Compare Academy Sports & Outdoors, Inc. with Similar Stocks

Dashboard

High Management Efficiency with a high ROCE of 35.63%

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 0.39 times

Healthy long term growth as Operating profit has grown by an annual rate 10.61%

Flat results in Jul 25

With ROCE of 23.26%, it has a attractive valuation with a 1.38 Enterprise value to Capital Employed

Consistent Underperformance against the benchmark over the last 3 years

Total Returns (Price + Dividend)

Academy Sports & Outdoors, Inc. for the last several years.

Risk Adjusted Returns v/s

News

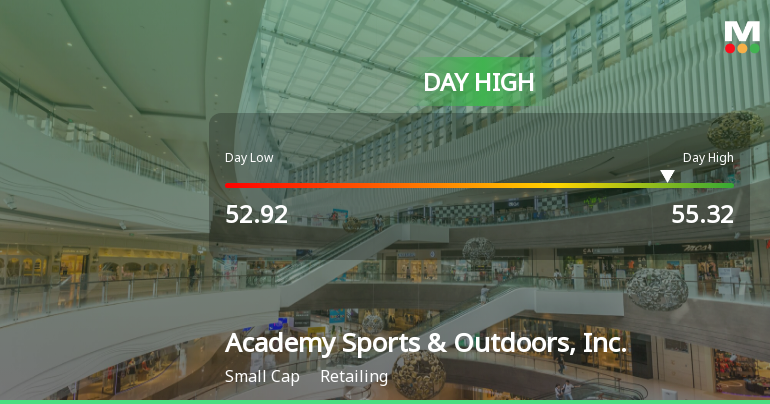

Academy Sports & Outdoors Hits Day High with 12.59% Surge

Academy Sports & Outdoors, Inc. saw a significant stock increase today, contrasting with a slight decline in the S&P 500. The company has shown strong management efficiency, a low debt-to-EBITDA ratio, and healthy long-term growth potential, despite a challenging year-to-date performance. Its market capitalization stands at USD 3,363 million.

Read full news article

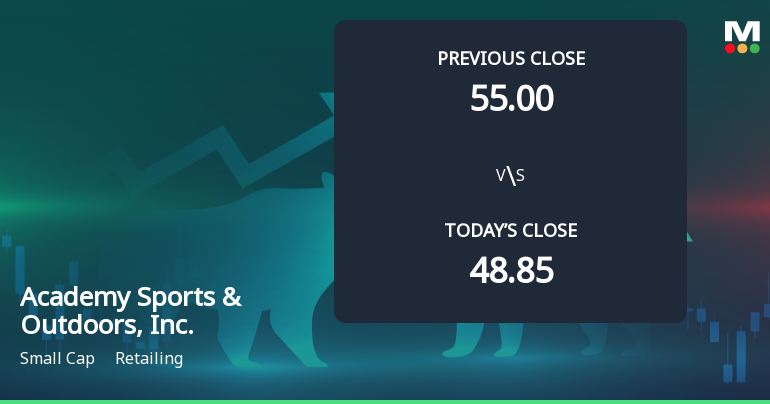

Academy Sports & Outdoors Stock Opens with 9.03% Gain, Marking Significant Gap Up

Academy Sports & Outdoors, Inc. experienced a significant stock increase, outperforming the S&P 500. The company has shown strong monthly growth, though technical indicators present mixed signals. Despite a decline in net profit and annual returns, it maintains a favorable valuation and strong management efficiency metrics.

Read full news article

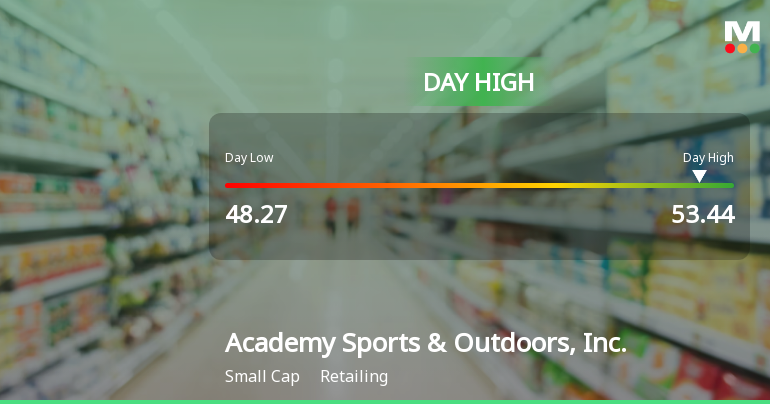

Academy Sports & Outdoors Stock Hits Day High with 8.64% Surge

Academy Sports & Outdoors, Inc. has seen a notable rise in stock performance, particularly on December 9, 2025. The company has outperformed the S&P 500 in various time frames, demonstrating strong management efficiency and a solid ability to service debt, while navigating challenges in longer-term performance.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Oct 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 108 Schemes (69.94%)

Held by 138 Foreign Institutions (8.46%)

Quarterly Results Snapshot (Consolidated) - Oct'25 - YoY

YoY Growth in quarter ended Oct 2025 is 3.01% vs -3.90% in Oct 2024

YoY Growth in quarter ended Oct 2025 is 8.81% vs -34.20% in Oct 2024

Annual Results Snapshot (Consolidated) - Jan'25

YoY Growth in year ended Jan 2025 is -3.67% vs -3.69% in Jan 2024

YoY Growth in year ended Jan 2025 is -19.41% vs -17.32% in Jan 2024