Compare Bartronics India with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Equity (ROE) of 2.78%

- Poor long term growth as Net Sales has grown by an annual rate of 5.29% over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 0.08

With ROE of 13.4, it has a Very Expensive valuation with a 14.7 Price to Book Value

Underperformed the market in the last 1 year

Stock DNA

Computers - Software & Consulting

INR 456 Cr (Micro Cap)

109.00

25

0.00%

-0.04

13.45%

14.72

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: Sep-21-2011

Risk Adjusted Returns v/s

Returns Beta

News

Bartronics India Ltd Sees Exceptional Volume Surge Amid Strong Price Gains

Bartronics India Ltd (ASMS), a micro-cap player in the Computers - Software & Consulting sector, has witnessed a remarkable surge in trading volume accompanied by a robust price rally, outperforming both its sector and the broader Sensex. This heightened activity signals renewed investor interest and potential accumulation, despite the company’s current sell-grade status.

Read full news article

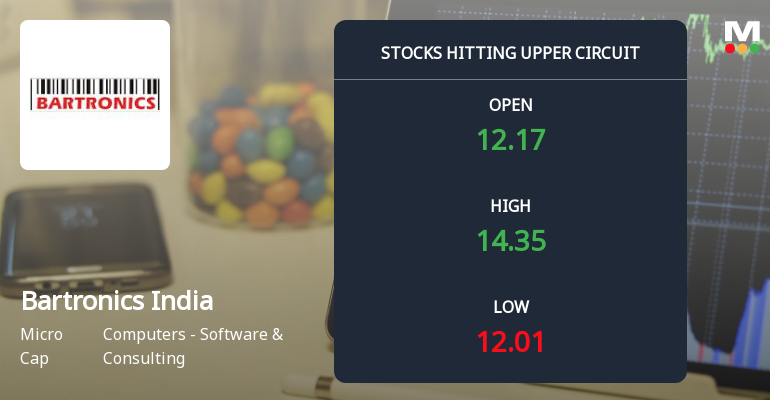

Bartronics India Ltd Surges to Upper Circuit on Robust Buying Momentum

Bartronics India Ltd, a micro-cap player in the Computers - Software & Consulting sector, witnessed a remarkable surge on 5 Feb 2026, hitting its upper circuit limit of 20% to close at ₹14.34. This sharp rally was driven by intense buying interest, significant volume expansion, and a notable outperformance relative to its sector and the broader market indices.

Read full news article

Bartronics India Ltd is Rated Sell

Bartronics India Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 02 February 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 05 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Press Release / Media Release

04-Feb-2026 | Source : BSEPlease find the enclosed press release for your records.

Announcement under Regulation 30 (LODR)-Press Release / Media Release (Revised)

04-Feb-2026 | Source : BSEPlease find the enclosed revised press release for your records.

Announcement under Regulation 30 (LODR)-Investor Presentation

04-Feb-2026 | Source : BSEPlease find the enclosed investor presentation.

Corporate Actions

No Upcoming Board Meetings

Bartronics India Ltd has declared 10% dividend, ex-date: 21 Sep 11

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 9 FIIs (1.68%)

Kinex India Private Limited (69.37%)

Scan Help Technologies Private Limited (4.56%)

19.72%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 289.84% vs 40.43% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 145.00% vs 122.22% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -5.31% vs -8.53% in Sep 2024

Growth in half year ended Sep 2025 is 27.19% vs 315.09% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 123.48% vs -14.55% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 381.48% vs 237.29% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -18.02% vs -7.20% in Mar 2024

YoY Growth in year ended Mar 2025 is 18.12% vs -98.75% in Mar 2024