Compare Sanco Industries with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -100.00% and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

Flat results in Sep 25

Risky - Negative EBITDA

Stock DNA

Diversified consumer products

INR 4 Cr (Micro Cap)

NA (Loss Making)

24

0.00%

-9.07

5.56%

-0.65

Total Returns (Price + Dividend)

Sanco Industries for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

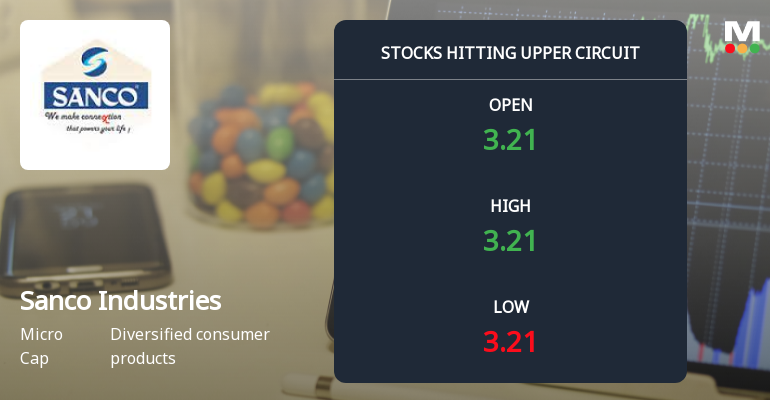

Sanco Industries Ltd Surges to Upper Circuit Amid Robust Buying Pressure

Sanco Industries Ltd, a micro-cap player in the diversified consumer products sector, surged to hit its upper circuit limit on 9 Jan 2026, closing at ₹3.21 with a maximum daily gain of 4.9%. This sharp uptick was driven by intense buying interest, resulting in a regulatory freeze on further transactions and signalling strong investor demand despite the company’s current sell-grade rating.

Read full news article

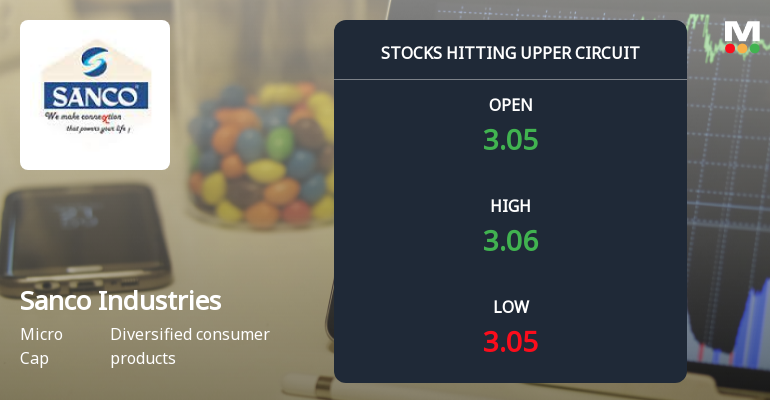

Sanco Industries Ltd Surges to Upper Circuit Amid Strong Buying Pressure

Sanco Industries Ltd, a micro-cap player in the diversified consumer products sector, surged to hit its upper circuit limit on 8 Jan 2026, registering a robust daily gain of 4.79%. This remarkable price movement was driven by intense buying interest, pushing the stock to trade at ₹3.06, the maximum permissible price band for the day, signalling strong market enthusiasm despite its modest market capitalisation of ₹4.00 crore.

Read full news article

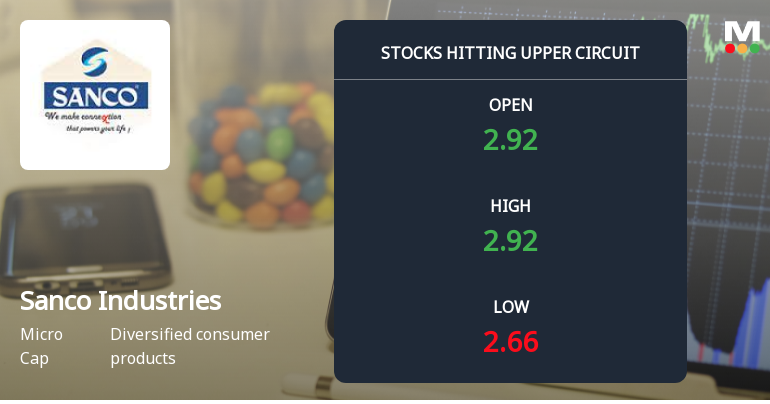

Sanco Industries Ltd Hits Upper Circuit Amid Strong Buying Pressure

Sanco Industries Ltd, a micro-cap player in the diversified consumer products sector, surged to hit its upper circuit price limit on 7 Jan 2026, reflecting intense buying interest and unfilled demand despite a subdued broader market. The stock’s maximum daily gain and regulatory freeze on further trading underscore a notable shift in investor sentiment towards this Rs 4.00 crore market cap company.

Read full news article Announcements

Sanco Industries Limited - Outcome of Board Meeting

14-Nov-2019 | Source : NSESanco Industries Limited has informed the Exchange regarding Board meeting held on November 13, 2019.

Sanco Industries Limited - Updates

01-Nov-2019 | Source : NSESanco Industries Limited has informed the Exchange regarding 'As per the letter attached.'.

Sanco Industries Limited - Outcome of Board Meeting

31-Oct-2019 | Source : NSESanco Industries Limited has informed the Exchange regarding Board meeting held on October 31, 2019.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

Sanco Industries Ltd has announced 1:5 bonus issue, ex-date: 10 Aug 16

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Sanjay Gupta (13.63%)

Shubham Kumar (2.85%)

52.91%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 0.00% vs 0.00% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 53.33% vs 6.25% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 0.00% vs 0.00% in Sep 2024

Growth in half year ended Sep 2025 is 22.73% vs 18.52% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 0.00% vs -100.00% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 30.23% vs 97.76% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 0.00% vs 0.00% in Mar 2024

YoY Growth in year ended Mar 2025 is 27.27% vs 34.52% in Mar 2024