Compare 10X Genomics, Inc. with Similar Stocks

Stock DNA

Pharmaceuticals & Biotechnology

USD 2,642 Million (Small Cap)

NA (Loss Making)

NA

0.00%

-0.60

-15.69%

3.36

Total Returns (Price + Dividend)

10X Genomics, Inc. for the last several years.

Risk Adjusted Returns v/s

News

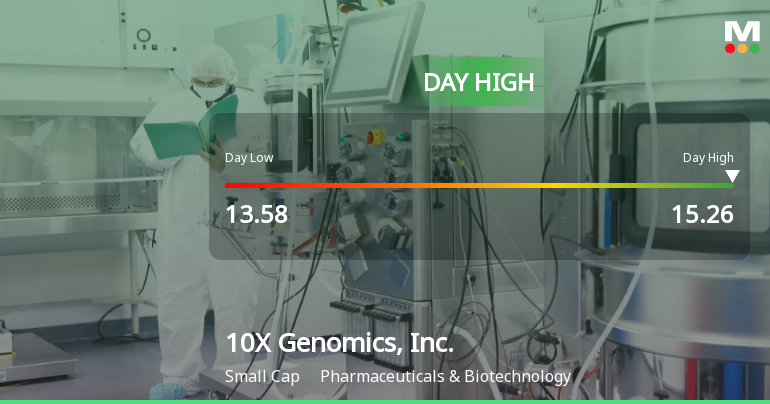

10X Genomics Stock Soars 17.31%, Hits Intraday High of $15.26

10X Genomics, Inc. saw a notable stock price increase on November 7, 2025, amid a modest rise in the broader market. The company has shown strong weekly and monthly performance, despite a decline over the past year. High institutional ownership reflects investor confidence, while challenges remain with negative EBITDA.

Read full news article

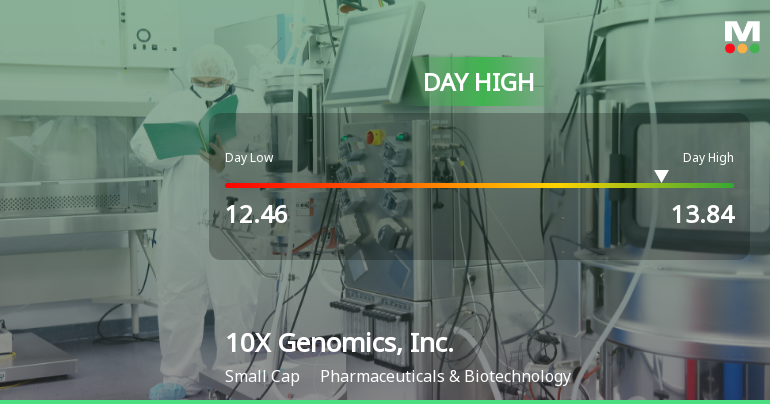

10X Genomics Hits Day High with 9.65% Surge in Intraday Performance

10X Genomics, Inc. experienced a notable stock price increase on October 31, 2025, despite facing a challenging year with a significant decline. The company has high institutional ownership but struggles with negative financial metrics, indicating ongoing profitability issues amid a volatile market environment.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 70 Schemes (61.52%)

Held by 166 Foreign Institutions (24.9%)

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -1.78% vs -1.24% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 23.18% vs 61.51% in Sep 2024

Annual Results Snapshot (Consolidated) - Dec'24

YoY Growth in year ended Dec 2024 is -1.28% vs 19.81% in Dec 2023

YoY Growth in year ended Dec 2024 is 28.42% vs -53.67% in Dec 2023