Digi International Hits Day High with Strong 7.12% Intraday Surge

2025-11-14 16:15:00Digi International, Inc. has seen notable stock performance, gaining 7.12% on November 13, 2025, with an intraday high of USD 44.79. The company has outperformed the S&P 500 over various periods and reported a strong annual growth rate in operating profit, despite a low Return on Capital Employed.

Read More

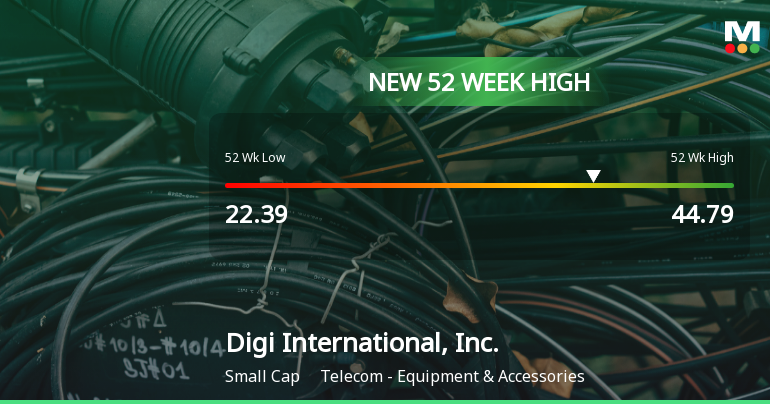

Digi International Hits New 52-Week High at $44.79, Up 71.63%

2025-11-14 15:48:01Digi International, Inc. has achieved a new 52-week high of USD 44.79, reflecting a significant performance increase of 71.63% over the past year. With a market cap of USD 1,506 million, the company demonstrates strong financial health, characterized by a low debt-to-equity ratio and a return on equity of 6.95%.

Read More

Digi International Experiences Revision in Its Stock Evaluation Amid Mixed Market Metrics

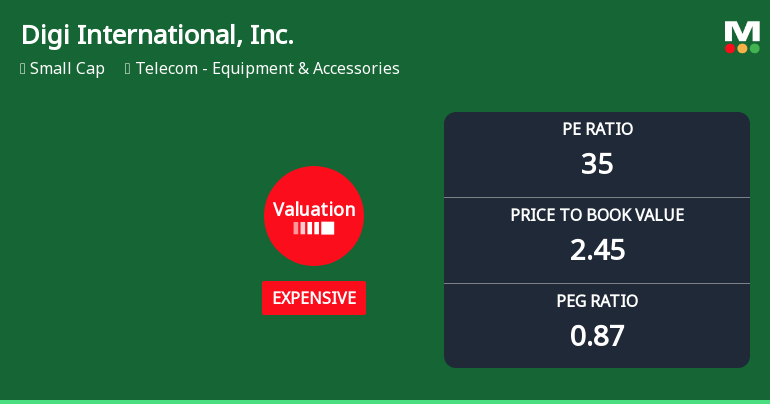

2025-11-03 15:35:11Digi International, Inc. has recently adjusted its valuation, with a P/E ratio of 35 and a Price to Book Value of 2.45. Key metrics indicate operational efficiency, while its stock performance has varied, outperforming the S&P 500 year-to-date but lagging over three years amid competitive industry dynamics.

Read More

Digi International Hits New 52-Week High of $39.62, Surges 72.92%

2025-10-27 16:37:35Digi International, Inc. has achieved a new 52-week high of USD 39.62, reflecting a substantial increase over the past year. With a market capitalization of USD 1,506 million, the company showcases strong financial metrics, including a low debt-to-equity ratio and solid performance indicators, despite not offering dividends.

Read More

Digi International Experiences Revision in Its Stock Evaluation Amid Strong Market Performance

2025-10-27 15:39:50Digi International, Inc. has recently adjusted its valuation, showcasing a P/E ratio of 35 and a price-to-book value of 2.45. The company demonstrates operational efficiency with an EV to EBIT of 27.88 and a year-to-date stock return of 28.42%, outperforming the S&P 500.

Read MoreIs Digi International, Inc. overvalued or undervalued?

2025-10-21 12:01:18As of 17 October 2025, the valuation grade for Digi International, Inc. has moved from attractive to expensive, indicating a shift towards overvaluation. The company appears to be overvalued based on its P/E ratio of 35, which is higher than the peer average of approximately 34.86, and an EV to EBITDA ratio of 17.30, which also exceeds the peer average of 16.75. Additionally, the PEG ratio of 0.87 suggests that the stock may not be as growth-oriented as its price implies. In comparison to its peers, InterDigital, Inc. has a higher P/E of 43.22 but a more favorable PEG ratio of 0.68, while Harmonic, Inc. is valued attractively with an EV to EBITDA of 9.46. Despite the recent performance, where Digi International returned 25.41% year-to-date compared to the S&P 500's 13.30%, the elevated valuation metrics suggest that the stock may not provide sufficient upside relative to its current price....

Read More

Digi International, Inc. Experiences Valuation Adjustment Amid Strong Year-to-Date Performance

2025-10-20 15:53:05Digi International, Inc. has recently adjusted its valuation metrics, showcasing a P/E ratio of 35 and a price-to-book value of 2.45. The company's year-to-date return of 25.41% surpasses the S&P 500's 13.30%, indicating a strong competitive position within the Telecom Equipment & Accessories sector.

Read MoreIs Digi International, Inc. overvalued or undervalued?

2025-10-20 12:19:06As of 17 October 2025, the valuation grade for Digi International, Inc. has moved from attractive to expensive, indicating a shift towards overvaluation. The company is currently considered overvalued based on its valuation ratios, including a P/E ratio of 35, an EV to EBITDA of 17.30, and a PEG ratio of 0.87. In comparison, peer InterDigital, Inc. has a higher P/E of 43.22, while Harmonic, Inc. shows a much lower EV to EBITDA of 9.46, highlighting the disparity in valuations within the sector. Digi International's recent stock performance has outpaced the S&P 500, with a year-to-date return of 25.41% compared to the S&P 500's 13.30%. However, the long-term returns reveal a concerning trend, as the 3-year return of 8.75% significantly lags behind the S&P 500's 81.19%, suggesting potential challenges ahead for sustained growth....

Read MoreIs Digi International, Inc. overvalued or undervalued?

2025-10-19 11:56:48As of 17 October 2025, the valuation grade for Digi International, Inc. has moved from attractive to expensive, indicating a shift towards overvaluation. The company is currently considered overvalued based on its P/E ratio of 35, which is higher than the peer average of approximately 34.86, and its EV to EBITDA ratio of 27.88, which also exceeds the peer average of 16.75. Additionally, the PEG ratio stands at 0.87, suggesting that while the company may have growth potential, its current valuation does not adequately reflect that potential compared to its peers. In comparison to its peers, InterDigital, Inc. has a higher P/E ratio of 43.22 but a lower PEG ratio of 0.68, indicating it may be more attractively valued despite a higher earnings multiple. Meanwhile, ViaSat, Inc. and Calix, Inc. are considered risky with significantly negative P/E ratios, further emphasizing Digi's relative position in the marke...

Read More