Compare Digi International, Inc. with Similar Stocks

Dashboard

Poor Management Efficiency with a low ROCE of 5.88%

- The company has been able to generate a Return on Capital Employed (avg) of 5.88% signifying low profitability per unit of total capital (equity and debt)

Healthy long term growth as Operating profit has grown by an annual rate 41.08%

The company has declared Positive results for the last 5 consecutive quarters

With ROCE of 8.43%, it has a fair valuation with a 2.35 Enterprise value to Capital Employed

Market Beating Performance

Stock DNA

Telecom - Equipment & Accessories

USD 1,623 Million (Small Cap)

35.00

NA

0.00%

0.22

6.79%

2.55

Total Returns (Price + Dividend)

Digi International, Inc. for the last several years.

Risk Adjusted Returns v/s

News

Digi International Hits Day High with Strong 7.12% Intraday Surge

Digi International, Inc. has seen notable stock performance, gaining 7.12% on November 13, 2025, with an intraday high of USD 44.79. The company has outperformed the S&P 500 over various periods and reported a strong annual growth rate in operating profit, despite a low Return on Capital Employed.

Read full news article

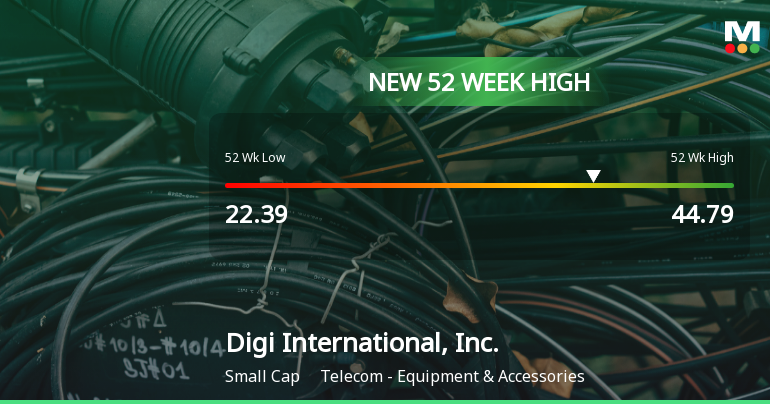

Digi International Hits New 52-Week High at $44.79, Up 71.63%

Digi International, Inc. has achieved a new 52-week high of USD 44.79, reflecting a significant performance increase of 71.63% over the past year. With a market cap of USD 1,506 million, the company demonstrates strong financial health, characterized by a low debt-to-equity ratio and a return on equity of 6.95%.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 68 Schemes (57.39%)

Held by 86 Foreign Institutions (8.72%)

Quarterly Results Snapshot (Consolidated) - Jun'25 - QoQ

QoQ Growth in quarter ended Jun 2025 is 2.87% vs 0.58% in Mar 2025

QoQ Growth in quarter ended Jun 2025 is -2.86% vs 3.96% in Mar 2025

Annual Results Snapshot (Consolidated) - Sep'24

YoY Growth in year ended Sep 2024 is -4.68% vs 14.58% in Sep 2023

YoY Growth in year ended Sep 2024 is -9.27% vs 27.84% in Sep 2023