Compare Shrydus Indust. with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 10 Cr (Micro Cap)

1.00

22

0.00%

0.00

16.38%

0.19

Total Returns (Price + Dividend)

Shrydus Indust. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

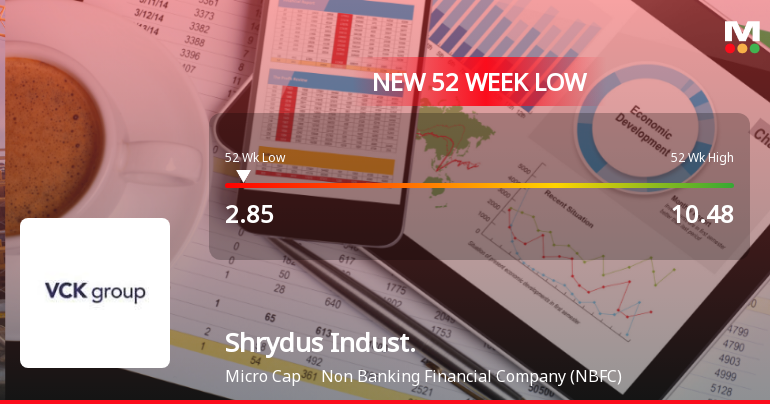

Shrydus Industries Ltd Stock Hits 52-Week Low Amid Continued Underperformance

Shrydus Industries Ltd, a player in the Non Banking Financial Company (NBFC) sector, has touched a new 52-week low of Rs.2.85 today, marking a significant decline in its stock price amid persistent underperformance relative to market benchmarks and sector peers.

Read full news article

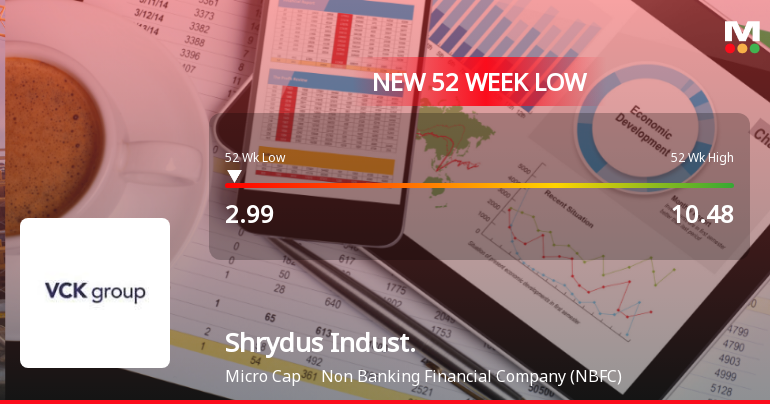

Shrydus Industries Ltd Falls to 52-Week Low of Rs.2.99 Amid Continued Underperformance

Shrydus Industries Ltd, a Non Banking Financial Company (NBFC), has touched a new 52-week low of Rs.2.99 today, marking a significant decline in its share price amid persistent underperformance relative to its sector and benchmark indices.

Read full news article

Shrydus Industries Ltd Falls to 52-Week Low of Rs.3.26 Amid Continued Underperformance

Shrydus Industries Ltd, a Non Banking Financial Company (NBFC), touched a fresh 52-week low of Rs.3.26 today, marking a significant decline in its stock price amid ongoing challenges reflected in its financial and market performance.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Jan-2026 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018

Closure of Trading Window

26-Dec-2025 | Source : BSEIntimation for closure of Trading window

Announcement under Regulation 30 (LODR)-Newspaper Publication

18-Nov-2025 | Source : BSENewspaper Publication for unaudited standalone and consolidated financial result for the quarter and half year ended September 30 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

Shrydus Industries Ltd has announced 5:3 rights issue, ex-date: 19 Jul 24

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Shrey Premal Parekh (21.74%)

Somani Ventures And Innovations (4.11%)

62.18%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 0.00% vs 0.00% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 71.43% vs 96.45% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -100.00% vs -6.82% in Sep 2024

Growth in half year ended Sep 2025 is -103.60% vs 1,058.33% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is -43.27% vs 32.06% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 462.50% vs 182.35% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -52.28% vs 1.72% in Mar 2024

YoY Growth in year ended Mar 2025 is 40.38% vs 73.33% in Mar 2024