Compare Ujaas Energy with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Low ability to service debt as the company has a high Debt to EBITDA ratio of -1.00 times

The company has declared Negative results for the last 4 consecutive quarters

Risky - Negative EBITDA

Despite the size of the company, domestic mutual funds hold only 0% of the company

Total Returns (Price + Dividend)

Latest dividend: 0.05000000000000001 per share ex-dividend date: Sep-11-2017

Risk Adjusted Returns v/s

Returns Beta

News

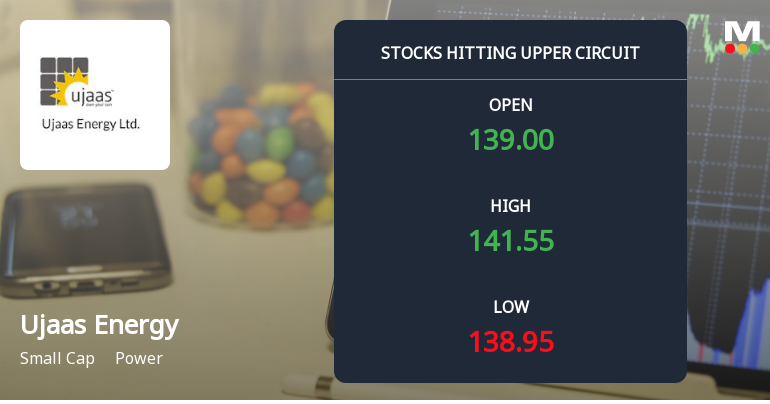

Ujaas Energy Ltd Surges to Upper Circuit Amid Robust Buying Pressure

Ujaas Energy Ltd, a small-cap player in the power sector, surged to hit its upper circuit limit on 3 February 2026, closing at ₹136.21 with a maximum daily gain of 4.99%. This sharp price movement was driven by robust buying interest, sustained investor participation, and a regulatory freeze on further trading, signalling strong demand that remains unfilled at current levels.

Read full news article

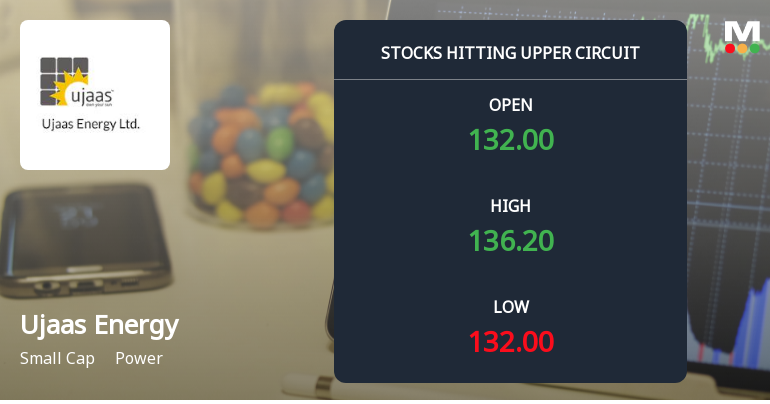

Ujaas Energy Ltd Hits Upper Circuit Amid Strong Buying Pressure

Ujaas Energy Ltd witnessed a remarkable surge on 2 Feb 2026, hitting its upper circuit price limit of ₹129.73, marking a 4.99% gain on the day. This strong buying momentum reflects heightened investor interest despite the company’s current Strong Sell mojo grade, underscoring a complex market dynamic in the power sector.

Read full news article

Ujaas Energy Ltd is Rated Strong Sell

Ujaas Energy Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 21 January 2026. However, the analysis and financial metrics discussed here reflect the company’s current position as of 25 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

22-Jan-2026 | Source : BSENewspaper publication of extract of Un- Audited financial results for the quarter and nine months ended on December 31 2025.

Financial Results For The Quarter And Nine Months Ended On December 31 2025.

20-Jan-2026 | Source : BSEFinancial Results for the quarter and nine months ended on December 31 2025.

Board Meeting Outcome for Outcome Of Board Meeting Held On 20.01.2026.

20-Jan-2026 | Source : BSEOutcome of Board Meeting held on 20.01.2026.

Corporate Actions

No Upcoming Board Meetings

Ujaas Energy Ltd has declared 5% dividend, ex-date: 11 Sep 17

Ujaas Energy Ltd has announced 1:10 stock split, ex-date: 21 Dec 12

Ujaas Energy Ltd has announced 2:1 bonus issue, ex-date: 10 Oct 25

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Sva Family Welfare Trust (represented By Vandana Mundra) (74.21%)

Swastika Fin Mart Private Limited (23.61%)

1.19%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is -57.28% vs 39.90% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -95.93% vs -91.35% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -31.76% vs -21.72% in Sep 2024

Growth in half year ended Sep 2025 is -44.03% vs 137.33% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -42.64% vs -3.62% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -67.92% vs -74.20% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 0.79% vs -13.55% in Mar 2024

YoY Growth in year ended Mar 2025 is -69.44% vs 265.58% in Mar 2024