Compare 1-800-FLOWERS.COM, Inc. with Similar Stocks

Dashboard

Poor long term growth as Operating profit has grown by an annual rate -192.14% of over the last 5 years

- OPERATING CASH FLOW(Y) Lowest at USD -26.36 MM

- PRE-TAX PROFIT(Q) At USD -45.19 MM has Fallen at -60.87%

- ROCE(HY) Lowest at -54.45%

Risky - Negative Operating Profits

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

E-Retail/ E-Commerce

USD 164 Million (Micro Cap)

NA (Loss Making)

NA

0.00%

1.24

-31.78%

0.75

Total Returns (Price + Dividend)

1-800-FLOWERS.COM, Inc. for the last several years.

Risk Adjusted Returns v/s

News

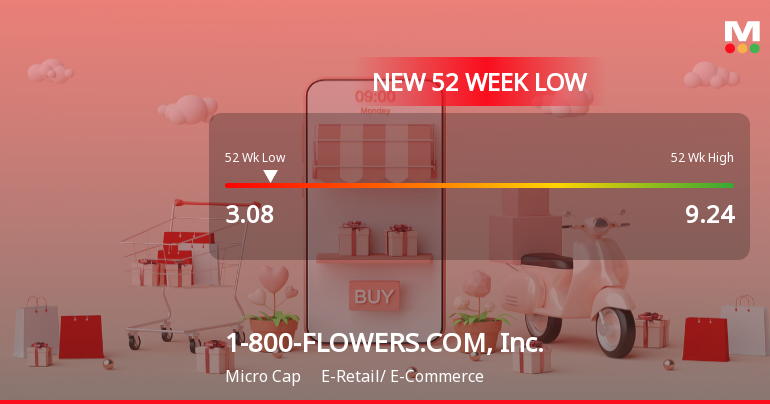

1-800-FLOWERS.COM Hits 52-Week Low as Stock Plummets to $3.08

1-800-FLOWERS.COM, Inc. has reached a new 52-week low, reflecting a challenging year with a significant stock price decline. The company faces ongoing financial difficulties, including negative return on equity and declining operating cash flow. Its market capitalization stands at USD 429 million amid consistent underperformance.

Read full news article

1-800-FLOWERS.COM Stock Plummets to New 52-Week Low of $3.44

1-800-FLOWERS.COM, Inc. has reached a new 52-week low, reflecting a significant decline in its stock price over the past year. The company, with a market capitalization of USD 429 million, faces financial challenges, including negative returns on equity and declining operating profits, alongside substantial operating cash flow losses.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Foreign Institutions

Held in 50 Schemes (29.41%)

Held by 60 Foreign Institutions (34.07%)

Quarterly Results Snapshot (Consolidated) - Jun'25 - YoY

YoY Growth in quarter ended Jun 2025 is -6.73% vs -9.50% in Jun 2024

YoY Growth in quarter ended Jun 2025 is -148.33% vs 7.11% in Jun 2024

Annual Results Snapshot (Consolidated) - Jun'24

YoY Growth in year ended Jun 2024 is -9.24% vs -8.61% in Jun 2023

YoY Growth in year ended Jun 2024 is 86.35% vs -251.01% in Jun 2023