Stock DNA

Diversified Commercial Services

INR 2,601 Cr (Small Cap)

22.00

36

0.00%

-0.27

12.24%

2.72

Total Returns (Price + Dividend)

Team Lease Serv. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

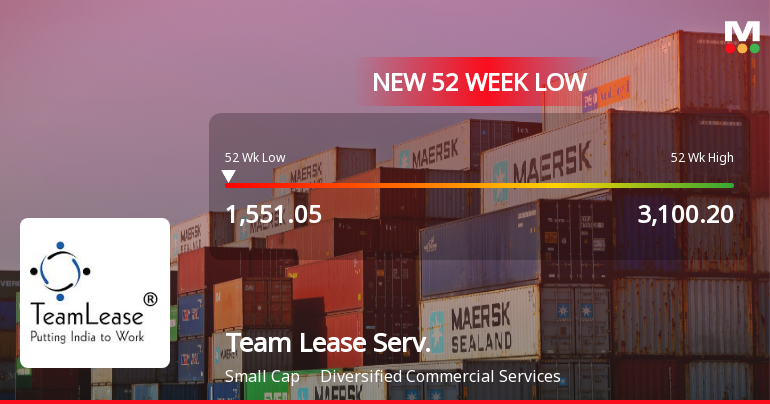

Team Lease Services Stock Falls to 52-Week Low of Rs.1551.05

Team Lease Services has reached a new 52-week low of Rs.1551.05, marking a significant price level for the stock amid a period of sustained downward movement. This development reflects ongoing pressures within the diversified commercial services sector and highlights the stock's recent performance trends.

Read More

Team Lease Services Stock Falls to 52-Week Low of Rs.1570

Team Lease Services has reached a new 52-week low of Rs.1570, marking a significant decline amid a broader market that remains relatively stable. The stock's recent performance contrasts with the positive momentum seen in key indices such as the Sensex, which is trading close to its own 52-week high.

Read More

Team Lease Serv. Sees Revision in Market Evaluation Amidst Challenging Performance

Team Lease Serv., a small-cap player in the Diversified Commercial Services sector, has experienced a revision in its market evaluation reflecting recent shifts in its fundamental and technical outlook. This adjustment follows a period marked by subdued financial trends and persistent underperformance relative to broader market benchmarks.

Read More Announcements

Teamlease Services Limited - Other General Purpose

03-Dec-2019 | Source : NSETeamlease Services Limited has informed the Exchange regarding Disclosure of Related Party Transactions -On consolidated basis for the half year ended September 30, 2019

Teamlease Services Limited - Acquisition

13-Nov-2019 | Source : NSETeamlease Services Limited has informed the Exchange about Acquisition of 72.7% stake in I.M.S.I. Staffing Private Limited on November 12, 2019

Teamlease Services Limited - Outcome of Board Meeting

08-Nov-2019 | Source : NSETeamlease Services Limited has informed the Exchange regarding Board meeting held on November 08, 2019.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Mutual Funds

None

Held by 20 Schemes (46.96%)

Held by 72 FIIs (6.68%)

Hr Offshoring Ventures Pte Ltd (23.8%)

Franklin India Balanced Advantage Fund (8.13%)

9.45%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 8.41% vs 23.07% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 11.96% vs -9.86% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 10.17% vs 20.98% in Sep 2024

Growth in half year ended Sep 2025 is 19.15% vs -15.46% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 20.44% vs 17.92% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -12.84% vs -3.12% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 19.68% vs 18.44% in Mar 2024

YoY Growth in year ended Mar 2025 is -3.02% vs 0.73% in Mar 2024