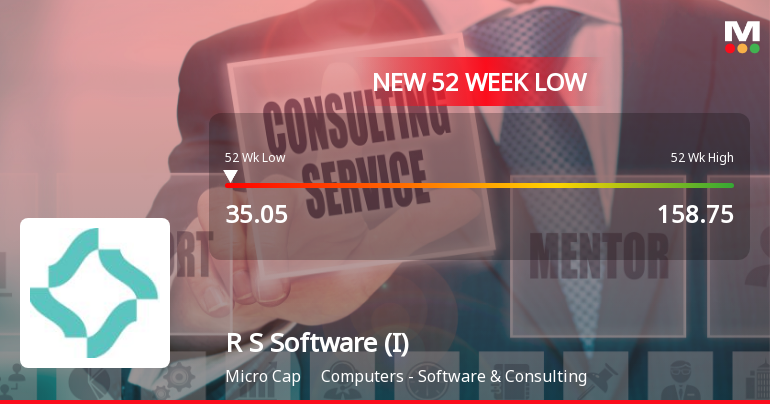

R S Software (India) Ltd has touched a new 52-week low of Rs.35.05 today, marking a significant decline in its stock price amid ongoing financial difficulties and subdued market performance. The stock has underperformed its sector and broader market indices, reflecting persistent challenges in its business metrics and financial health.

Read full news article

R S Software (India) Ltd Falls to 52-Week Low Amidst Continued Financial Struggles

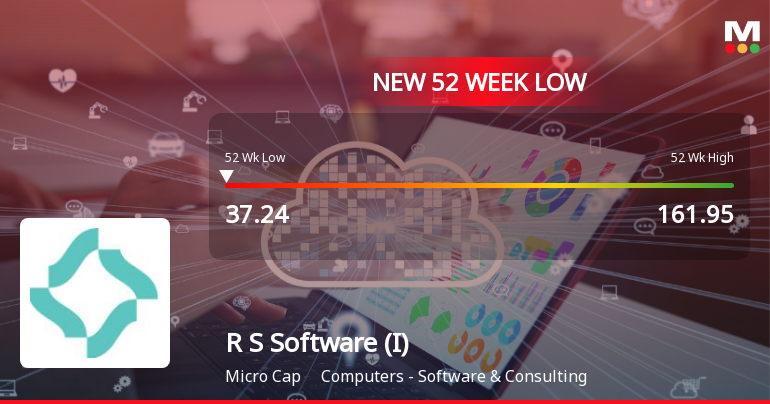

R S Software (India) Ltd’s stock declined sharply to a fresh 52-week low of Rs.37.24 on 29 Jan 2026, marking a significant drop of 6.15% on the day and underperforming its sector by 4.67%. This new low reflects ongoing financial difficulties and a challenging market environment for the company within the Computers - Software & Consulting sector.

Read full news article

R S Software (India) Ltd is Rated Strong Sell

R S Software (India) Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 21 January 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 29 January 2026, providing investors with an up-to-date view of the stock’s fundamentals, valuation, financial trend, and technical outlook.

Read full news article Announcements

Board Meeting Outcome for Revised Outcome

30-Jan-2026 | Source : BSESubmission of Revised Outcome of Board Meeting held on 5th November 2025.

Announcement under Regulation 30 (LODR)-Newspaper Publication

22-Jan-2026 | Source : BSESubmission of paper cutting of advertisements of the Financial Results of the company for the period ending 31st December 2025 which was approved by the Board of Directors on 21st January 2026.

Board Meeting Outcome for Outcome Of Board Meeting & Financial Results

21-Jan-2026 | Source : BSEOutcome of Board Meeting & Financial Results

Corporate Actions

No Upcoming Board Meetings

R S Software (India) Ltd has declared 5% dividend, ex-date: 19 Jul 24

R S Software (India) Ltd has announced 5:10 stock split, ex-date: 21 Jan 15

R S Software (India) Ltd has announced 28:100 bonus issue, ex-date: 21 Jun 10

R S Software (India) Ltd has announced 1:2 rights issue, ex-date: 27 Sep 06

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 2 Schemes (0.01%)

Held by 3 FIIs (0.83%)

Rajnit Rai Jain (39.46%)

R Ramaraj (1.4%)

48.25%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -11.86% vs -21.88% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -42.40% vs -63.99% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -61.51% vs 63.38% in Sep 2024

Growth in half year ended Sep 2025 is -199.37% vs 177.17% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is -60.55% vs 17.74% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -260.50% vs -1.24% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -3.73% vs 97.61% in Mar 2024

YoY Growth in year ended Mar 2025 is -51.79% vs 322.21% in Mar 2024