Compare AAON, Inc. with Similar Stocks

Dashboard

1

With a fall in Net Sales of -3.26%, the company declared Very Negative results in Jun 25

- The company has declared negative results for the last 2 consecutive quarters

- INTEREST COVERAGE RATIO(Q) Lowest at 1,086.61

- OPERATING CASH FLOW(Y) Lowest at USD 31.95 MM

- ROCE(HY) Lowest at 15.52%

2

With ROE of 19.47%, it has a very expensive valuation with a 9.64 Price to Book Value

3

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

TimePeriod

Price Return

Dividend Return

Total Return

3 Months

-8.14%

0%

-8.14%

6 Months

18.69%

0%

18.69%

1 Year

-30.64%

0%

-30.64%

2 Years

32.21%

0%

32.21%

3 Years

26.24%

0%

26.24%

4 Years

42.35%

0%

42.35%

5 Years

28.5%

0%

28.5%

AAON, Inc. for the last several years.

Risk Adjusted Returns v/s

News

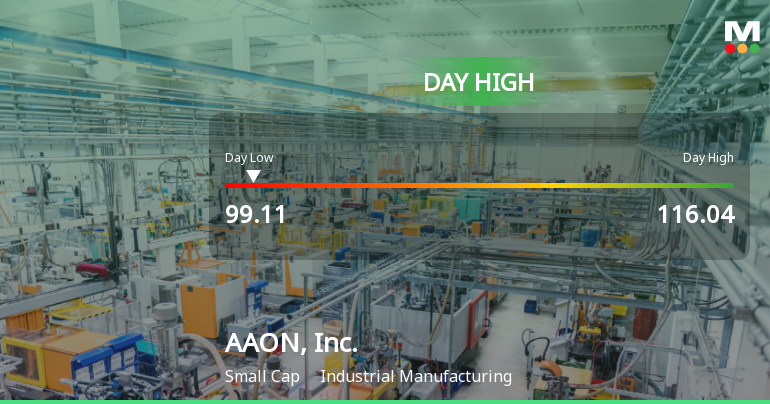

AAON, Inc. Stock Hits Day High with Strong 11.23% Surge

AAON, Inc. saw a notable increase in its stock price on November 6, 2025, reaching an intraday high. However, the company has struggled over the past year, with declines in net sales and year-to-date performance, highlighting mixed financial metrics and a premium valuation compared to peers.

Read full news article Announcements

No announcement available

Corporate Actions

No corporate action available

Quality key factors

Factor

Value

Sales Growth (5y)

20.32%

EBIT Growth (5y)

12.35%

EBIT to Interest (avg)

59.15

Debt to EBITDA (avg)

0.43

Net Debt to Equity (avg)

0.33

Sales to Capital Employed (avg)

1.31

Tax Ratio

17.39%

Dividend Payout Ratio

20.84%

Pledged Shares

0

Institutional Holding

89.35%

ROCE (avg)

22.63%

ROE (avg)

18.85%

Valuation key factors

Factor

Value

P/E Ratio

50

Industry P/E

Price to Book Value

9.64

EV to EBIT

41.25

EV to EBITDA

30.62

EV to Capital Employed

7.50

EV to Sales

6.45

PEG Ratio

NA

Dividend Yield

0.30%

ROCE (Latest)

18.18%

ROE (Latest)

19.47%

Technicals key factors

Indicator

Weekly

Monthly

MACD

Mildly Bullish

Mildly Bearish

RSI

No Signal

No Signal

Bollinger Bands

Mildly Bullish

Mildly Bearish

Moving Averages

Mildly Bearish (Daily)

KST

Bearish

Mildly Bearish

Dow Theory

No Trend

Mildly Bearish

OBV

No Trend

Mildly Bullish

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Majority shareholders

Domestic Funds

Domestic Funds

Held in 121 Schemes (62.68%)

Foreign Institutions

Held by 155 Foreign Institutions (13.02%)

Strategic Entities with highest holding

Highest Public shareholder

Quarterly Results Snapshot (Consolidated) - Jun'25 - QoQ

Jun'25

Mar'25

Change(%)

Net Sales

311.60

322.10

-3.26%

Operating Profit (PBDIT) excl Other Income

43.60

54.00

-19.26%

Interest

4.00

2.80

42.86%

Exceptional Items

0.00

0.00

Consolidate Net Profit

15.50

29.30

-47.10%

Operating Profit Margin (Excl OI)

75.70%

108.90%

-3.32%

USD in Million.

Net Sales

QoQ Growth in quarter ended Jun 2025 is -3.26% vs 8.20% in Mar 2025

Consolidated Net Profit

QoQ Growth in quarter ended Jun 2025 is -47.10% vs 18.62% in Mar 2025

Annual Results Snapshot (Consolidated) - Dec'24

Dec'24

Dec'23

Change(%)

Net Sales

1,200.60

1,168.50

2.75%

Operating Profit (PBDIT) excl Other Income

272.00

274.30

-0.84%

Interest

2.90

4.80

-39.58%

Exceptional Items

0.00

0.00

Consolidate Net Profit

168.60

177.60

-5.07%

Operating Profit Margin (Excl OI)

174.20%

194.70%

-2.05%

USD in Million.

Net Sales

YoY Growth in year ended Dec 2024 is 2.75% vs 31.47% in Dec 2023

Consolidated Net Profit

YoY Growth in year ended Dec 2024 is -5.07% vs 76.89% in Dec 2023

About AAON, Inc.

AAON, Inc.

Industrial Manufacturing

AAON, Inc. is engaged in the engineering, manufacturing, marketing and sale of air conditioning and heating equipment consisting of standard, semi-custom and custom rooftop units, chillers, packaged outdoor mechanical rooms, air handling units, makeup air units, energy recovery units, condensing units, geothermal/water-source heat pumps and coils. Its products serve the commercial and industrial new construction and replacement markets. Its rooftop and condensing unit markets consist of units installed on commercial or industrial structures of less than 10 stories in height. Its air handling units, self-contained units, geothermal/water-source heat pumps, chillers, packaged outdoor mechanical rooms and coils are applicable to all sizes of commercial and industrial buildings. The replacement market consists of products installed to replace existing units/components that are worn or damaged.

Company Coordinates

Company Details

2425 S Yukon Ave , TULSA OK : 74107-2728

Registrar Details