Compare Vedanta with Similar Stocks

Dashboard

High Management Efficiency with a high ROCE of 29.57%

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 1.31 times

The company has declared Positive results for the last 7 consecutive quarters

With ROCE of 22.2, it has a Fair valuation with a 3.1 Enterprise value to Capital Employed

Company is among the highest 1% of companies rated by MarketsMojo across all 4,000 stocks

Market Beating performance in long term as well as near term

Stock DNA

Non - Ferrous Metals

INR 258,614 Cr (Large Cap)

17.00

21

3.51%

1.57

32.68%

6.38

Total Returns (Price + Dividend)

Latest dividend: 16 per share ex-dividend date: Aug-26-2025

Risk Adjusted Returns v/s

Returns Beta

News

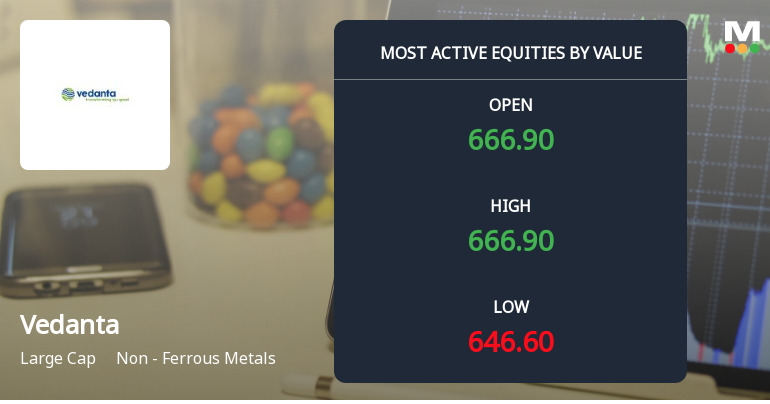

Vedanta Ltd. Sees High-Value Trading Amid Mixed Market Sentiment

Vedanta Ltd., a heavyweight in the Non-Ferrous Metals sector, has emerged as one of the most actively traded stocks by value on 6 February 2026, reflecting significant institutional interest and robust liquidity. Despite a modest decline in price, the stock continues to attract large volumes, underscoring its pivotal role in the metals space and its appeal among investors navigating a volatile market environment.

Read full news article

Vedanta Ltd. is Rated Buy by MarketsMOJO

Vedanta Ltd. is rated 'Buy' by MarketsMOJO, with this rating last updated on 30 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 05 February 2026, providing investors with the most up-to-date insight into the company’s performance and outlook.

Read full news article

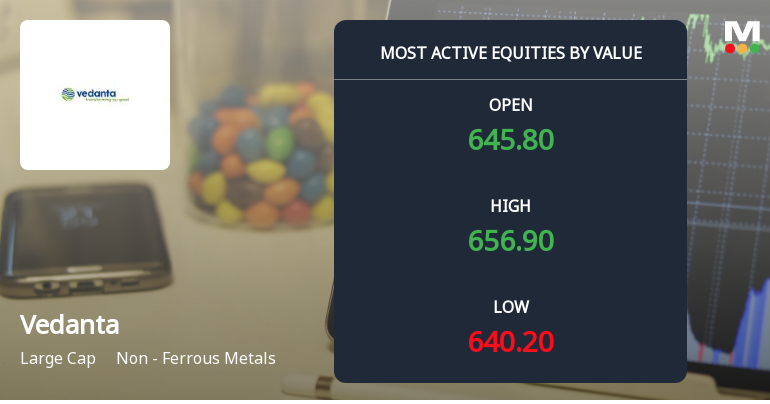

Vedanta Ltd Sees High-Value Trading Amid Sector Downturn and Institutional Interest

Vedanta Ltd., a heavyweight in the Non-Ferrous Metals sector, witnessed significant trading activity on 5 February 2026, with a total traded value exceeding ₹2,845 crores. Despite a sharp intraday decline, the stock remains a focal point for institutional investors, reflecting its large-cap stature and strategic importance within the metals industry.

Read full news article Announcements

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

04-Feb-2026 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Axis Trustee Services Ltd

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

03-Feb-2026 | Source : BSEPlease refer the enclosed file.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

03-Feb-2026 | Source : BSEPlease refer the enclosed file.

Corporate Actions

No Upcoming Board Meetings

Vedanta Ltd. has declared 1600% dividend, ex-date: 26 Aug 25

Vedanta Ltd. has announced 1:10 stock split, ex-date: 08 Aug 08

Vedanta Ltd. has announced 1:1 bonus issue, ex-date: 08 Aug 08

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

99.9935

Held by 42 Schemes (8.43%)

Held by 788 FIIs (12.15%)

Twin Star Holdings Ltd (40.02%)

Life Insurance Corporation Of India (4.97%)

11.65%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 24.65% vs -50.44% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 217.58% vs -43.55% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 5.85% vs 0.99% in Sep 2024

Growth in half year ended Sep 2025 is -37.38% vs 828.59% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 11.72% vs -16.41% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -7.06% vs 300.87% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -52.16% vs -2.43% in Mar 2024

YoY Growth in year ended Mar 2025 is 253.57% vs -59.91% in Mar 2024