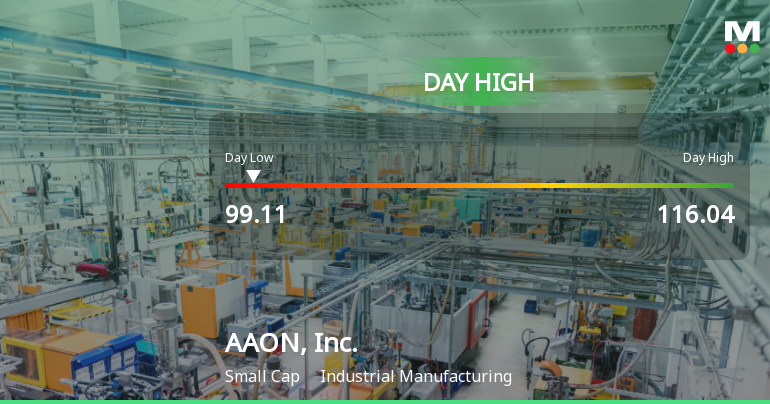

AAON, Inc. Stock Hits Day High with Strong 11.23% Surge

2025-11-07 16:32:50AAON, Inc. saw a notable increase in its stock price on November 6, 2025, reaching an intraday high. However, the company has struggled over the past year, with declines in net sales and year-to-date performance, highlighting mixed financial metrics and a premium valuation compared to peers.

Read full news articleNo announcement available

Corporate Actions

No corporate action available