Compare Prime Securities with Similar Stocks

Dashboard

Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 15.23%

Healthy long term growth as Operating profit has grown by an annual rate of 37.85%

Flat results in Dec 25

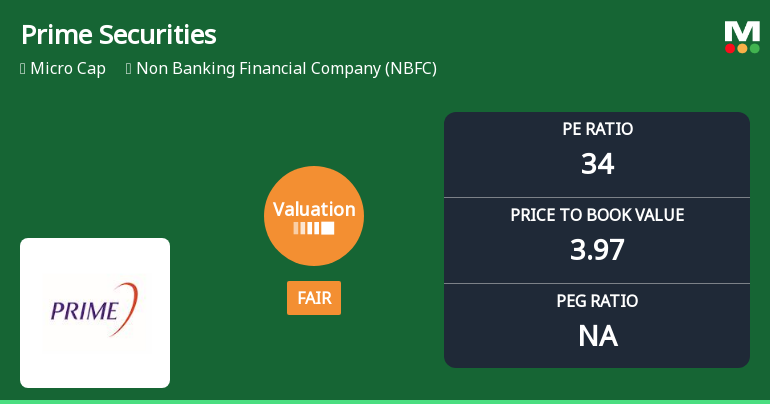

With ROE of 14.5, it has a Expensive valuation with a 4.1 Price to Book Value

Increasing Participation by Institutional Investors

Consistent Returns over the last 3 years

Stock DNA

Non Banking Financial Company (NBFC)

INR 928 Cr (Micro Cap)

35.00

22

0.55%

0.01

14.48%

3.97

Total Returns (Price + Dividend)

Latest dividend: 1.5 per share ex-dividend date: Jun-26-2025

Risk Adjusted Returns v/s

Returns Beta

News

Prime Securities Ltd Valuation Shifts to Fair, Enhancing Price Attractiveness Amid NBFC Sector Dynamics

Prime Securities Ltd, a key player in the Non Banking Financial Company (NBFC) sector, has seen a notable shift in its valuation parameters, moving from an expensive to a fair valuation grade. This change is underpinned by adjustments in its price-to-earnings (P/E) and price-to-book value (P/BV) ratios, signalling a more attractive price point for investors compared to its historical and peer averages.

Read full news article

Prime Securities Ltd Upgraded to Hold as Valuation and Technicals Shift

Prime Securities Ltd, a notable player in the Non Banking Financial Company (NBFC) sector, has seen its investment rating upgraded from Sell to Hold as of 30 January 2026. This change reflects a nuanced reassessment across four key parameters: quality, valuation, financial trend, and technicals. Despite some recent challenges, the company’s long-term fundamentals and market positioning continue to command investor attention.

Read full news article

Prime Securities Ltd Technical Momentum Shifts Amid Mixed Market Signals

Prime Securities Ltd, a notable player in the Non Banking Financial Company (NBFC) sector, has experienced a discernible shift in its technical momentum, moving from a mildly bullish stance to a sideways trend. This transition is underscored by a complex interplay of technical indicators including MACD, RSI, moving averages, and Bollinger Bands, reflecting a nuanced market sentiment as the stock navigates recent price fluctuations.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

22-Jan-2026 | Source : BSENewspaper Publication of Unaudited Financial Results

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

21-Jan-2026 | Source : BSECertificate pursuant to Regulation 74(5) of SEBI (DP) Regulations 2018

Announcement under Regulation 30 (LODR)-Press Release / Media Release

20-Jan-2026 | Source : BSEPress Release - Unaudited Financial Results December 31 2025

Corporate Actions

No Upcoming Board Meetings

Prime Securities Ltd has declared 30% dividend, ex-date: 26 Jun 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 7 Schemes (4.9%)

Held by 22 FIIs (4.93%)

None

Gkk Capital Markets Private Limited (13.07%)

35.78%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 42.54% vs 18.26% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -74.39% vs 3.40% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 32.51% vs 63.44% in Sep 2024

Growth in half year ended Sep 2025 is -17.24% vs 226.28% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 35.16% vs 48.45% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -29.73% vs 121.76% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 34.15% vs 43.56% in Mar 2024

YoY Growth in year ended Mar 2025 is 106.36% vs 66.01% in Mar 2024