Compare Adobe, Inc. with Similar Stocks

Dashboard

Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 41.40%

- Healthy long term growth as Net Sales has grown by an annual rate of 13.48% and Operating profit at 17.27%

- Company has a low Debt to Equity ratio (avg) at times

Flat results in Aug 25

With ROE of 52.06%, it has a attractive valuation with a 18.41 Price to Book Value

Below par performance in long term as well as near term

Stock DNA

Software Products

USD 123,165 Million (Large Cap)

35.00

NA

0.00%

-0.03

61.34%

10.60

Total Returns (Price + Dividend)

Adobe, Inc. for the last several years.

Risk Adjusted Returns v/s

News

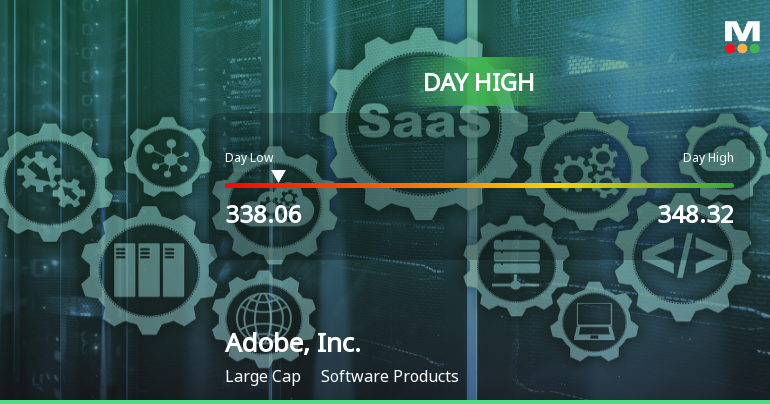

Adobe Stock Soars 3.16%, Hits Intraday High of $348.32

Adobe, Inc. saw a significant increase in its stock performance on December 8, 2025, reaching an intraday high. The company has demonstrated strong financial fundamentals, including a high Return on Equity and low Debt to Equity ratio, alongside healthy long-term growth in net sales and profits.

Read full news article

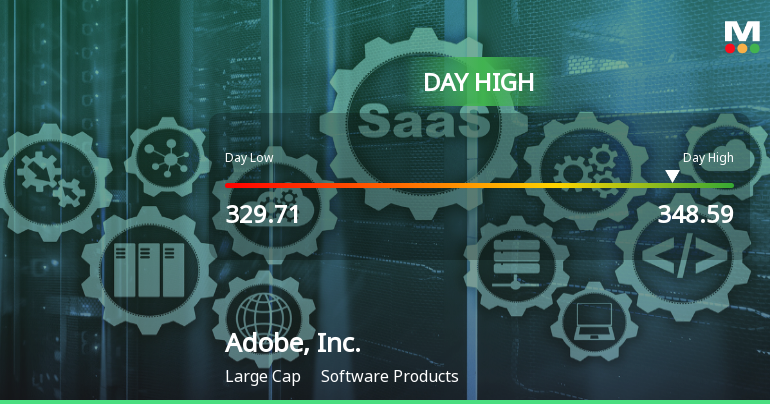

Adobe Stock Soars 5.33%, Hits Intraday High of $348.59

Adobe, Inc. has seen a notable rise in its stock today, reaching an intraday high amid a modestly performing broader market. Despite a challenging year, the company maintains strong fundamentals, including a high Return on Equity and healthy growth in net sales and operating profit, reflecting its solid market position.

Read full news articleIs Adobe, Inc. overvalued or undervalued?

As of 21 November 2025, Adobe, Inc. has moved from a very attractive to an attractive valuation grade. The company appears to be overvalued based on its current metrics. Key ratios include a P/E ratio of 35, an EV to EBITDA of 26.66, and a PEG ratio of 1.18. In comparison to peers, Microsoft Corp. has a P/E of 36.17, while Salesforce, Inc. shows a more favorable EV to EBITDA of 16.87, indicating that Adobe's valuation may not be justified relative to its competitors. Recent stock performance has been disappointing, with a year-to-date return of -28.32%, significantly underperforming the S&P 500's return of 12.26% during the same period. This stark contrast in returns further reinforces the notion that Adobe may be overvalued in the current market environment....

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Nov 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 292 Schemes (33.99%)

Held by 808 Foreign Institutions (24.5%)

Quarterly Results Snapshot (Consolidated) - Nov'25 - YoY

YoY Growth in quarter ended Nov 2025 is 10.49% vs 11.16% in Nov 2024

YoY Growth in quarter ended Nov 2025 is 10.28% vs 13.49% in Nov 2024

Annual Results Snapshot (Consolidated) - Nov'25

YoY Growth in year ended Nov 2025 is 10.42% vs 11.14% in Nov 2024

YoY Growth in year ended Nov 2025 is 28.24% vs 2.43% in Nov 2024