Compare Agio Paper with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of % and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

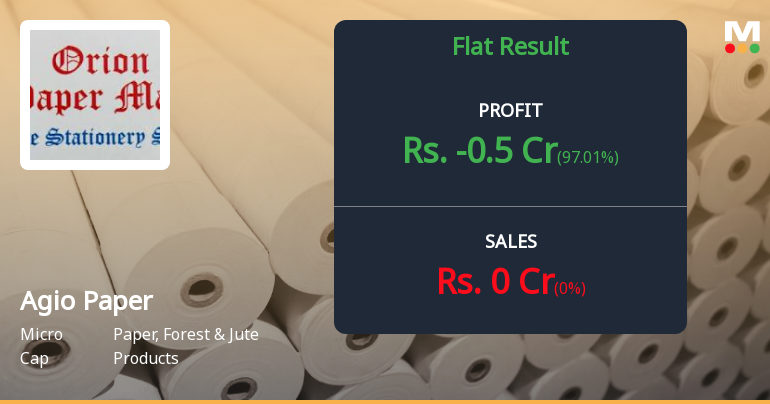

Flat results in Dec 25

Risky - Negative EBITDA

Below par performance in long term as well as near term

Stock DNA

Paper, Forest & Jute Products

INR 7 Cr (Micro Cap)

NA (Loss Making)

17

0.00%

-1.01

6.87%

-0.46

Total Returns (Price + Dividend)

Agio Paper for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Are Agio Paper & Industries Ltd latest results good or bad?

Agio Paper & Industries Ltd's latest financial results for the quarter ending December 2025 indicate a company facing significant operational challenges. The company reported a net loss of ₹0.50 crores, which, while appearing modest compared to the previous quarter's loss of ₹16.70 crores, still reflects ongoing financial distress. Notably, Agio Paper has generated zero revenue for the seventh consecutive quarter, highlighting a complete operational shutdown. The absence of sales is coupled with a quarterly interest burden of ₹0.29 crores, which continues to strain the company's financial resources despite no income. The minimal employee costs of ₹0.09 crores suggest a skeletal workforce, likely limited to essential administrative functions. Furthermore, the company's book value per share is negative at ₹-16.86, indicating that its liabilities exceed its assets, raising serious concerns about its solvency ...

Read full news article

Agio Paper Q3 FY26: Mounting Losses Signal Deepening Crisis as Operations Remain Dormant

Agio Paper & Industries Ltd., a Kolkata-based micro-cap company in the paper manufacturing sector, reported a net loss of ₹0.50 crores for Q3 FY26, reflecting the company's continued operational paralysis. With zero revenue generation for yet another quarter and a market capitalisation of merely ₹8.00 crores, the stock has plunged 5.00% to ₹4.75, trading 42.07% below its 52-week high of ₹8.20. The company's negative book value of ₹-16.86 per share and mounting debt obligations paint a grim picture of a business struggling to survive.

Read full news article Announcements

Board Meeting Outcome for Submission Of The Following Documents For The Quarter & Nine Months Ended 31St December 2025 Pursuant To Regulation 33 Of SEBI (LODR) Regulations 2015

31-Jan-2026 | Source : BSESubmission of the following documents for the Quarter & Nine Months ended 31st December 2025 pursuant to Regulation 33 of SEBI (LODR) Regulations 2015

Disclosure Under Regulation 32(1) Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

31-Jan-2026 | Source : BSERegulation 32 (1 ) of SEBI LODR

RESULT FOR QUARTER ENDED 31.12.2025

31-Jan-2026 | Source : BSERESULT FOR QUARTER ENDED 31.12.2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 3 Schemes (0.04%)

Held by 0 FIIs

Ankit Jalan (45.34%)

Bharat Mekani (9.3%)

34.61%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 0.00% vs 0.00% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 97.01% vs -3,530.43% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 0.00% vs 0.00% in Sep 2024

Growth in half year ended Sep 2025 is -2,017.28% vs -19.12% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 0.00% vs -100.00% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -1,383.19% vs -32.22% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -100.00% vs 0.00% in Mar 2024

YoY Growth in year ended Mar 2025 is -46.30% vs 23.94% in Mar 2024