Compare Indokem with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 4.51%

- Poor long term growth as Net Sales has grown by an annual rate of 13.02% over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.94 times

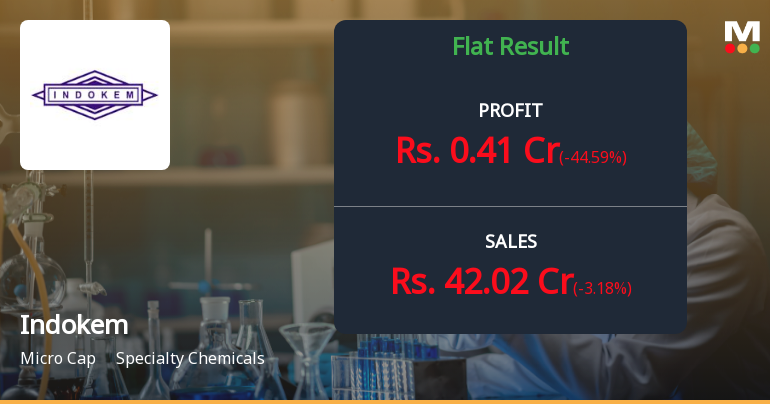

Flat results in Dec 25

With ROCE of 8.8, it has a Very Expensive valuation with a 24.3 Enterprise value to Capital Employed

Despite the size of the company, domestic mutual funds hold only 0.31% of the company

Stock DNA

Specialty Chemicals

INR 1,961 Cr (Micro Cap)

376.00

31

0.00%

0.32

8.95%

30.43

Total Returns (Price + Dividend)

Indokem for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Indokem Ltd is Rated Sell by MarketsMOJO

Indokem Ltd is rated Sell by MarketsMOJO, with this rating last updated on 16 December 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 02 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news articleAre Indokem Ltd latest results good or bad?

Indokem Ltd's latest financial results for Q3 FY26 reveal significant challenges in its operational performance. The company reported net sales of ₹42.02 crores, which reflects a modest sequential growth of 4.27% compared to the previous quarter but a decline of 3.18% year-on-year from ₹43.40 crores in Q3 FY25. This indicates a struggle to maintain revenue levels amidst a challenging market environment. The most concerning aspect of the results is the sharp decline in operating profitability, with the operating profit margin (excluding other income) falling to 0.43%, down from 3.25% in the same quarter last year. This marks the lowest operating margin recorded in recent quarters, highlighting increasing pressure on the company's core manufacturing operations, particularly in the textile chemicals sector, which has faced headwinds due to weak demand and rising costs. Net profit for the quarter stood at ₹0....

Read full news article

Indokem Q3 FY26: Profitability Under Pressure as Operating Margins Collapse to 0.43%

Indokem Limited, a speciality chemicals manufacturer within the Khatau Mahendra Group, reported a consolidated net profit of ₹0.41 crores for Q3 FY26 ended December 2025, remaining virtually flat sequentially whilst declining 44.59% year-on-year from ₹0.74 crores in Q3 FY25. The ₹2,080-crore market cap company witnessed its stock trading at ₹734.05 as of January 30, 2026, down 0.30% on the day, reflecting investor caution following the subdued quarterly performance.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

31-Jan-2026 | Source : BSEPursuant to Regulation 47 of the SEBI (LODR) Regulations 2015 we enclose herewith copies of the newspaper cutting extracts of Unaudited Financial Results for the Quarter and Nine months ended 31st December 2025 as approved by the Board of Directors of the Company in its meeting held on Friday 30th January 2026.

Board Meeting Outcome for Board Meeting Outcome For Meeting Held On 30.01.2026

30-Jan-2026 | Source : BSEPursuant to Regulation 30 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 (Listing Regulations) we hereby inform you that the Board of Directors at its Meeting held today has approved the matter as mentioned in the enclosed intimation.

Results- Financial Results For The Quarter Ended 31St December 2025

30-Jan-2026 | Source : BSEThe unaudited Standalone and Consolidated Financial Results for the Quarter and Nine months ended 31st December 2025 were approved by the Board of Directors at its meeting held today. Results are enclosed with this intimation.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 10 Schemes (0.1%)

Held by 0 FIIs

Vindhyapriya Holdings Pvt Ltd (19.76%)

Sangeetha S (1.79%)

25.95%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is -3.18% vs 7.80% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -44.59% vs 628.57% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 1.99% vs -5.01% in Sep 2024

Growth in half year ended Sep 2025 is 180.43% vs 72.67% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 0.18% vs -0.87% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 337.50% vs 87.67% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 8.06% vs 47.33% in Mar 2024

YoY Growth in year ended Mar 2025 is 151.21% vs -2,096.77% in Mar 2024